Enlarge image

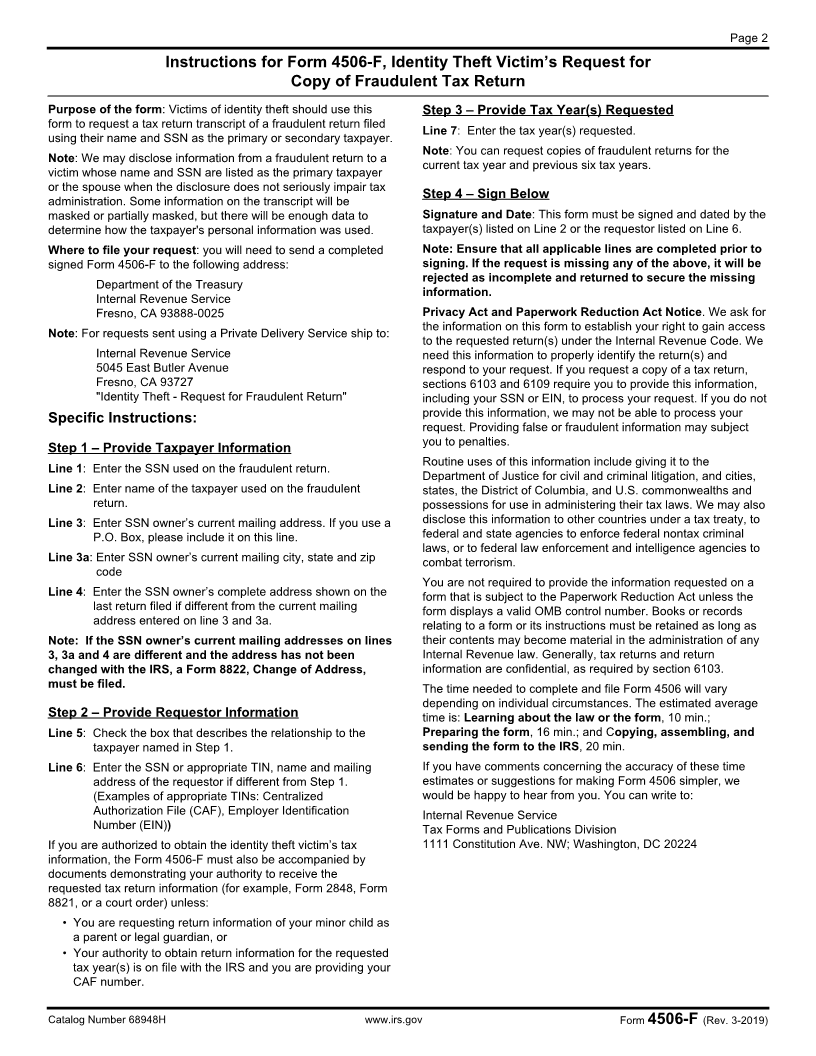

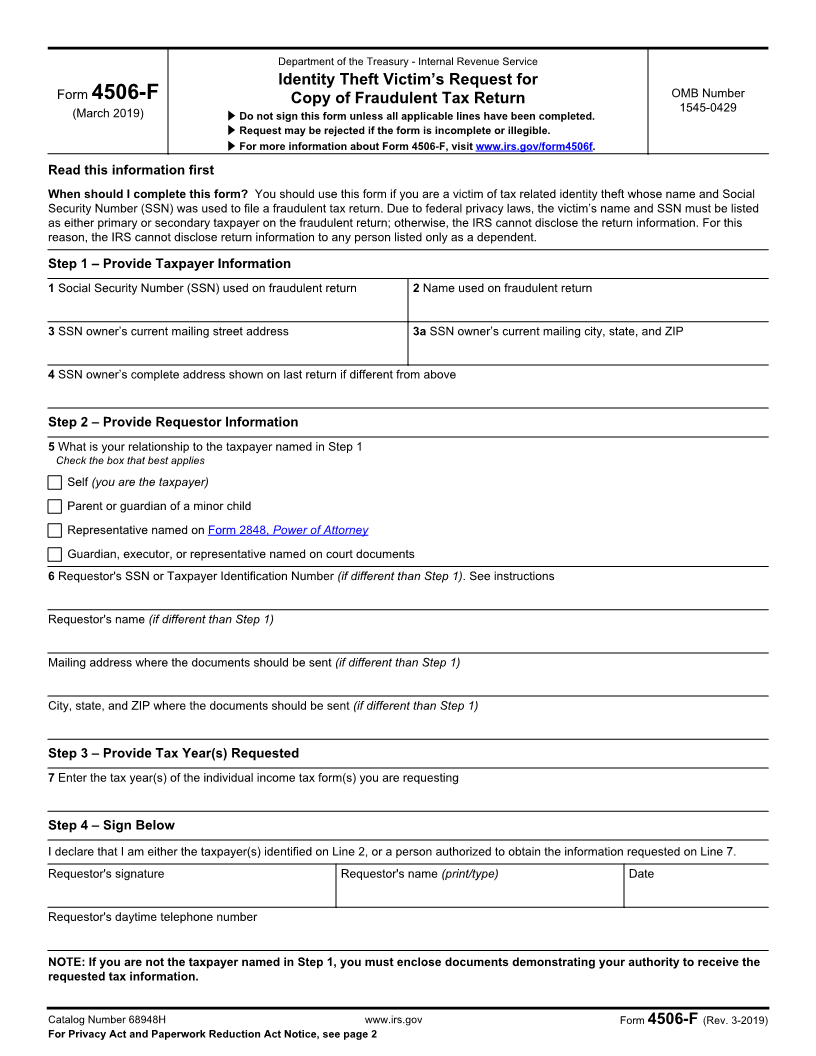

Department of the Treasury - Internal Revenue Service

Identity Theft Victim’s Request for

OMB Number

Form 4506-F Copy of Fraudulent Tax Return 1545-0429

(March 2019) ▶ Do not sign this form unless all applicable lines have been completed.

▶ Request may be rejected if the form is incomplete or illegible.

▶ For more information about Form 4506-F, visit www.irs.gov/form4506f.

Read this information first

When should I complete this form? You should use this form if you are a victim of tax related identity theft whose name and Social

Security Number (SSN) was used to file a fraudulent tax return. Due to federal privacy laws, the victim’s name and SSN must be listed

as either primary or secondary taxpayer on the fraudulent return; otherwise, the IRS cannot disclose the return information. For this

reason, the IRS cannot disclose return information to any person listed only as a dependent.

Step 1 – Provide Taxpayer Information

1 Social Security Number (SSN) used on fraudulent return 2 Name used on fraudulent return

3 SSN owner’s current mailing street address 3a SSN owner’s current mailing city, state, and ZIP

4 SSN owner’s complete address shown on last return if different from above

Step 2 – Provide Requestor Information

5 What is your relationship to the taxpayer named in Step 1

Check the box that best applies

Self (you are the taxpayer)

Parent or guardian of a minor child

Representative named on Form 2848, Power of Attorney

Guardian, executor, or representative named on court documents

6 Requestor's SSN or Taxpayer Identification Number (if different than Step 1). See instructions

Requestor's name (if different than Step 1)

Mailing address where the documents should be sent (if different than Step 1)

City, state, and ZIP where the documents should be sent (if different than Step 1)

Step 3 – Provide Tax Year(s) Requested

7 Enter the tax year(s) of the individual income tax form(s) you are requesting

Step 4 – Sign Below

I declare that I am either the taxpayer(s) identified on Line 2, or a person authorized to obtain the information requested on Line 7.

Requestor's signature Requestor's name (print/type) Date

Requestor's daytime telephone number

NOTE: If you are not the taxpayer named in Step 1, you must enclose documents demonstrating your authority to receive the

requested tax information.

Catalog Number 68948H www.irs.gov Form 4506-F (Rev. 3-2019)

For Privacy Act and Paperwork Reduction Act Notice, see page 2