Enlarge image

United States Estate (and Generation-Skipping Transfer) Tax Return

Form 706-NA

Estate of nonresident not a citizen of the United States

To be filed for decedents dying after December 31, 2011. OMB No. 1545-0531

(Rev. June 2019) Go to www.irs.gov/Form706NA for instructions and the latest information.

Department of the Treasury ▶ File Form 706-NA at the following address:

Internal Revenue Service Department of the Treasury, Internal Revenue Service Center, Kansas City, MO 64999.

Attach supplemental documents and translations. Show amounts in U.S. dollars.

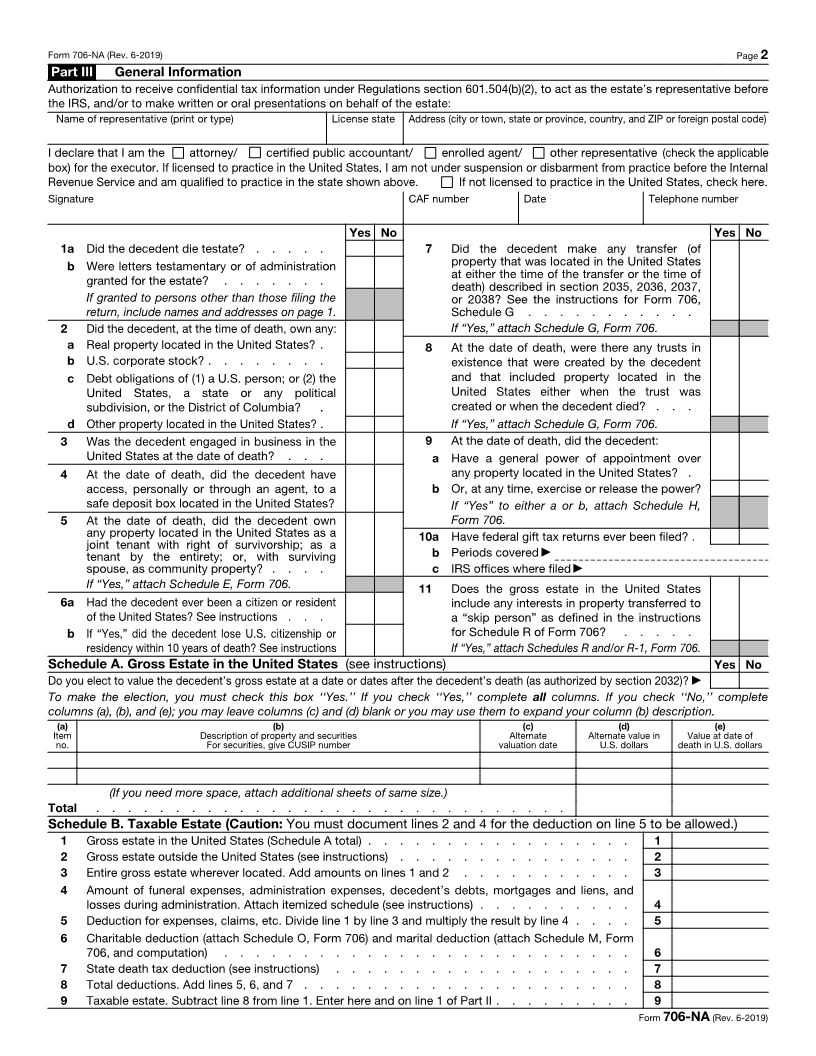

Part I Decedent, Executor, and Attorney

1a Decedent’s first (given) name and middle initial b Decedent’s last (family) name 2 U.S. taxpayer ID number (if any)

3 Place of death 4 Domicile at time of death 5 Citizenship (nationality) 6 Date of death

7a Date of birth b Place of birth 8 Business or occupation

9a Name of executor

b Address (city or town, state or province, country, and ZIP or foreign postal code)

c Telephone number d Fax number e Email address

10a Name of attorney for estate

b Address (city or town, state or province, country, and ZIP or foreign postal code)

c Telephone number d Fax number e Email address

11 If there are multiple executors or attorneys, check here and attach a list of the names, addresses, telephone numbers, fax

numbers, and email addresses of the additional executors or attorneys.

Part II Tax Computation

1 Taxable estate from Schedule B, line 9 . . . . . . . . . . . . . . . . . . . . . 1

2 Total taxable gifts of tangible or intangible property located in the U.S., transferred (directly or indirectly)

by the decedent after December 31, 1976, and not included in the gross estate (see section 2511) . . 2

3 Total. Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Tentative tax on the amount on line 3 (see instructions) . . . . . . . . . . . . . . . . 4

5 Tentative tax on the amount on line 2 (see instructions) . . . . . . . . . . . . . . . . 5

6 Gross estate tax. Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . . . 6

7 Unified credit. Enter smaller of line 6 amount or maximum allowed (see instructions) . . . . . . 7

8 Balance. Subtract line 7 from line 6 . . . . . . . . . . . . . . . . . . . . . . 8

9 Other credits (see instructions) . . . . . . . . . . . . . . . . 9

10 Credit for tax on prior transfers. Attach Schedule Q, Form 706 . . . . . 10

11 Total. Add lines 9 and 10 . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Net estate tax. Subtract line 11 from line 8 . . . . . . . . . . . . . . . . . . . . 12

13 Total generation-skipping transfer tax. Attach Schedule R, Form 706 . . . . . . . . . . . 13

14 Total transfer taxes. Add lines 12 and 13 . . . . . . . . . . . . . . . . . . . . 14

15 Earlier payments. See instructions and attach explanation . . . . . . . . . . . . . . . 15

16 Balance due. Subtract line 15 from line 14 (see instructions) . . . . . . . . . . . . . . 16

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is

true, correct, and complete. I understand that a complete return requires listing all property constituting the part of the decedent’s gross estate (as defined by the statute)

situated in the United States. Declaration of preparer (other than the executor) is based on all information of which preparer has any knowledge.

▲ ▲ May the IRS discuss this return

with the preparer shown below?

Sign Signature of executor Date See instructions.

▲ ▲

Here Yes No

Signature of executor Date

Print/Type preparer’s name Preparer’s signature Date

Paid Check if PTIN

self-employed

Preparer ▶ Firm’s EIN ▶

Firm’s name

Use Only Firm’s address ▶ Phone no.

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 10145K Form 706-NA (Rev. 6-2019)