Enlarge image

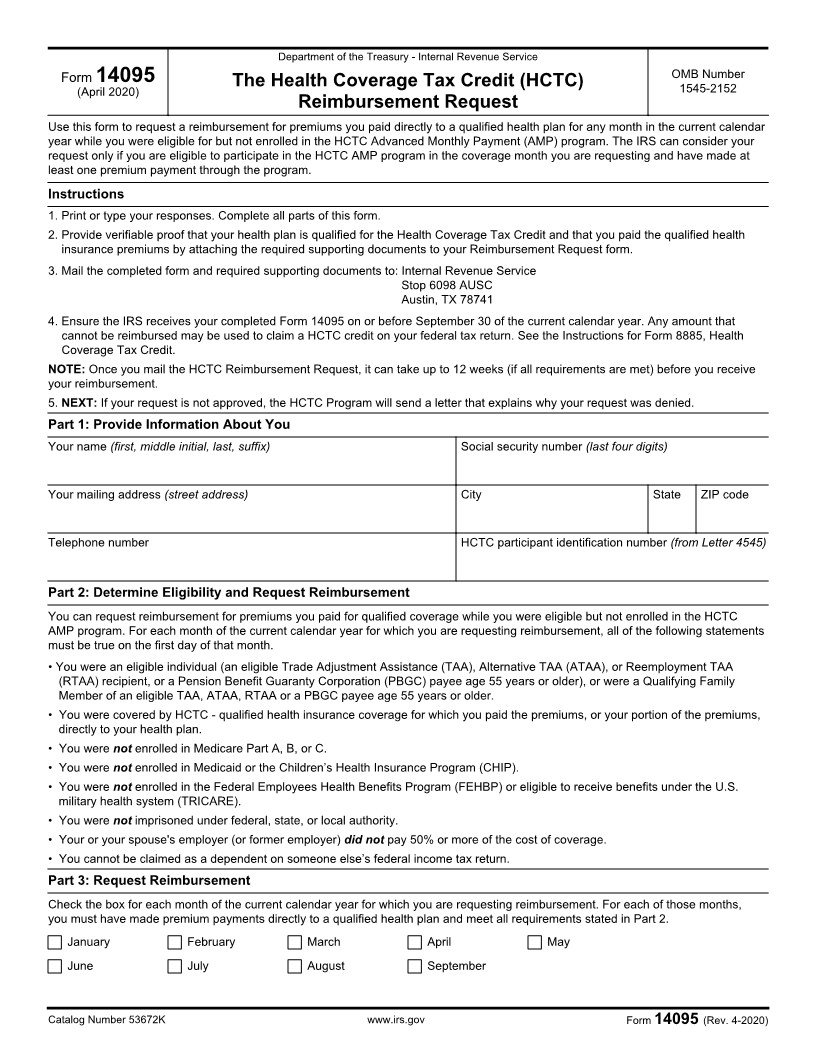

Department of the Treasury - Internal Revenue Service

Form 14095 OMB Number

(April 2020) The Health Coverage Tax Credit (HCTC) 1545-2152

Reimbursement Request

Use this form to request a reimbursement for premiums you paid directly to a qualified health plan for any month in the current calendar

year while you were eligible for but not enrolled in the HCTC Advanced Monthly Payment (AMP) program. The IRS can consider your

request only if you are eligible to participate in the HCTC AMP program in the coverage month you are requesting and have made at

least one premium payment through the program.

Instructions

1. Print or type your responses. Complete all parts of this form.

2. Provide verifiable proof that your health plan is qualified for the Health Coverage Tax Credit and that you paid the qualified health

insurance premiums by attaching the required supporting documents to your Reimbursement Request form.

