Enlarge image

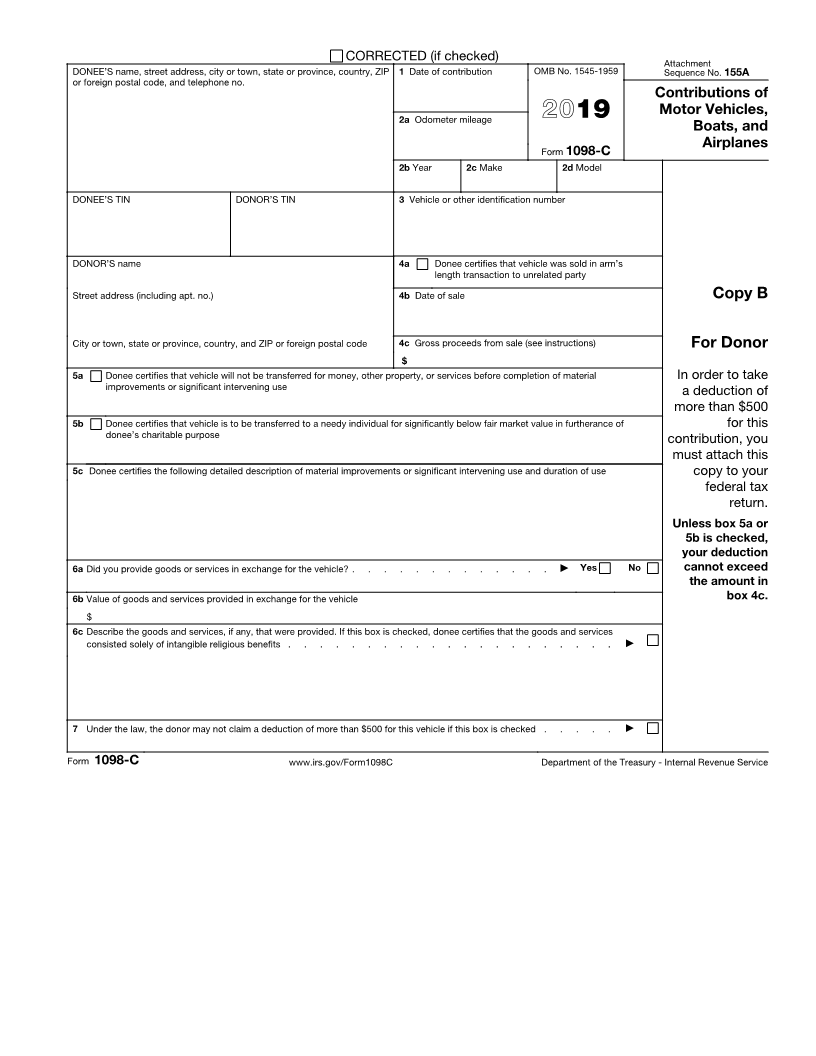

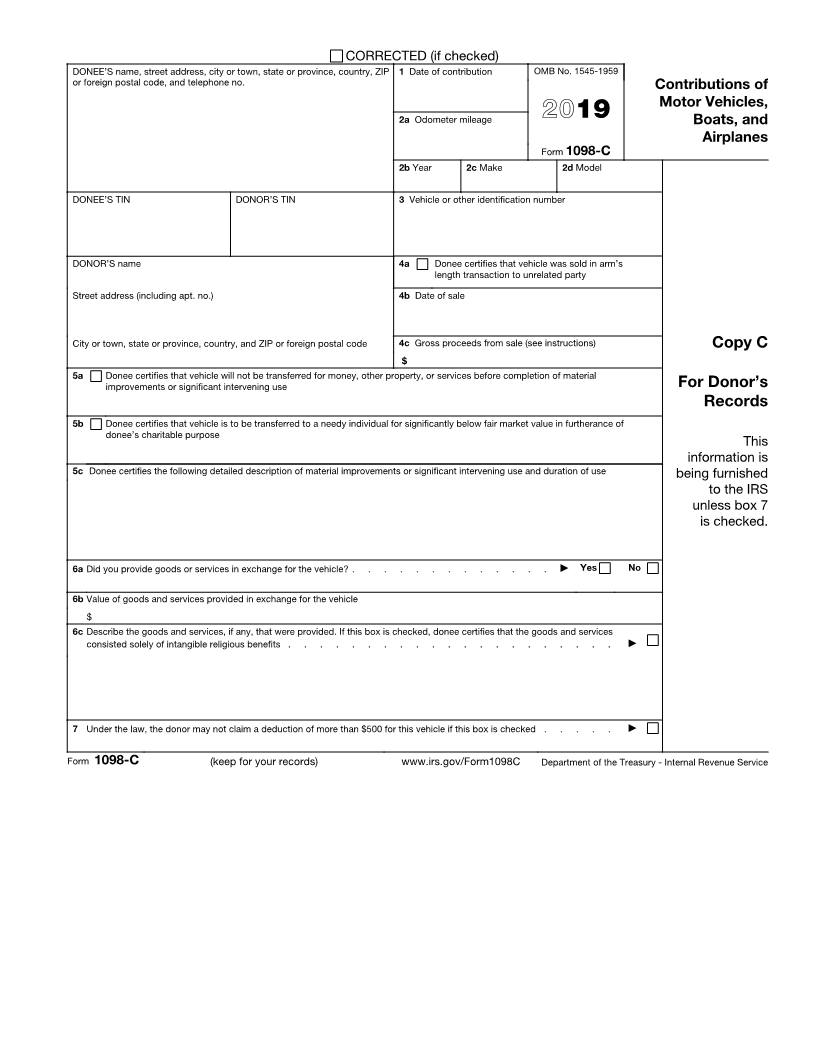

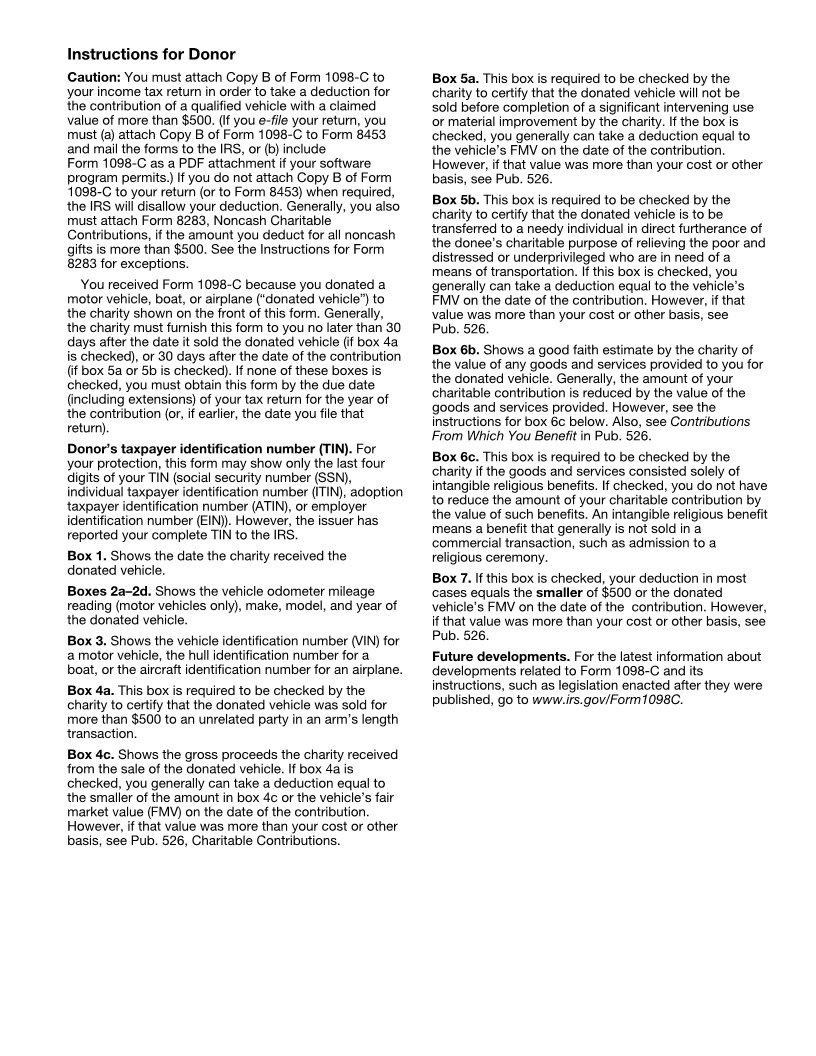

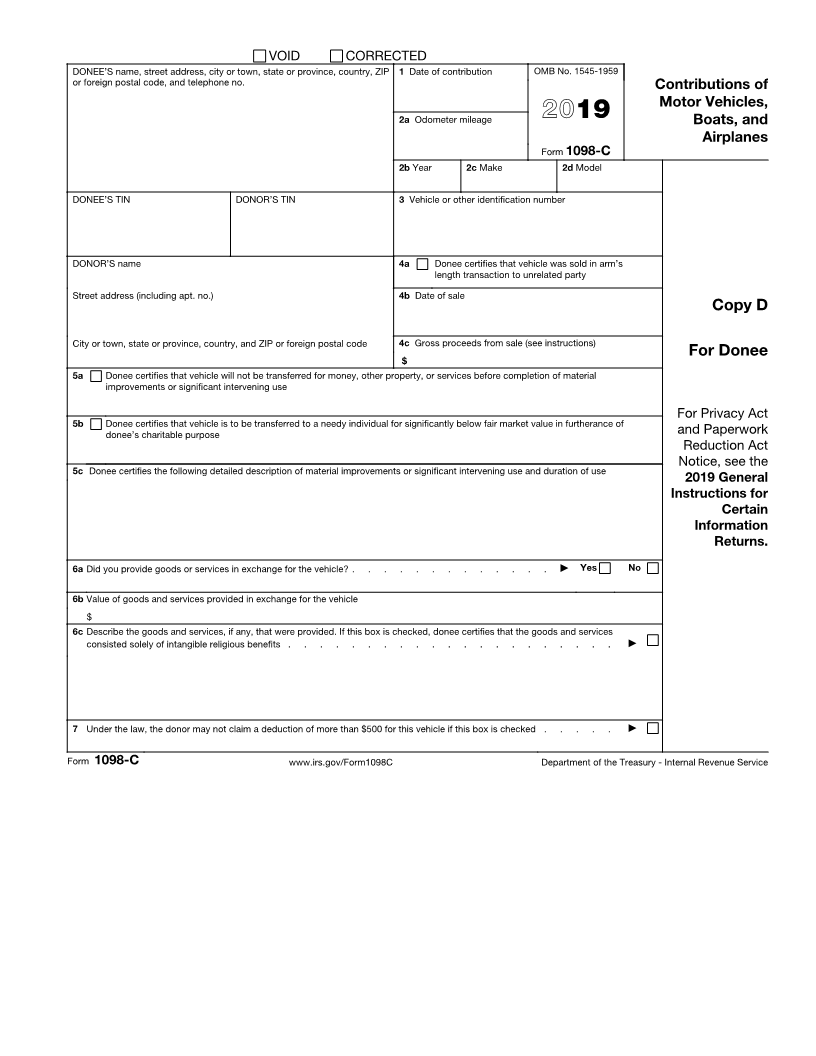

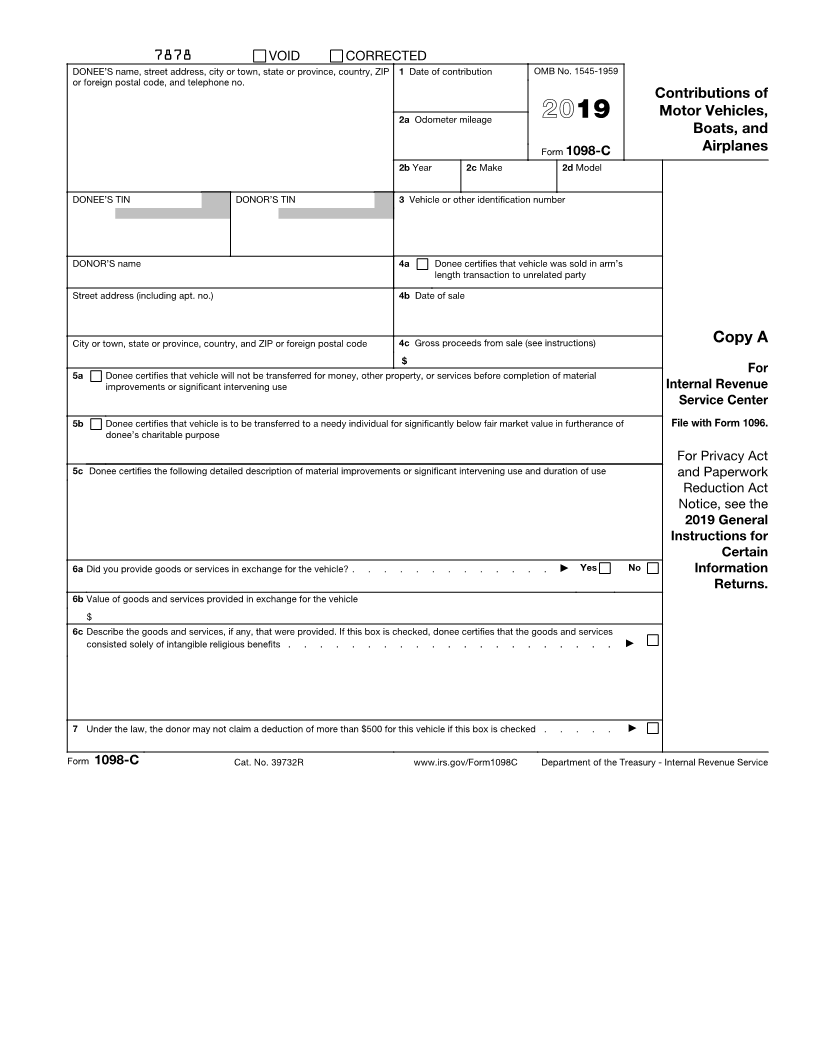

7878 VOID CORRECTED

DONEE’S name, street address, city or town, state or province, country, ZIP 1 Date of contribution OMB No. 1545-1959

or foreign postal code, and telephone no.

Contributions of

2a Odometer mileage 2019 Motor Vehicles,

Boats, and

Form 1098-C Airplanes

2b Year 2c Make 2d Model

