Enlarge image

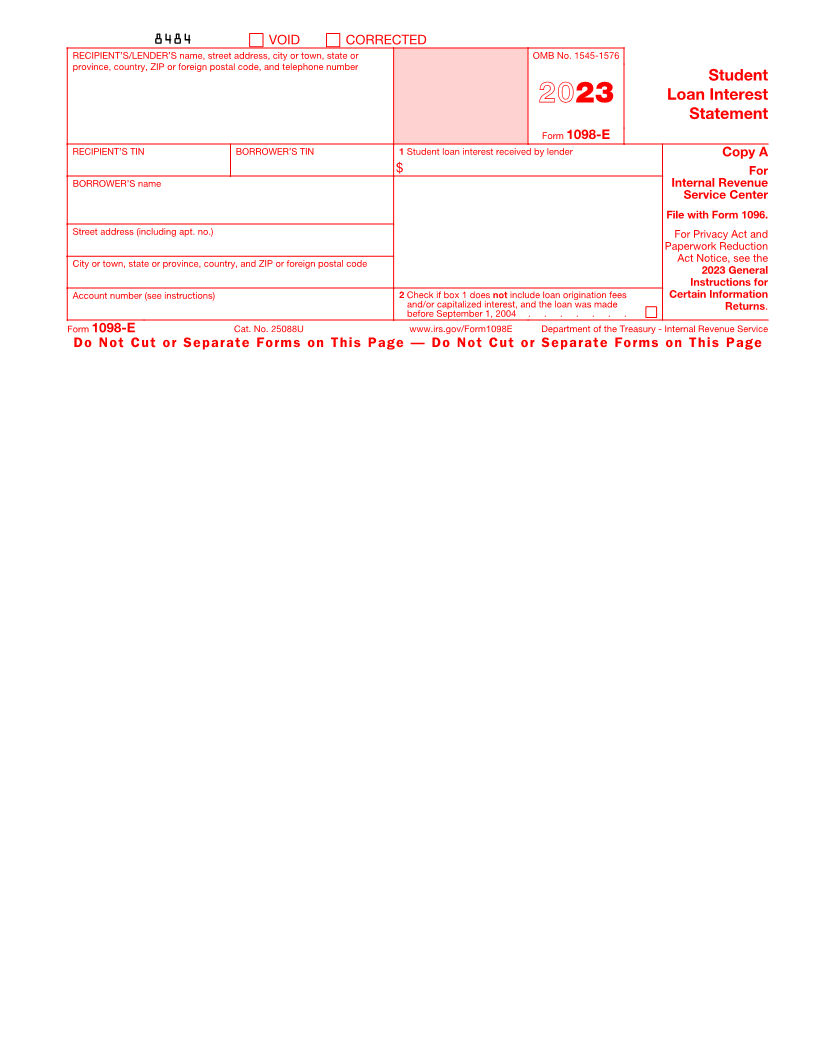

8484 VOID CORRECTED

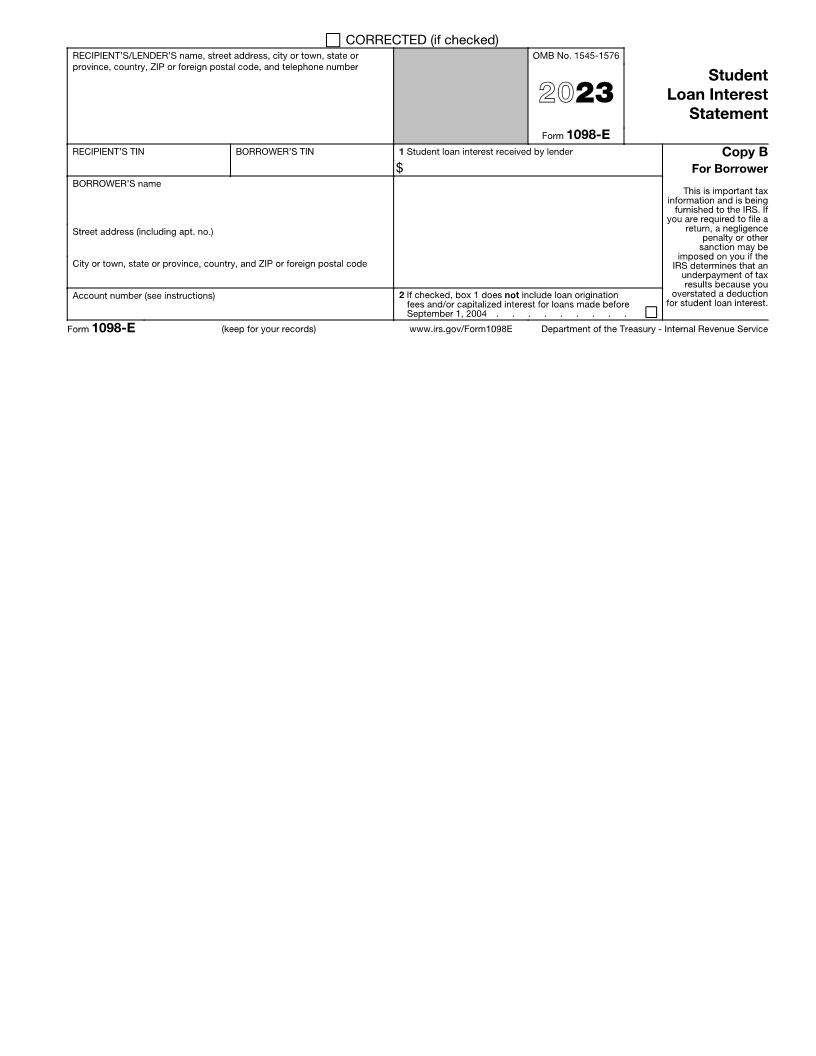

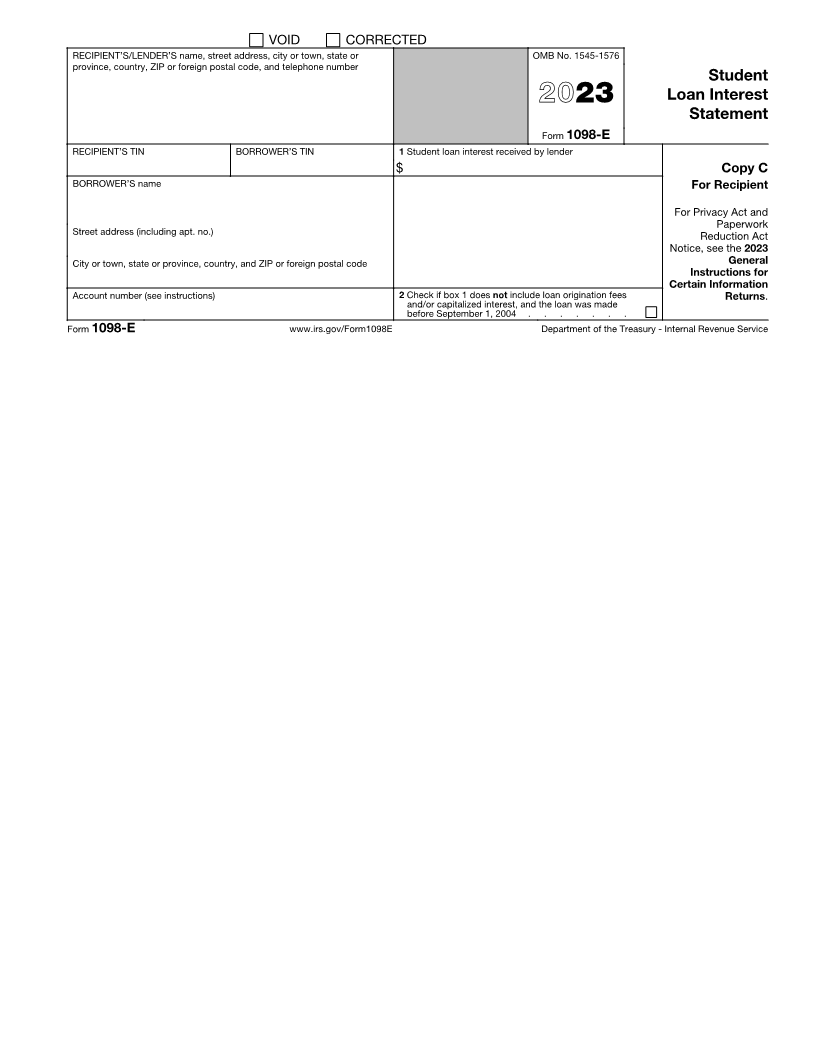

RECIPIENT’S/LENDER’S name, street address, city or town, state or OMB No. 1545-1576

province, country, ZIP or foreign postal code, and telephone number

Student

2023 Loan Interest

Statement

Form 1098-E

RECIPIENT’S TIN BORROWER’S TIN 1 Student loan interest received by lender Copy A

$ For

BORROWER’S name Internal Revenue

Service Center

File with Form 1096.

Street address (including apt. no.) For Privacy Act and

Paperwork Reduction

City or town, state or province, country, and ZIP or foreign postal code Act Notice, see the

2023 General

Instructions for

Account number (see instructions) 2 Check if box 1 does not include loan origination fees Certain Information

and/or capitalized interest, and the loan was made Returns.

before September 1, 2004 . . . . . . .

Form 1098-E Cat. No. 25088U www.irs.gov/Form1098E Department of the Treasury - Internal Revenue Service

Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This Page