Enlarge image

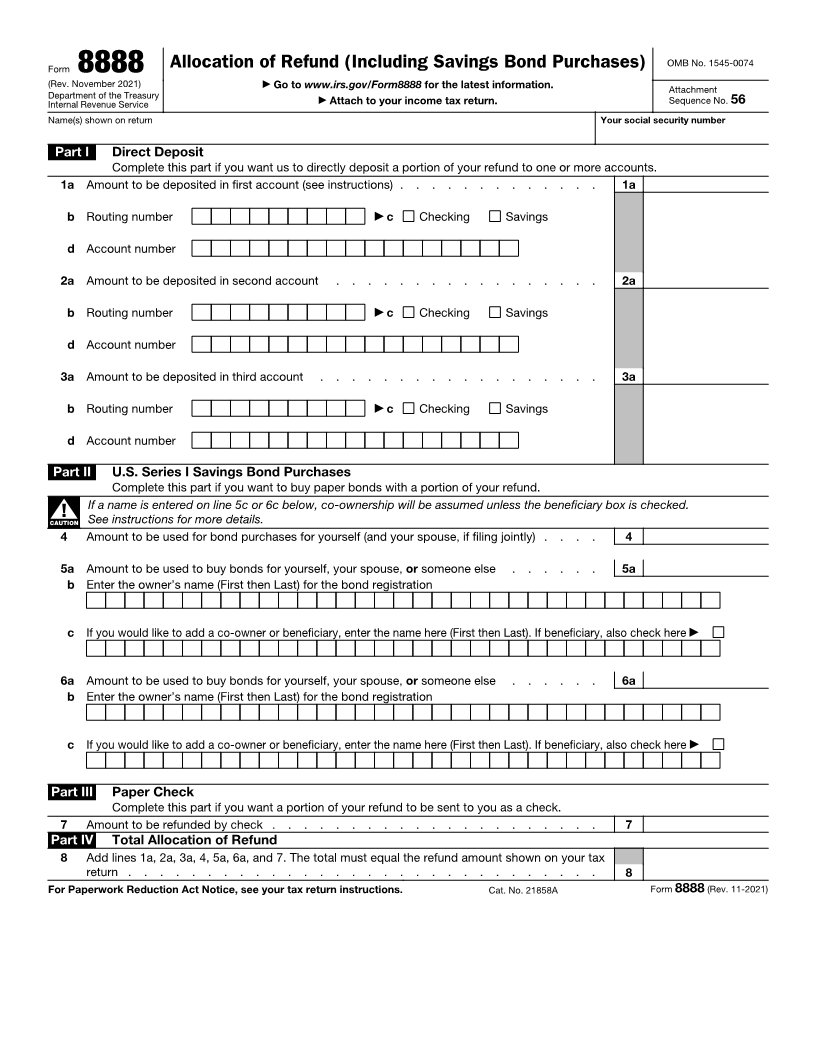

Allocation of Refund (Including Savings Bond Purchases) OMB No. 1545-0074

Form 8888

(Rev. November 2021) ▶ Go to www.irs.gov/Form8888 for the latest information. Attachment

Department of the Treasury ▶ Attach to your income tax return. Sequence No. 56

Internal Revenue Service

Name(s) shown on return Your social security number

Part I Direct Deposit

Complete this part if you want us to directly deposit a portion of your refund to one or more accounts.

1a Amount to be deposited in first account (see instructions) . . . . . . . . . . . . . 1a

