Enlarge image

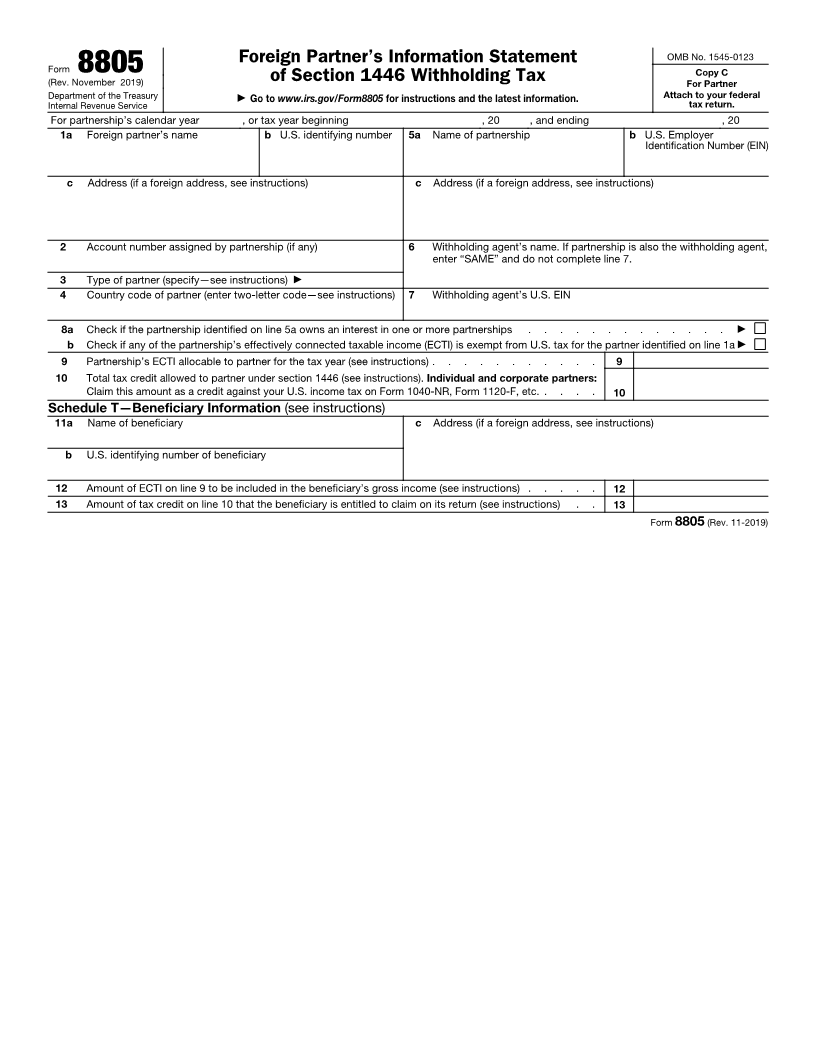

Foreign Partner’s Information Statement OMB No. 1545-0123

Form 8805 of Section 1446 Withholding Tax Copy A

(Rev. November 2019) For Internal Revenue Service

Department of the Treasury ▶ Go to www.irs.gov/Form8805 for instructions and the latest information. Attach to Form 8804.

Internal Revenue Service

For partnership’s calendar year , or tax year beginning , 20 , and ending , 20

1a Foreign partner’s name b U.S. identifying number 5a Name of partnership b U.S. Employer

Identification Number (EIN)

c Address (if a foreign address, see instructions) c Address (if a foreign address, see instructions)

2 Account number assigned by partnership (if any) 6 Withholding agent’s name. If partnership is also the withholdingagent,

enter “SAME” and do not complete line 7.

3 Type of partner (specify—see instructions) ▶

4 Country code of partner (enter two-letter code—see instructions) 7 Withholding agent’s U.S. EIN

8a Check if the partnership identified on line 5a owns an interest in one or more partnerships . . . . . . . . . . . . . ▶

b Check if any of the partnership’s effectively connected taxable income (ECTI) is exempt from U.S. tax for the partner identified on line 1a ▶

9 Partnership’s ECTI allocable to partner for the tax year (see instructions) . . . . . . . . . . . 9

10 Total tax credit allowed to partner under section 1446 (see instructions). Individual and corporate partners:

Claim this amount as a credit against your U.S. income tax on Form 1040-NR, Form 1120-F, etc. . . . . 10

Schedule T—Beneficiary Information (see instructions)

11a Name of beneficiary c Address (if a foreign address, see instructions)

b U.S. identifying number of beneficiary

12 Amount of ECTI on line 9 to be included in the beneficiary’s gross income (see instructions) . . . . . 12

13 Amount of tax credit on line 10 that the beneficiary is entitled to claim on its return (see instructions) . . 13

For Paperwork Reduction Act Notice, see separate Instructions for Forms 8804, 8805, and 8813. Cat. No. 10078E Form 8805 (Rev. 11-2019)