Enlarge image

Verify & Print Form

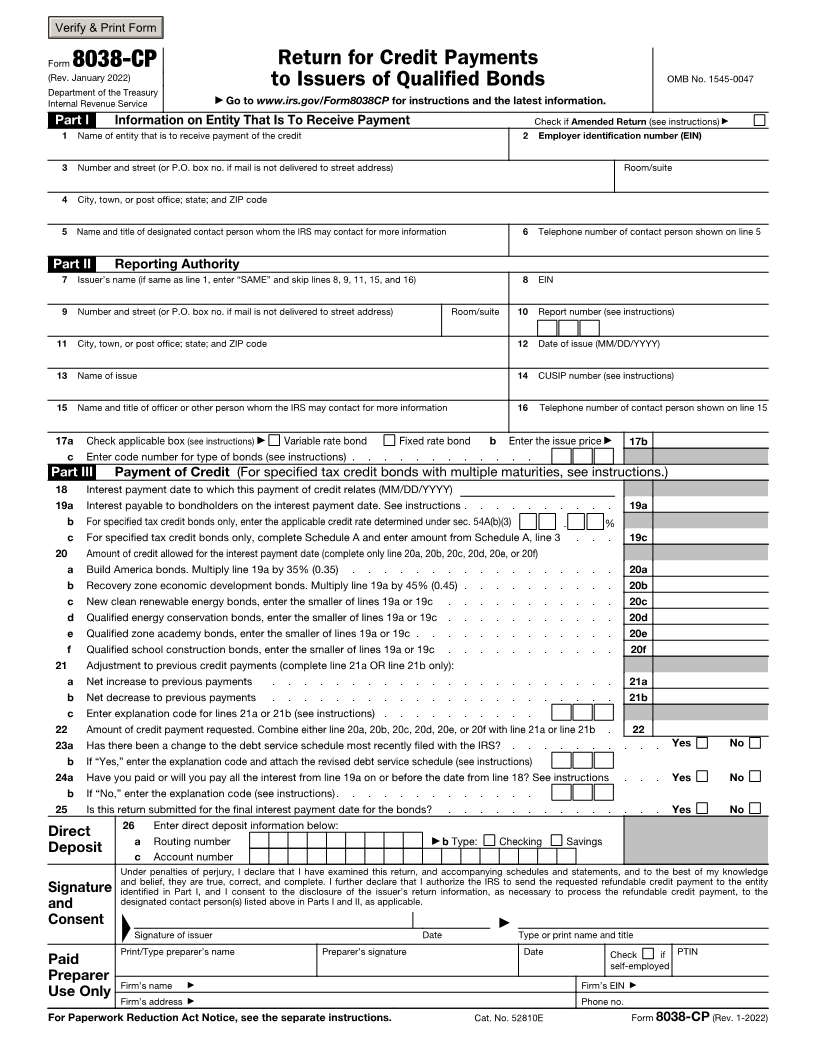

Form 8038-CP Return for Credit Payments

(Rev. January 2022) OMB No. 1545-0047

to Issuers of Qualified Bonds

Internal Revenue Service

Department of the Treasury ▶ Go to www.irs.gov/Form8038CP for instructions and the latest information.

Part I Information on Entity That Is To Receive Payment Check if Amended Return (see instructions) ▶

1 Name of entity that is to receive payment of the credit 2 Employer identification number (EIN)

3 Number and street (or P.O. box no. if mail is not delivered to street address) Room/suite

4 City, town, or post office; state; and ZIP code

5 Name and title of designated contact person whom the IRS may contact for more information 6 Telephone number of contact person shown on line 5

Part II Reporting Authority

7 Issuer’s name (if same as line 1, enter “SAME” and skip lines 8, 9, 11, 15, and 16) 8 EIN

9 Number and street (or P.O. box no. if mail is not delivered to street address) Room/suite 10 Report number (see instructions)

11 City, town, or post office; state; and ZIP code 12 Date of issue (MM/DD/YYYY)

13 Name of issue 14 CUSIP number (see instructions)

15 Name and title of officer or other person whom the IRS may contact for more information 16 Telephone number of contact person shown on line 15

17a Check applicable box (see instructions) ▶ Variable rate bond Fixed rate bond b Enter the issue price ▶ 17b

c Enter code number for type of bonds (see instructions) . . . . . . . . . . . .

Part III Payment of Credit (For specified tax credit bonds with multiple maturities, see instructions.)

18 Interest payment date to which this payment of credit relates (MM/DD/YYYY)

19a Interest payable to bondholders on the interest payment date. See instructions . . . . . . . . . . 19a

b For specified tax credit bonds only, enter the applicable credit rate determined under sec. 54A(b)(3) . %

c For specified tax credit bonds only, complete Schedule A and enter amount from Schedule A, line 3 . . . 19c

20 Amount of credit allowed for the interest payment date (complete only line 20a, 20b, 20c, 20d, 20e, or 20f)

a Build America bonds. Multiply line 19a by 35% (0.35) . . . . . . . . . . . . . . . . . 20a

b Recovery zone economic development bonds. Multiply line 19a by 45% (0.45) . . . . . . . . . . 20b

c New clean renewable energy bonds, enter the smaller of lines 19a or 19c . . . . . . . . . . . 20c

d Qualified energy conservation bonds, enter the smaller of lines 19a or 19c . . . . . . . . . . . 20d

e Qualified zone academy bonds, enter the smaller of lines 19a or 19c . . . . . . . . . . . . . 20e

f Qualified school construction bonds, enter the smaller of lines 19a or 19c . . . . . . . . . . . 20f

21 Adjustment to previous credit payments (complete line 21a OR line 21b only):

a Net increase to previous payments . . . . . . . . . . . . . . . . . . . . . . 21a

b Net decrease to previous payments . . . . . . . . . . . . . . . . . . . . . . 21b

c Enter explanation code for lines 21a or 21b (see instructions) . . . . . . . . . .

22 Amount of credit payment requested. Combine either line 20a, 20b, 20c, 20d, 20e, or 20f with line 21a or line 21b . 22

23a Has there been a change to the debt service schedule most recently filed with the IRS? . . . . . . . . . . Yes No

b If “Yes,” enter the explanation code and attach the revised debt service schedule (see instructions)

24a Have you paid or will you pay all the interest from line 19a on or before the date from line 18? See instructions . . . Yes No

b If “No,” enter the explanation code (see instructions). . . . . . . . . . . . .

25 Is this return submitted for the final interest payment date for the bonds? . . . . . . . . . . . . . . Yes No

26 Enter direct deposit information below:

Direct ▶ b Type: Checking Savings

a Routing number

Deposit

c Account number

Under penalties of perjury, I declare that I have examined this return, and accompanying schedules and statements, and to the best of my knowledge

and belief, they are true, correct, and complete. I further declare that I authorize the IRS to send the requested refundable credit payment to the entity

Signature identified in Part I, and I consent to the disclosure of the issuer’s return information, as necessary to process the refundable credit payment, to the

and ▲designated contact person(s) listed above in Parts I and II, as applicable.

Consent ▶

Signature of issuer Date Type or print name and title

Print/Type preparer’s name Preparer’s signature Date Check if PTIN

Paid self-employed

Preparer ▶ Firm’s EIN ▶

Firm’s name

Use Only ▶ Phone no.

Firm’s address

For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 52810E Form 8038-CP (Rev. 1-2022)