Enlarge image

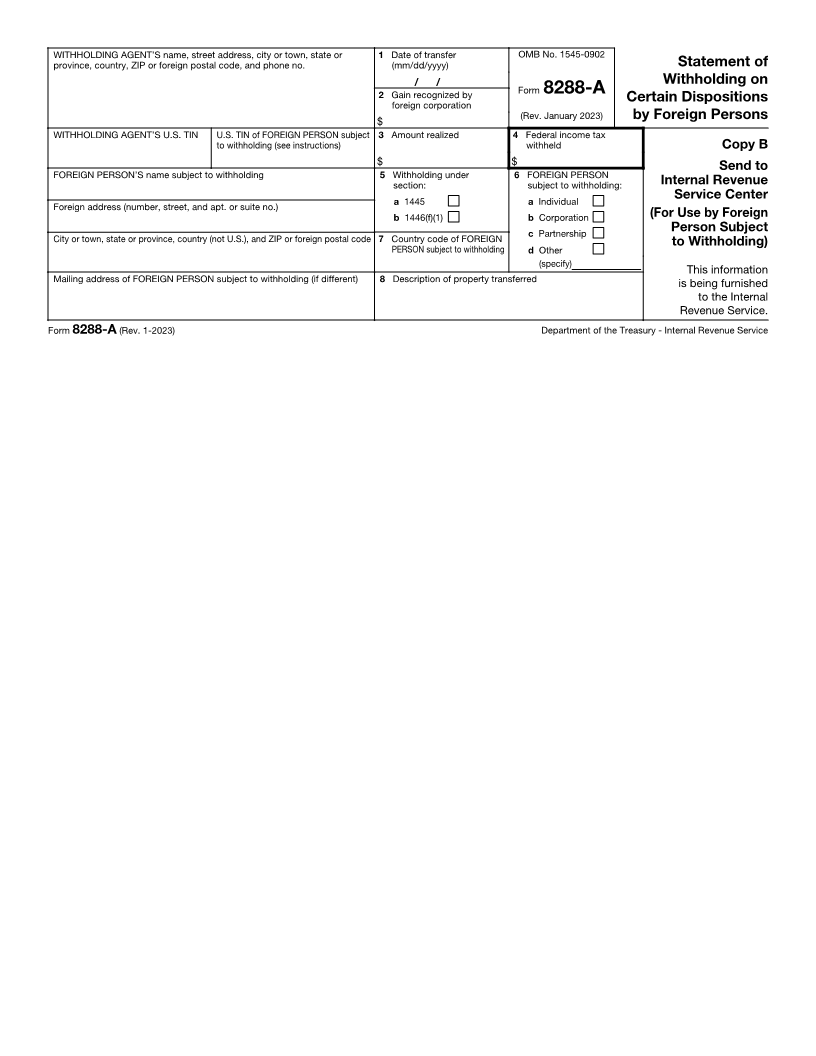

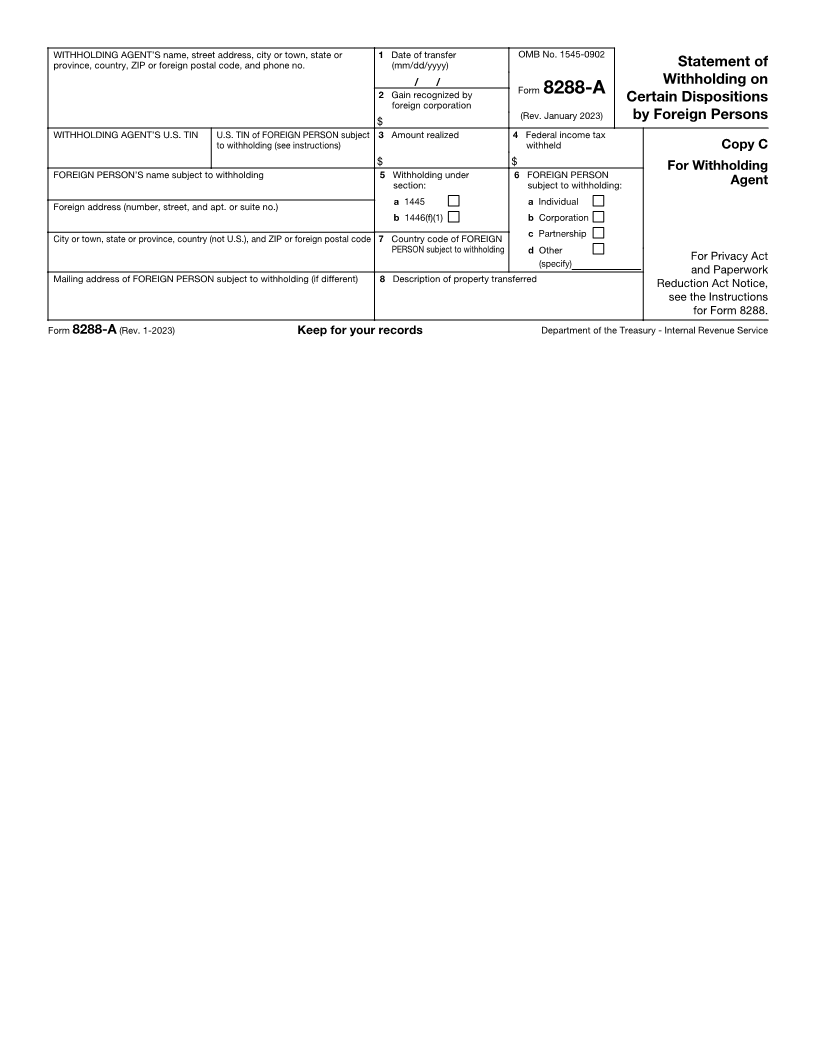

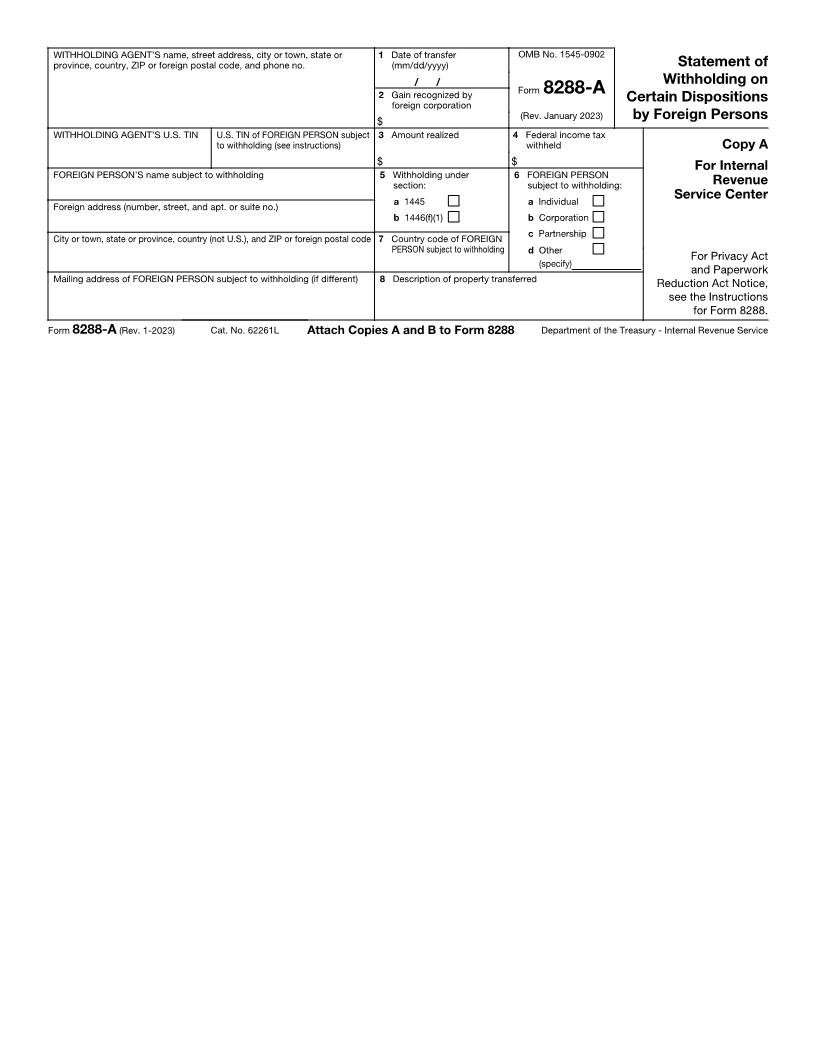

WITHHOLDING AGENT’S name, street address, city or town, state or 1 Date of transfer OMB No. 1545-0902

province, country, ZIP or foreign postal code, and phone no. (mm/dd/yyyy) Statement of

/ / Withholding on

2 Gain recognized by Form 8288-A

foreign corporation Certain Dispositions

$ (Rev. January 2023) by Foreign Persons

WITHHOLDING AGENT’S U.S. TIN U.S. TIN of FOREIGN PERSON subject 3 Amount realized 4 Federal income tax

to withholding (see instructions) withheld Copy A

$ $ For Internal

FOREIGN PERSON’S name subject to withholding 5 Withholding under 6 FOREIGN PERSON

section: subject to withholding: Revenue

a 1445 a Individual Service Center

Foreign address (number, street, and apt. or suite no.)

b 1446(f)(1) b Corporation

City or town, state or province, country (not U.S.), and ZIP or foreign postal code 7 Country code of FOREIGN c Partnership

PERSON subject to withholding d Other

(specify) For Privacy Act

and Paperwork

Mailing address of FOREIGN PERSON subject to withholding (if different) 8 Description of property transferred Reduction Act Notice,

see the Instructions

for Form 8288.

Form 8288-A (Rev. 1-2023) Cat. No. 62261L Attach Copies A and B to Form 8288 Department of the Treasury - Internal Revenue Service