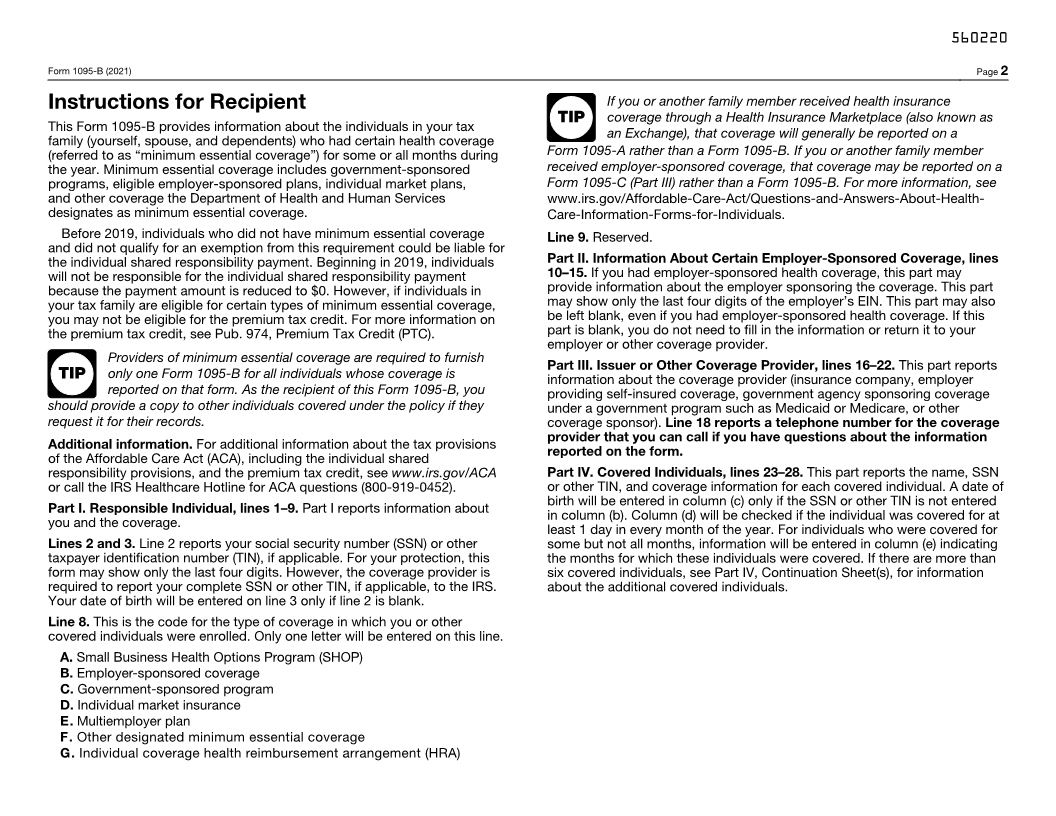

Enlarge image

560118

VOID OMB No. 1545-2252

Form 1095-B Health Coverage

Department of the Treasury ▶ Do not attach to your tax return. Keep for your records. CORRECTED 2021

Internal Revenue Service ▶ Go to www.irs.gov/Form1095B for instructions and the latest information.

Part I Responsible Individual

1 Name of responsible individual–First name, middle name, last name 2 Social security number (SSN) or other TIN 3 Date of birth (if SSN or other TIN is not available)

4 Street address (including apartment no.) 5 City or town 6 State or province 7 Country and ZIP or foreign postal code

9 Reserved

8 Enter letter identifying Origin of the Health Coverage (see instructions for codes): . . . ▶

Part II Information About Certain Employer-Sponsored Coverage (see instructions)

10 Employer name 11 Employer identification number (EIN)

12 Street address (including room or suite no.) 13 City or town 14 State or province 15 Country and ZIP or foreign postal code

Part III Issuer or Other Coverage Provider (see instructions)

16 Name 17 Employer identification number (EIN) 18 Contact telephone number

19 Street address (including room or suite no.) 20 City or town 21 State or province 22 Country and ZIP or foreign postal code

Part IV Covered Individuals (Enter the information for each covered individual.)

(a) Name of covered individual(s) (b) SSN or other TIN (c) DOB (if SSN or other (d) Covered (e) Months of coverage

First name, middle initial, last name TIN is not available) all 12 months

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

23

24

25

26

27

28

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 60704B Form 1095-B (2021)