- 2 -

Enlarge image

|

Page 2 of 2

General Instructions

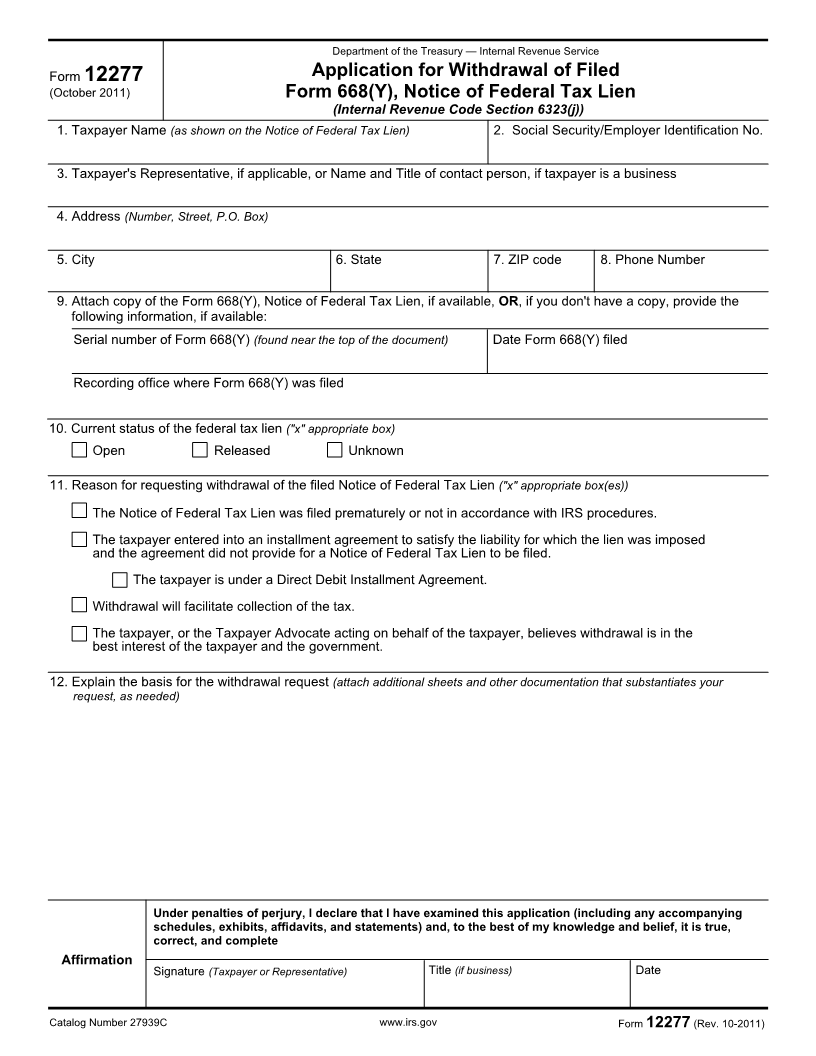

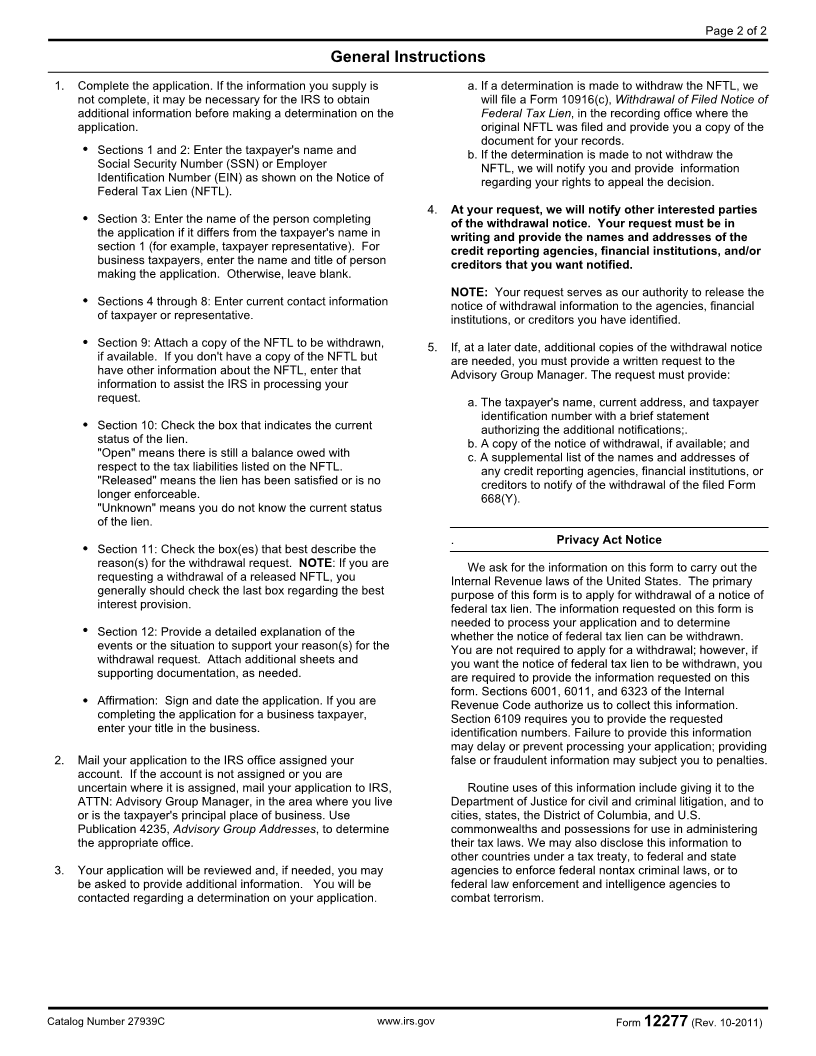

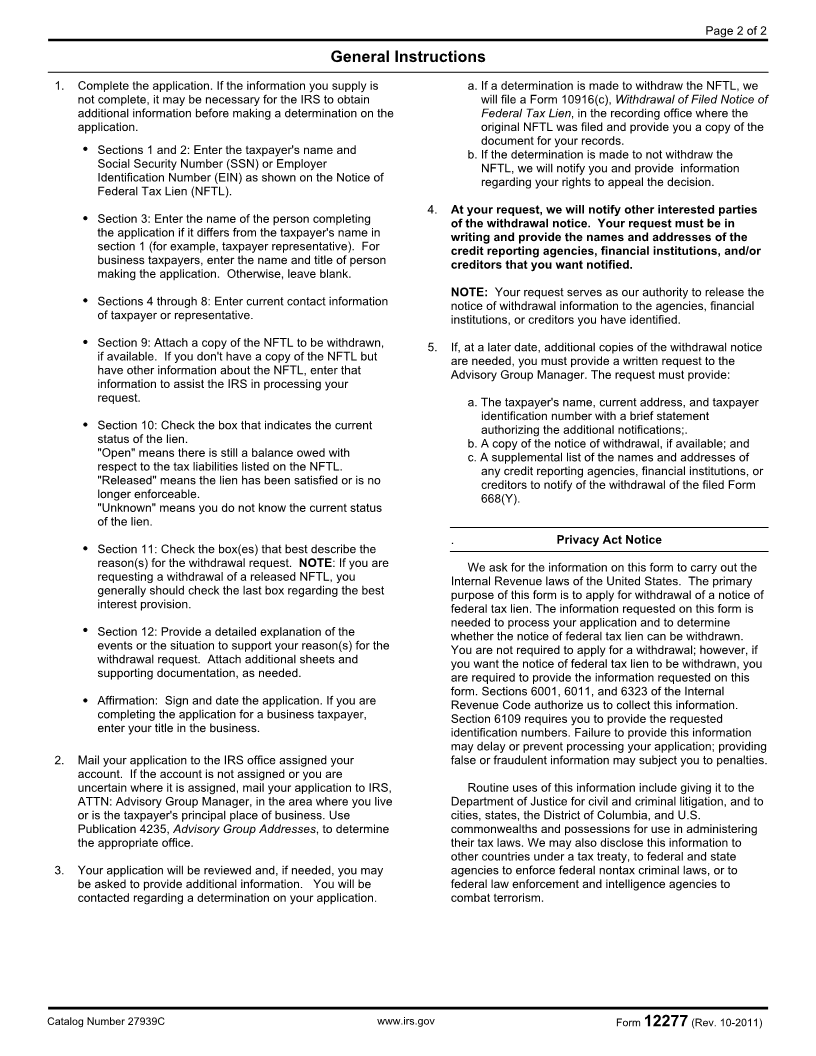

1. Complete the application. If the information you supply is a. If a determination is made to withdraw the NFTL, we

not complete, it may be necessary for the IRS to obtain will file a Form 10916(c), Withdrawal of Filed Notice of

additional information before making a determination on the Federal Tax Lien, in the recording office where the

application. original NFTL was filed and provide you a copy of the

document for your records.

