Enlarge image

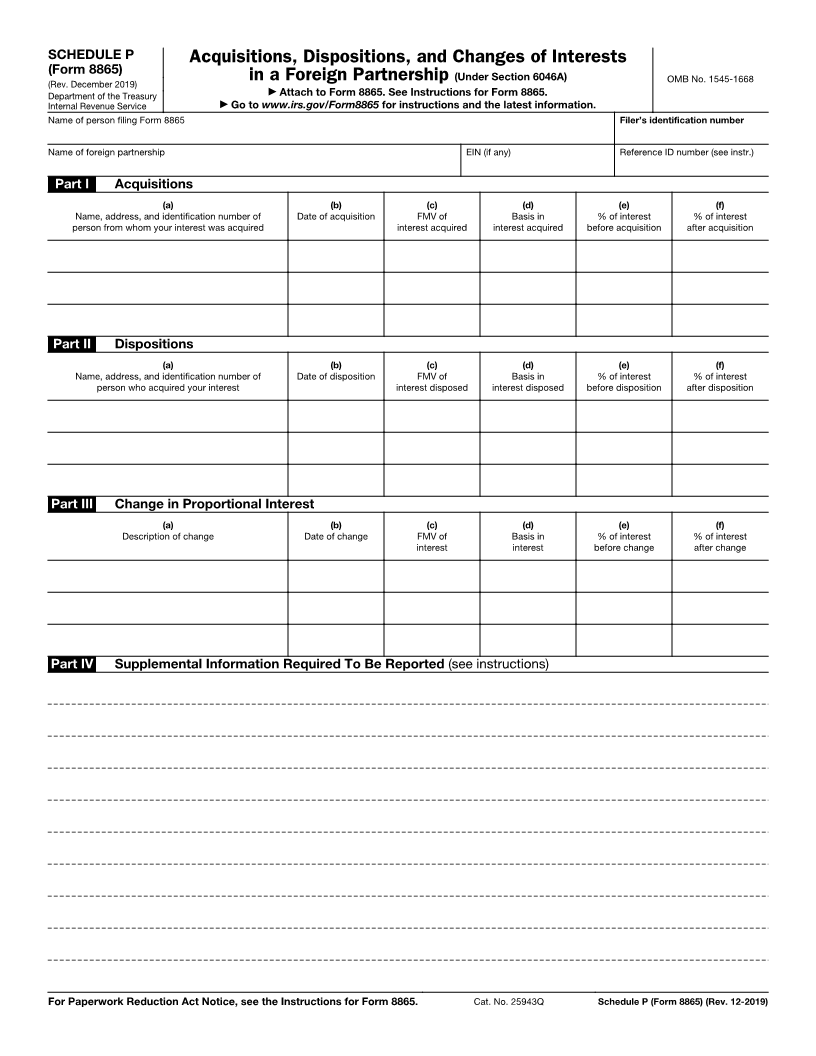

SCHEDULE P Acquisitions, Dispositions, and Changes of Interests

(Form 8865) (Under Section 6046A) OMB No. 1545-1668

(Rev. December 2019) in a Foreign Partnership

Department of the Treasury ▶ Attach to Form 8865. See Instructions for Form 8865.

Internal Revenue Service ▶ Go to www.irs.gov/Form8865 for instructions and the latest information.

Name of person filing Form 8865 Filer’s identification number

Name of foreign partnership EIN (if any) Reference ID number (see instr.)

Part I Acquisitions

(a) (b) (c) (d) (e) (f)

Name, address, and identification number of Date of acquisition FMV of Basis in % of interest % of interest

person from whom your interest was acquired interest acquired interest acquired before acquisition after acquisition

Part II Dispositions

(a) (b) (c) (d) (e) (f)

Name, address, and identification number of Date of disposition FMV of Basis in % of interest % of interest

person who acquired your interest interest disposed interest disposed before disposition after disposition

Part III Change in Proportional Interest

(a) (b) (c) (d) (e) (f)

Description of change Date of change FMV of Basis in % of interest % of interest

interest interest before change after change

Part IV Supplemental Information Required To Be Reported (see instructions)

For Paperwork Reduction Act Notice, see the Instructions for Form 8865. Cat. No. 25943Q Schedule P (Form 8865) (Rev. 12-2019)