Enlarge image

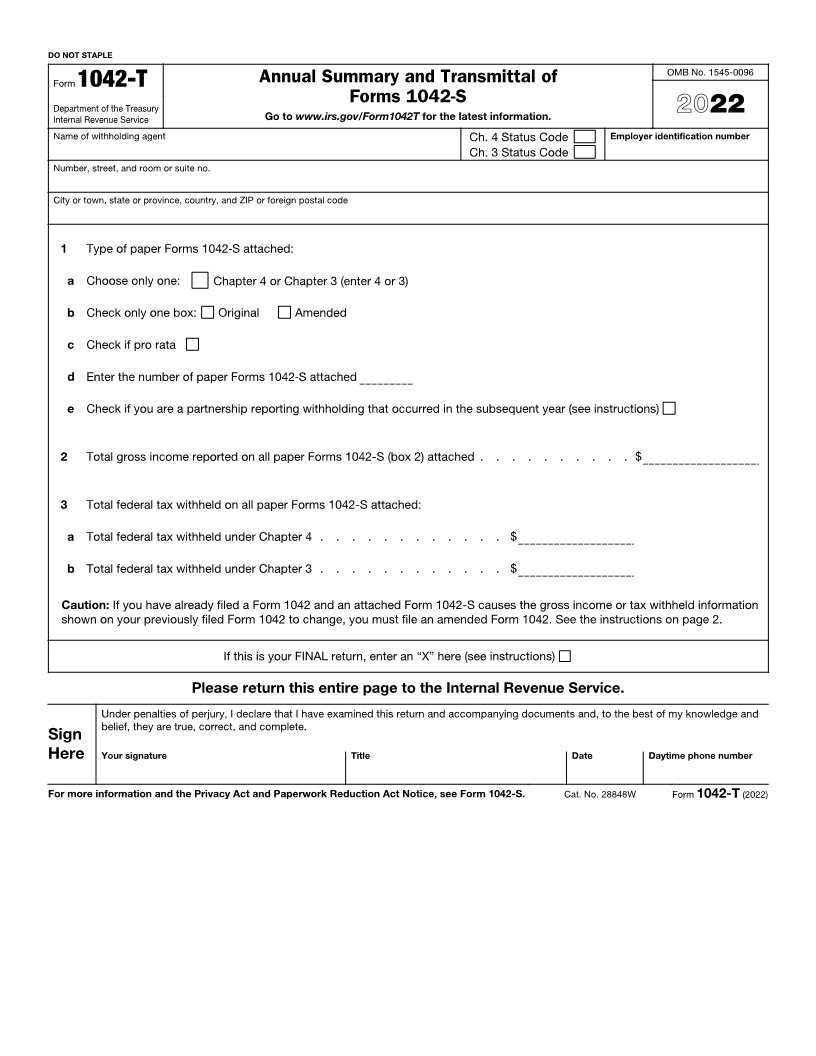

DO NOT STAPLE

OMB No. 1545-0096

Form 1042-T Annual Summary and Transmittal of

Forms 1042-S

Department of the Treasury 2022

Internal Revenue Service Go to www.irs.gov/Form1042T for the latest information.

Name of withholding agent Ch. 4 Status Code Employer identification number

Ch. 3 Status Code

Number, street, and room or suite no.

City or town, state or province, country, and ZIP or foreign postal code

1 Type of paper Forms 1042‐S attached:

a Choose only one: Chapter 4 or Chapter 3 (enter 4 or 3)

b Check only one box: Original Amended

c Check if pro rata

d Enter the number of paper Forms 1042‐S attached

e Check if you are a partnership reporting withholding that occurred in the subsequent year (see instructions)

2 Total gross income reported on all paper Forms 1042-S (box 2) attached . . . . . . . . . . $

3 Total federal tax withheld on all paper Forms 1042-S attached:

a Total federal tax withheld under Chapter 4 . . . . . . . . . . . . $

b Total federal tax withheld under Chapter 3 . . . . . . . . . . . . $

Caution: If you have already filed a Form 1042 and an attached Form 1042-S causes the gross income or tax withheld information

shown on your previously filed Form 1042 to change, you must file an amended Form 1042. See the instructions on page 2.

If this is your FINAL return, enter an “X” here (see instructions)

Please return this entire page to the Internal Revenue Service.

Under penalties of perjury, I declare that I have examined this return and accompanying documents and, to the best of my knowledge and

belief, they are true, correct, and complete.

Sign

Here Your signature Title Date Daytime phone number

For more information and the Privacy Act and Paperwork Reduction Act Notice, see Form 1042-S. Cat. No. 28848W Form 1042-T (2022)