Enlarge image

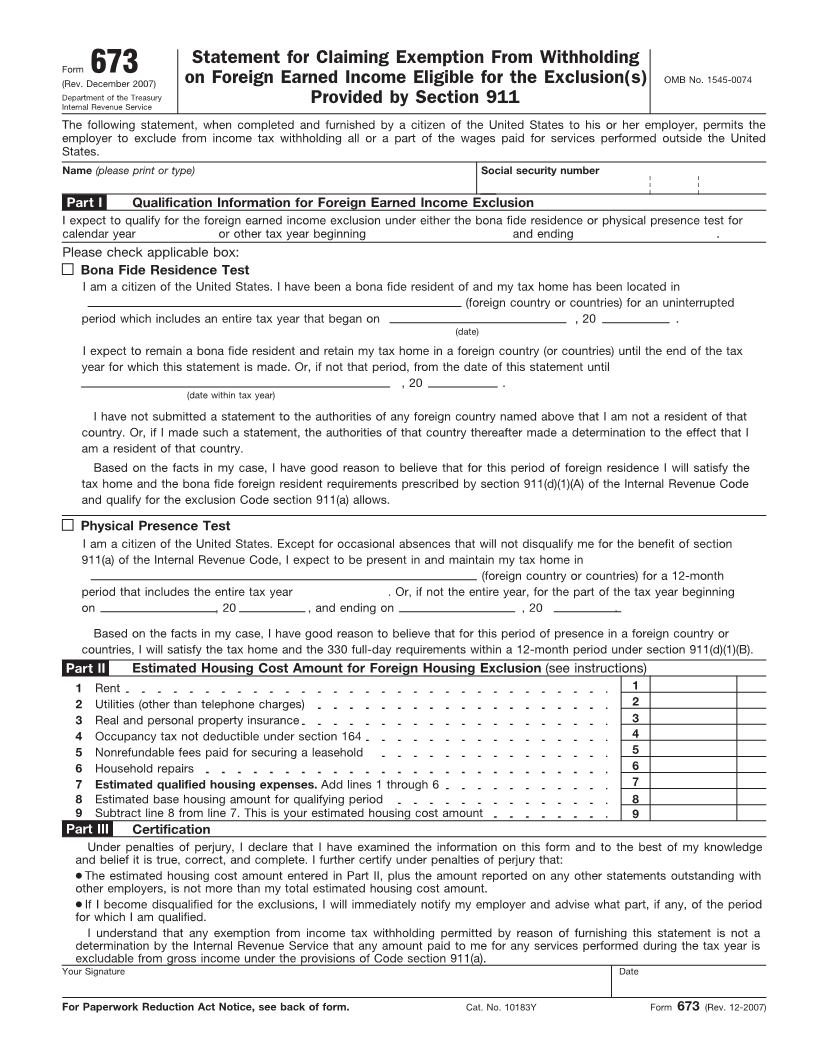

Statement for Claiming Exemption From Withholding

Form 673

(Rev. December 2007) on Foreign Earned Income Eligible for the Exclusion(s) OMB No. 1545-0074

Department of the Treasury Provided by Section 911

Internal Revenue Service

The following statement, when completed and furnished by a citizen of the United States to his or her employer, permits the

employer to exclude from income tax withholding all or a part of the wages paid for services performed outside the United

States.

Name (please print or type) Social security number

Part I Qualification Information for Foreign Earned Income Exclusion

I expect to qualify for the foreign earned income exclusion under either the bona fide residence or physical presence test for

calendar year or other tax year beginning and ending .

Please check applicable box:

Bona Fide Residence Test

I am a citizen of the United States. I have been a bona fide resident of and my tax home has been located in

(foreign country or countries) for an uninterrupted

period which includes an entire tax year that began on , 20 .

(date)

I expect to remain a bona fide resident and retain my tax home in a foreign country (or countries) until the end of the tax

year for which this statement is made. Or, if not that period, from the date of this statement until

, 20 .

(date within tax year)

I have not submitted a statement to the authorities of any foreign country named above that I am not a resident of that

country. Or, if I made such a statement, the authorities of that country thereafter made a determination to the effect that I

am a resident of that country.

Based on the facts in my case, I have good reason to believe that for this period of foreign residence I will satisfy the

tax home and the bona fide foreign resident requirements prescribed by section 911(d)(1)(A) of the Internal Revenue Code

and qualify for the exclusion Code section 911(a) allows.

Physical Presence Test

I am a citizen of the United States. Except for occasional absences that will not disqualify me for the benefit of section

911(a) of the Internal Revenue Code, I expect to be present in and maintain my tax home in

(foreign country or countries) for a 12-month

period that includes the entire tax year . Or, if not the entire year, for the part of the tax year beginning

on , 20 , and ending on , 20 .

Based on the facts in my case, I have good reason to believe that for this period of presence in a foreign country or

countries, I will satisfy the tax home and the 330 full-day requirements within a 12-month period under section 911(d)(1)(B).

Part II Estimated Housing Cost Amount for Foreign Housing Exclusion (see instructions)

1 Rent 1

2 Utilities (other than telephone charges) 2

3 Real and personal property insurance 3

4 Occupancy tax not deductible under section 164 4

5 Nonrefundable fees paid for securing a leasehold 5

6 Household repairs 6

7 Estimated qualified housing expenses. Add lines 1 through 6 7

8 Estimated base housing amount for qualifying period 8

9 Subtract line 8 from line 7. This is your estimated housing cost amount 9

Part III Certification

Under penalties of perjury, I declare that I have examined the information on this form and to the best of my knowledge

and belief it is true, correct, and complete. I further certify under penalties of perjury that:

● The estimated housing cost amount entered in Part II, plus the amount reported on any other statements outstanding with

other employers, is not more than my total estimated housing cost amount.

● If I become disqualified for the exclusions, I will immediately notify my employer and advise what part, if any, of the period

for which I am qualified.

I understand that any exemption from income tax withholding permitted by reason of furnishing this statement is not a

determination by the Internal Revenue Service that any amount paid to me for any services performed during the tax year is

excludable from gross income under the provisions of Code section 911(a).

Your Signature Date

For Paperwork Reduction Act Notice, see back of form. Cat. No. 10183Y Form 673 (Rev. 12-2007)