Enlarge image

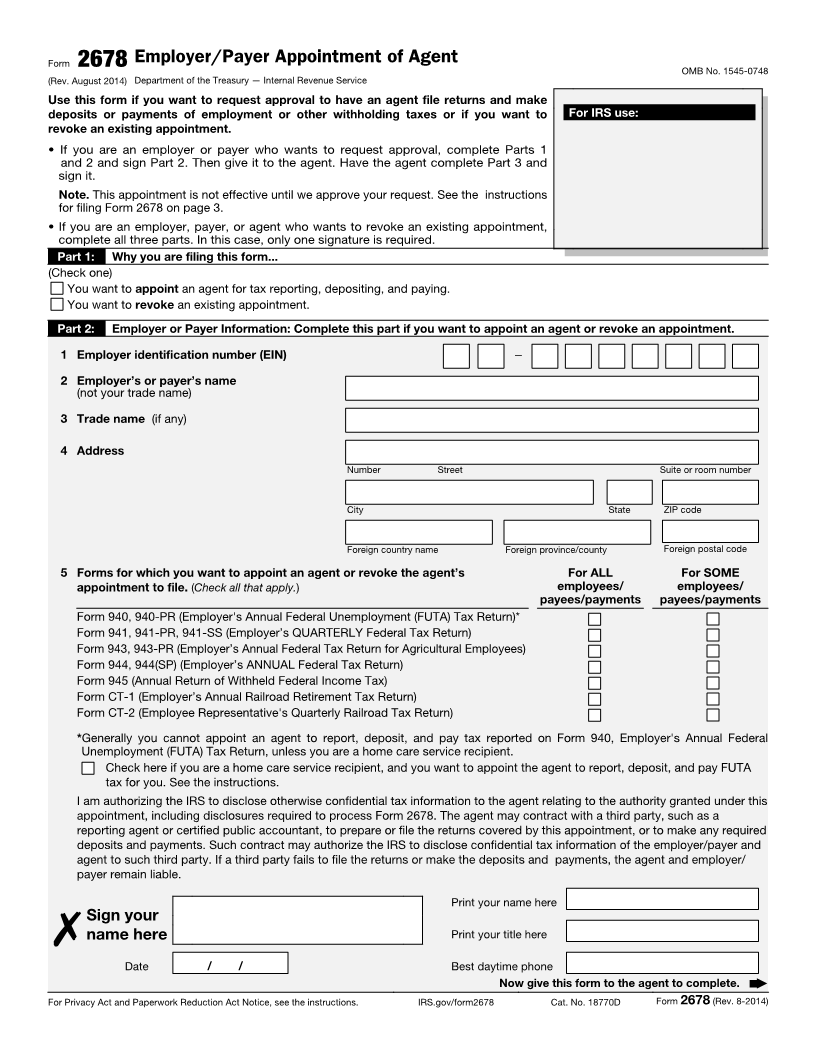

This update supplements Form 2678, Employer/Payer Appointment of Agent (Rev.

August 2014), and provides additional information for filers of the form. Filers should

rely on this update for the changes described, which will be incorporated into the next

revision of the form.

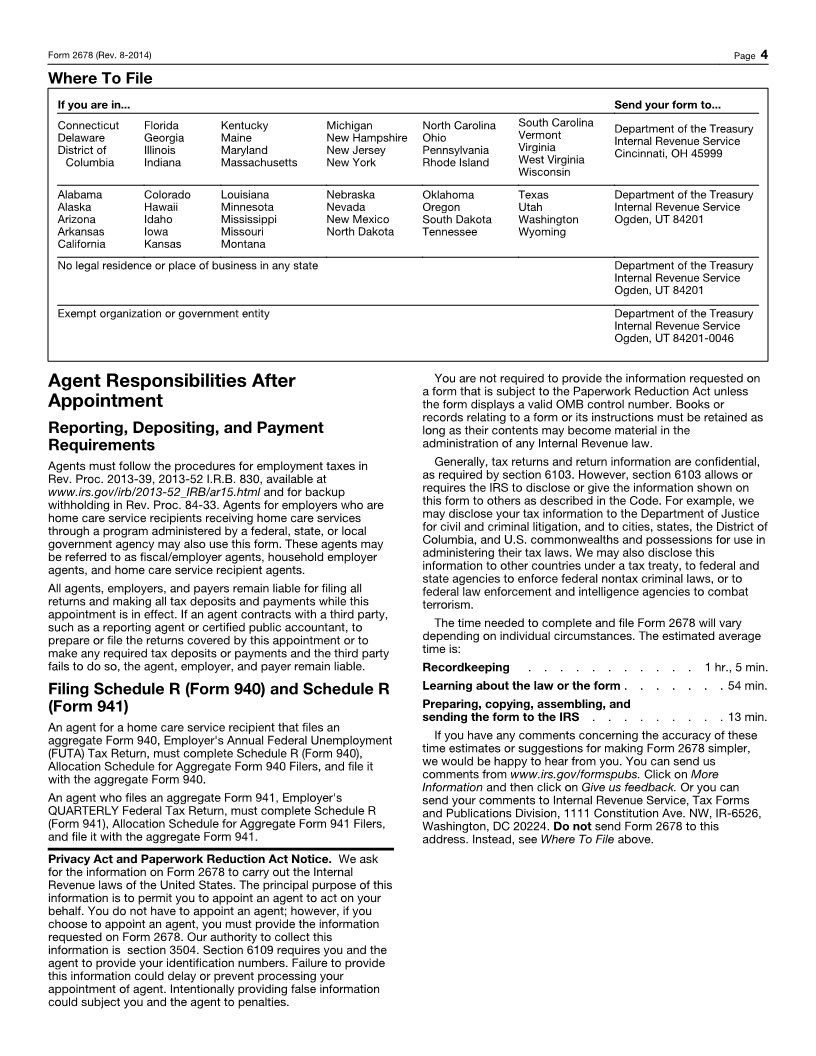

Beginning January 1, 2019, Where To File on page 4 of Form 2678 must be replaced

as shown below.

IF you are in... SEND your form to...

Connecticut, Delaware, District of Columbia, Department of the Treasury

Georgia, Illinois, Indiana, Kentucky, Maine, Internal Revenue Service

Maryland, Massachusetts, Michigan, New Kansas City, MO 64999

Hampshire, New Jersey, New York, North Carolina,

Ohio, Pennsylvania, Rhode Island, South Carolina,

Vermont, Virginia, West Virginia, Wisconsin

Alabama, Alaska, Arizona, Arkansas, California, Department of the Treasury

Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Internal Revenue Service

Louisiana, Minnesota, Mississippi, Missouri, Ogden, UT 84201

Montana, Nebraska, Nevada, New Mexico, North

Dakota, Oklahoma, Oregon, South Dakota,

Tennessee, Texas, Utah, Washington, Wyoming

No legal residence or place of business in any state Department of the Treasury

Internal Revenue Service

Ogden, UT 84201

Exempt organization or government entity Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0046