Enlarge image

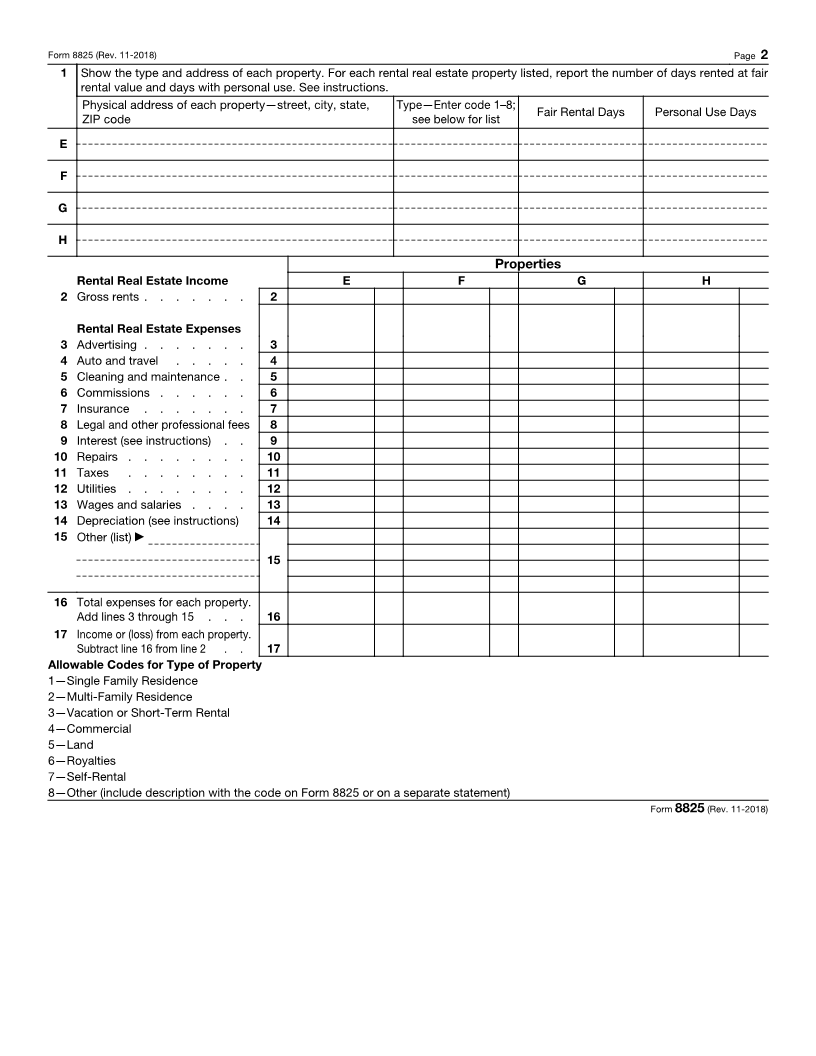

Rental Real Estate Income and Expenses of a

Form 8825 Partnership or an S Corporation OMB No. 1545-0123

(Rev. November 2018) ▶

Department of the Treasury Attach to Form 1065 or Form 1120S.

Internal Revenue Service ▶ Go to www.irs.gov/Form8825 for the latest information.