3. Mail the completed form and required supporting documents to: Internal Revenue Service

Stop 6098 AUSC

Austin, TX 78741

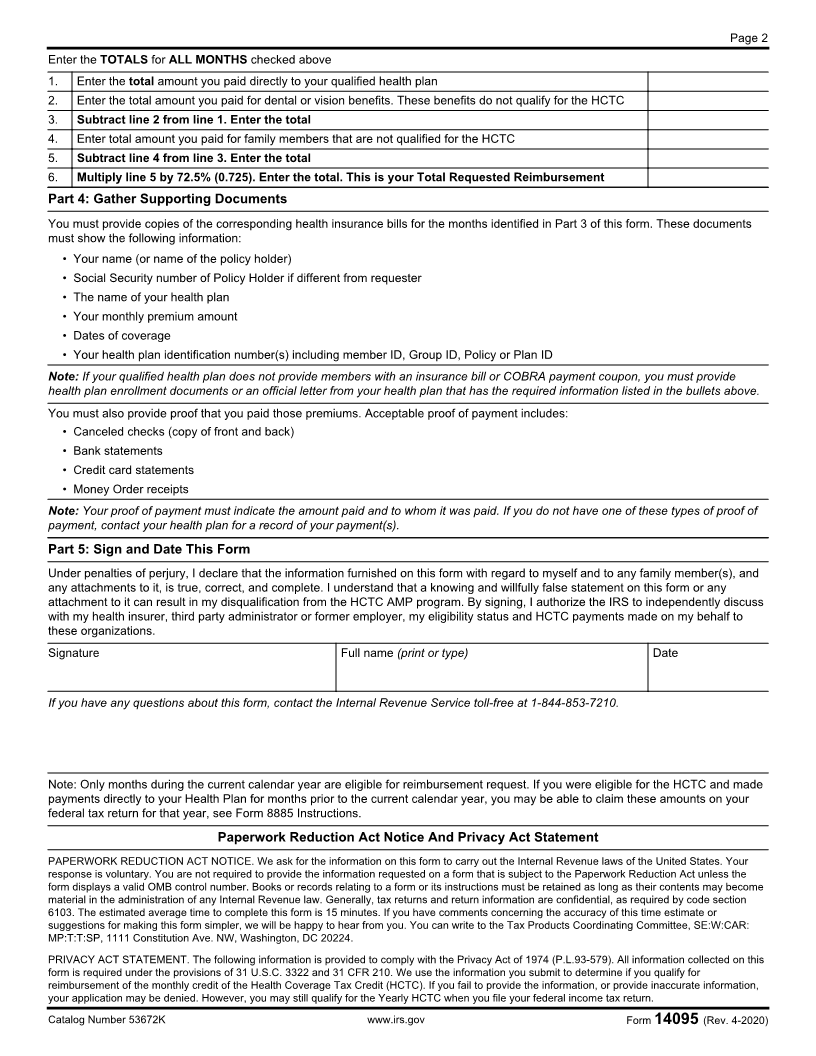

4. Ensure the IRS receives your completed Form 14095 on or before September 30 of the current calendar year. Any amount that

cannot be reimbursed may be used to claim a HCTC credit on your federal tax return. See the Instructions for Form 8885, Health

Coverage Tax Credit.

NOTE: Once you mail the HCTC Reimbursement Request, it can take up to 12 weeks (if all requirements are met) before you receive

your reimbursement.

5. NEXT: If your request is not approved, the HCTC Program will send a letter that explains why your request was denied.

Part 1: Provide Information About You

Your name (first, middle initial, last, suffix) Social security number (last four digits)

Your mailing address (street address) City State ZIP code

Telephone number HCTC participant identification number (from Letter 4545)

Part 2: Determine Eligibility and Request Reimbursement

You can request reimbursement for premiums you paid for qualified coverage while you were eligible but not enrolled in the HCTC

AMP program. For each month of the current calendar year for which you are requesting reimbursement, all of the following statements

must be true on the first day of that month.

• You were an eligible individual (an eligible Trade Adjustment Assistance (TAA), Alternative TAA (ATAA), or Reemployment TAA

(RTAA) recipient, or a Pension Benefit Guaranty Corporation (PBGC) payee age 55 years or older), or were a Qualifying Family

Member of an eligible TAA, ATAA, RTAA or a PBGC payee age 55 years or older.

• You were covered by HCTC - qualified health insurance coverage for which you paid the premiums, or your portion of the premiums,

directly to your health plan.

• You were not enrolled in Medicare Part A, B, or C.

• You were not enrolled in Medicaid or the Children’s Health Insurance Program (CHIP).

• You were not enrolled in the Federal Employees Health Benefits Program (FEHBP) or eligible to receive benefits under the U.S.

military health system (TRICARE).

• You were not imprisoned under federal, state, or local authority.

• Your or your spouse's employer (or former employer) did not pay 50% or more of the cost of coverage.

• You cannot be claimed as a dependent on someone else’s federal income tax return.

Part 3: Request Reimbursement

Check the box for each month of the current calendar year for which you are requesting reimbursement. For each of those months,

you must have made premium payments directly to a qualified health plan and meet all requirements stated in Part 2.

January February March April May

June July August September

Catalog Number 53672K www.irs.gov Form 14095 (Rev. 4-2020)