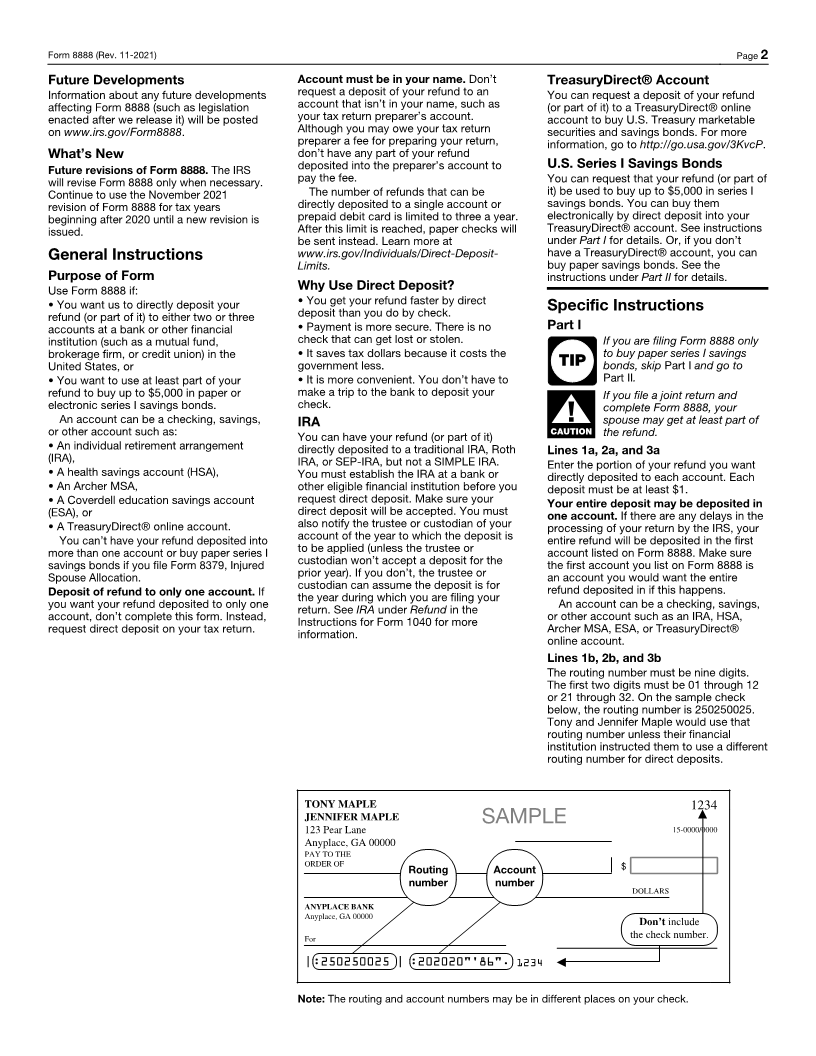

b Routing number ▶ c Checking Savings

d Account number

2 a Amount to be deposited in second account . . . . . . . . . . . . . . . . . 2a

b Routing number ▶ c Checking Savings

d Account number

3 a Amount to be deposited in third account . . . . . . . . . . . . . . . . . . 3a

b Routing number ▶ c Checking Savings

d Account number

Part II U.S. Series I Savings Bond Purchases

Complete this part if you want to buy paper bonds with a portion of your refund.

If a name is entered on line 5c or 6c below, co-ownership will be assumed unless the beneficiary box is checked.

▲CAUTION! See instructions for more details.

4 Amount to be used for bond purchases for yourself (and your spouse, if filing jointly) . . . . 4

5a Amount to be used to buy bonds for yourself, your spouse, orsomeone else . . . . . . 5a

b Enter the owner’s name (First then Last) for the bond registration

c If you would like to add a co-owner or beneficiary, enter the name here (First then Last). If beneficiary, also check here ▶

6a Amount to be used to buy bonds for yourself, your spouse, orsomeone else . . . . . . 6a

b Enter the owner’s name (First then Last) for the bond registration

c If you wouldil ke to add a co-owner or beneficiary, enter the name here (First then Last). If beneficiary, also check ▶here

Part III Paper Check

Complete this part if you want a portion of your refund to be sent to you as a check.

7 Amount to be refunded by check . . . . . . . . . . . . . . . . . . . . . 7

Part IV Total Allocation of Refund

8 Add lines 1a, 2a, 3a, 4, 5a, 6a, and 7. The total must equal the refund amount shown on your tax

return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 21858A Form 8888 (Rev. 11-2021)