DONEE’S TIN DONOR’S TIN 3 Vehicle or other identification number

DONOR’S name 4a Donee certifies that vehicle was sold in arm’s

length transaction to unrelated party

Street address (including apt. no.) 4b Date of sale

City or town, state or province, country, and ZIP or foreign postal code 4c Gross proceeds from sale (see instructions) Copy A

$

5a Donee certifies that vehicle will not be transferred for money, other property, or services before completion of material For

improvements or significant intervening use Internal Revenue

Service Center

5b Donee certifies that vehicle is to be transferred to a needy individual for significantly below fair market value in furtherance of File with Form 1096.

donee’s charitable purpose

For Privacy Act

5c Donee certifies the following detailed description of material improvements or significant intervening use and duration of use and Paperwork

Reduction Act

Notice, see the

2019 General

Instructions for

Certain

6a Did you provide goods or services in exchange for the vehicle? . . . . . . . . . . . . . ▶ Yes No Information

Returns.

6b Value of goods and services provided in exchange for the vehicle

$

6c Describe the goods and services, if any, that were provided. If this box is checked, donee certifies that the goods and services

consisted solely of intangible religious benefits . . . . . . . . . . . . . . . . . . . . . ▶

7 Under the law, the donor may not claim a deduction of more than $500 for this vehicle if this box is checked . . . . . ▶

Form 1098-C Cat. No. 39732R www.irs.gov/Form1098C Department of the Treasury - Internal Revenue Service