Sections 1 and 2: Enter the taxpayer's name and b. If the determination is made to not withdraw the

Social Security Number (SSN) or Employer NFTL, we will notify you and provide information

Identification Number (EIN) as shown on the Notice of regarding your rights to appeal the decision.

Federal Tax Lien (NFTL).

4. At your request, we will notify other interested parties

Section 3: Enter the name of the person completing of the withdrawal notice. Your request must be in

the application if it differs from the taxpayer's name in writing and provide the names and addresses of the

section 1 (for example, taxpayer representative). For credit reporting agencies, financial institutions, and/or

business taxpayers, enter the name and title of person creditors that you want notified.

making the application. Otherwise, leave blank.

NOTE: Your request serves as our authority to release the

Sections 4 through 8: Enter current contact information notice of withdrawal information to the agencies, financial

of taxpayer or representative. institutions, or creditors you have identified.

Section 9: Attach a copy of the NFTL to be withdrawn, 5. If, at a later date, additional copies of the withdrawal notice

if available. If you don't have a copy of the NFTL but are needed, you must provide a written request to the

have other information about the NFTL, enter that Advisory Group Manager. The request must provide:

information to assist the IRS in processing your

request. a. The taxpayer's name, current address, and taxpayer

identification number with a brief statement

Section 10: Check the box that indicates the current authorizing the additional notifications;.

status of the lien. b. A copy of the notice of withdrawal, if available; and

"Open" means there is still a balance owed with c. A supplemental list of the names and addresses of

respect to the tax liabilities listed on the NFTL. any credit reporting agencies, financial institutions, or

"Released" means the lien has been satisfied or is no creditors to notify of the withdrawal of the filed Form

longer enforceable. 668(Y).

"Unknown" means you do not know the current status

of the lien.

. Privacy Act Notice

Section 11: Check the box(es) that best describe the

reason(s) for the withdrawal request. NOTE: If you are We ask for the information on this form to carry out the

requesting a withdrawal of a released NFTL, you Internal Revenue laws of the United States. The primary

generally should check the last box regarding the best purpose of this form is to apply for withdrawal of a notice of

interest provision. federal tax lien. The information requested on this form is

needed to process your application and to determine

Section 12: Provide a detailed explanation of the whether the notice of federal tax lien can be withdrawn.

events or the situation to support your reason(s) for the You are not required to apply for a withdrawal; however, if

withdrawal request. Attach additional sheets and you want the notice of federal tax lien to be withdrawn, you

supporting documentation, as needed. are required to provide the information requested on this

form. Sections 6001, 6011, and 6323 of the Internal

Affirmation: Sign and date the application. If you are Revenue Code authorize us to collect this information.

completing the application for a business taxpayer, Section 6109 requires you to provide the requested

enter your title in the business. identification numbers. Failure to provide this information

may delay or prevent processing your application; providing

2. Mail your application to the IRS office assigned your false or fraudulent information may subject you to penalties.

account. If the account is not assigned or you are

uncertain where it is assigned, mail your application to IRS, Routine uses of this information include giving it to the

ATTN: Advisory Group Manager, in the area where you live Department of Justice for civil and criminal litigation, and to

or is the taxpayer's principal place of business. Use cities, states, the District of Columbia, and U.S.

Publication 4235, Advisory Group Addresses, to determine commonwealths and possessions for use in administering

the appropriate office. their tax laws. We may also disclose this information to

other countries under a tax treaty, to federal and state

3. Your application will be reviewed and, if needed, you may agencies to enforce federal nontax criminal laws, or to

be asked to provide additional information. You will be federal law enforcement and intelligence agencies to

contacted regarding a determination on your application. combat terrorism.

Catalog Number 27939C www.irs.gov Form 12277 (Rev. 10-2011)

|