Enlarge image

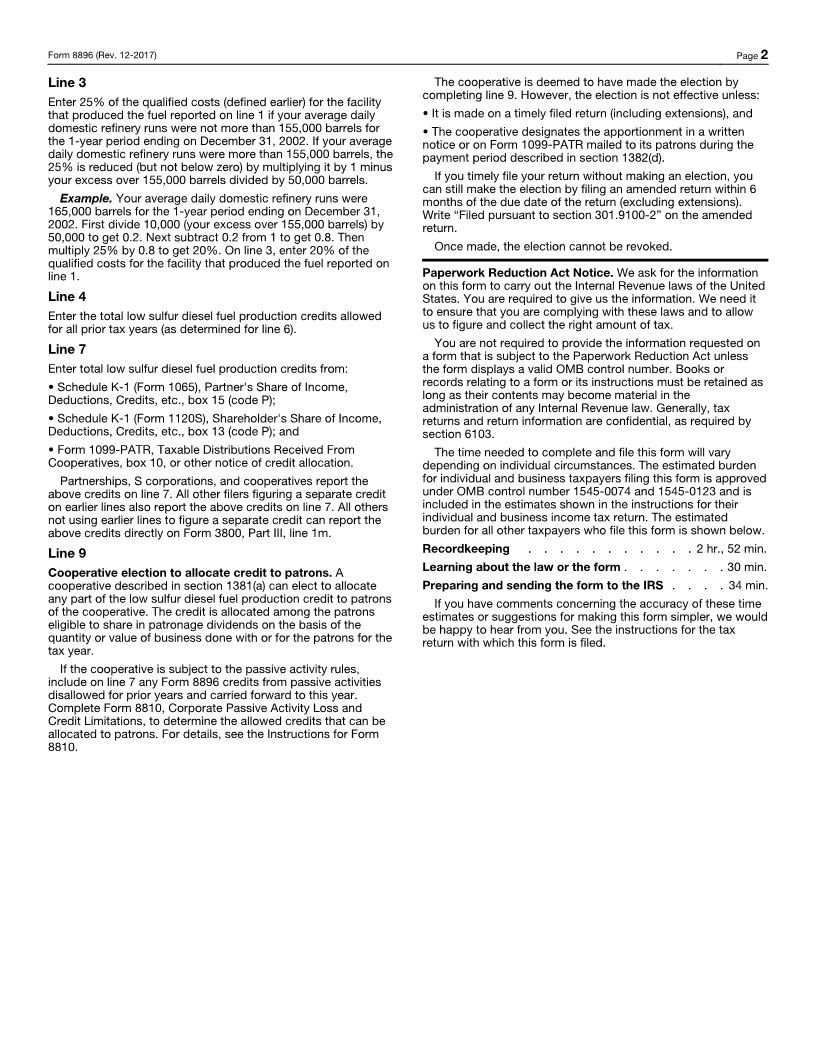

Low Sulfur Diesel Fuel Production Credit OMB No. 1545-1914

Form 8896

(Rev. December 2017) ▶ Attach to your tax return. Attachment

Department of the Treasury ▶ Go to www.irs.gov/Form8896 for the latest information. Sequence No. 142

Internal Revenue Service

Name(s) shown on return Identifying number

1 Low sulfur diesel fuel produced (in gallons) . . . . . . . . . . . . . . . . . . 1

2 Multiply line 1 by $0.05 . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Qualified costs limitation (see instructions) . . . . . . . . . . . . . . . . . . 3

4 Total low sulfur diesel fuel production credits allowed for all prior tax years (see instructions) . 4

5 Subtract line 4 from line 3 . . . . . . . . . . . . . . . . . . . . . . . 5

6 Enter the smaller of line 5 or line 2 . . . . . . . . . . . . . . . . . . . . . 6

7 Low sulfur diesel fuel production credit from partnerships, S corporations, and cooperatives

(see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Add lines 6 and 7. Cooperatives, go to line 9. Partnerships and S corporations, stop here and

report this amount on Schedule K. All others, stop here and report this amount on Form 3800,

Part III, line 1m . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Amount allocated to patrons of the cooperative (see instructions) . . . . . . . . . . 9

10 Cooperatives, subtract line 9 from line 8. Report this amount on Form 3800, Part III, line 1m . 10

General Instructions Qualified Costs

Section references are to the Internal Revenue Code unless For each facility, qualified costs are costs paid or incurred to

otherwise noted. comply with the highway diesel fuel sulfur control requirements

of the Environmental Protection Agency (EPA) during the period

Future Developments beginning January 1, 2003, and ending on the earlier of:

For the latest information about developments related to Form • The date 1 year after the date on which the refiner must

8896 and its instructions, such as legislation enacted after they comply with these EPA requirements with respect to such

were published, go to www.irs.gov/Form8896. facility; or

• December 31, 2009.

Purpose of Form

Qualified costs include costs for the construction of new

Use Form 8896 to claim the low sulfur diesel fuel production process operation units or the dismantling and reconstruction

credit. of existing process units to be used in the production of low

The credit generally is 5 cents for every gallon of low sulfur sulfur diesel fuel, associated adjacent or offsite equipment

diesel fuel produced by a qualified small business refiner during (including tankage, catalyst, and power supply), engineering,

the tax year. However, the total credits allowed for all tax years construction period interest, and site work.

cannot be more than the refiner’s qualified costs limitation on In addition, the small business refiner must obtain certification

line 3. This credit is part of the general business credit. from the IRS (which will consult with the EPA) that the

Partnerships, S corporations, and cooperatives must file this taxpayer’s qualified costs will result in compliance with the

form to claim the credit. All other taxpayers are not applicable EPA regulations. This certification must be obtained

required to complete or file this form if their only source for this not later than June 29, 2008, or, if later, the date that is 30

credit is a partnership, S corporation, or cooperative. months after the first day of the first tax year in which the credit

Instead, they can report this credit directly on line 1m in Part III is determined. For details, see Rev. Proc. 2007-69, 2007-49

of Form 3800, General Business Credit. I.R.B. 1137, available at

www.irs.gov/irb/2007-49_IRB#RP-2007-69.

Definitions Unless you elect not to take this credit, your

deductions will be reduced by the amount of your

Low Sulfur Diesel Fuel TIP credit. For details, see section 280C(d).

This is diesel fuel with a sulfur content of 15 parts per million or

less. Additional Information

Small Business Refiner For more information, see section 45H.

A small business refiner generally is a refiner of crude oil with an

average daily domestic refinery run or average retained Specific Instructions

production for all facilities that did not exceed 205,000 barrels

for the 1-year period ending on December 31, 2002. To figure Use lines 1 through 6 to figure any low sulfur diesel fuel

the average daily domestic refinery run or retained production, production credit from your own trade or business.

only include refineries that were refineries of the refiner or a

related person (within the meaning of section 613A(d)(3)) on Line 1

April 1, 2003. However, a refiner is not a small business refiner Enter the number of gallons of diesel fuel produced with a sulfur

for a tax year if more than 1,500 individuals are engaged in the content of 15 parts per million or less.

refinery operations of the business on any day during the tax

year.

For Paperwork Reduction Act Notice, see instructions. Cat. No. 37704F Form 8896 (Rev. 12-2017)