Name Employer identification number

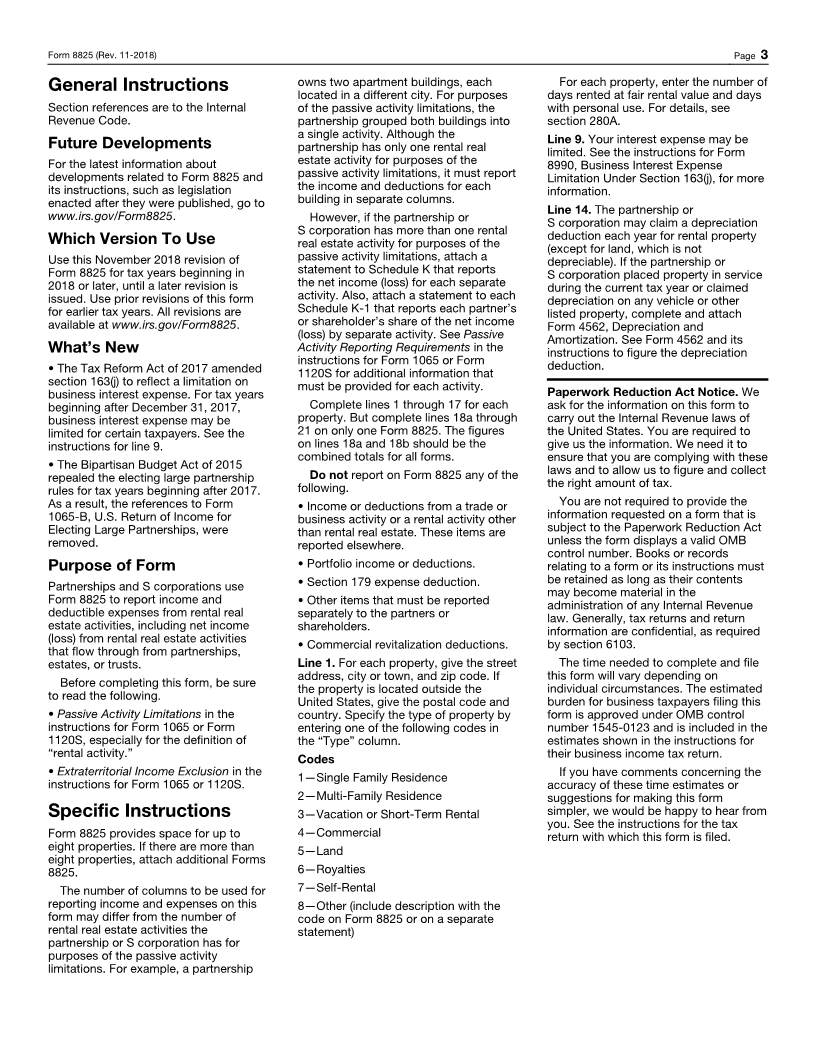

1 Show the type and address of each property. For each rental real estate property listed, report the number of days rented at fair

rental value and days with personal use. See instructions. See page 2 to list additional properties.

Physical address of each property—street, city, state, Type—Enter code 1–8;

Fair Rental Days Personal Use Days

ZIP code see page 2 for list

A

B

C

D

Properties

Rental Real Estate Income A B C D

2 Gross rents . . . . . . . 2

Rental Real Estate Expenses

3 Advertising . . . . . . . 3

4 Auto and travel . . . . . 4

5 Cleaning and maintenance . . 5

6 Commissions . . . . . . 6

7 Insurance . . . . . . . 7

8 Legal and other professional fees 8

9 Interest (see instructions) . . 9

10 Repairs . . . . . . . . 10

11 Taxes . . . . . . . . 11

12 Utilities . . . . . . . . 12

13 Wages and salaries . . . . 13

14 Depreciation (see instructions) 14

15 Other (list) ▶

15

16 Total expenses for each property.

Add lines 3 through 15 . . . 16

17 Income or (loss) from each property.

Subtract line 16 from line 2 . . 17

18 a Total gross rents. Add gross rents from line 2, columns A through H . . . . . . . . . . 18a

b Total expenses. Add total expenses from line 16, columns A through H . . . . . . . . . 18b ( )

19 Net gain (loss) from Form 4797, Part II, line 17, from the disposition of property from rental real

estate activities . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20 a Net income (loss) from rental real estate activities from partnerships, estates, and trusts in which

this partnership or S corporation is a partner or beneficiary (from Schedule K-1) . . . . . . 20a

b Identify below the partnerships, estates, or trusts from which net income (loss) is shown on line

20a. Attach a schedule if more space is needed.

(1) Name (2) Employer identification number

21 Net rental real estate income (loss). Combine lines 18a through 20a. Enter the result here and on: 21

• Form 1065 or 1120S: Schedule K, line 2

For Paperwork Reduction Act Notice, see instructions. Cat. No. 10136Z Form 8825 (Rev. 11-2018)