Enlarge image

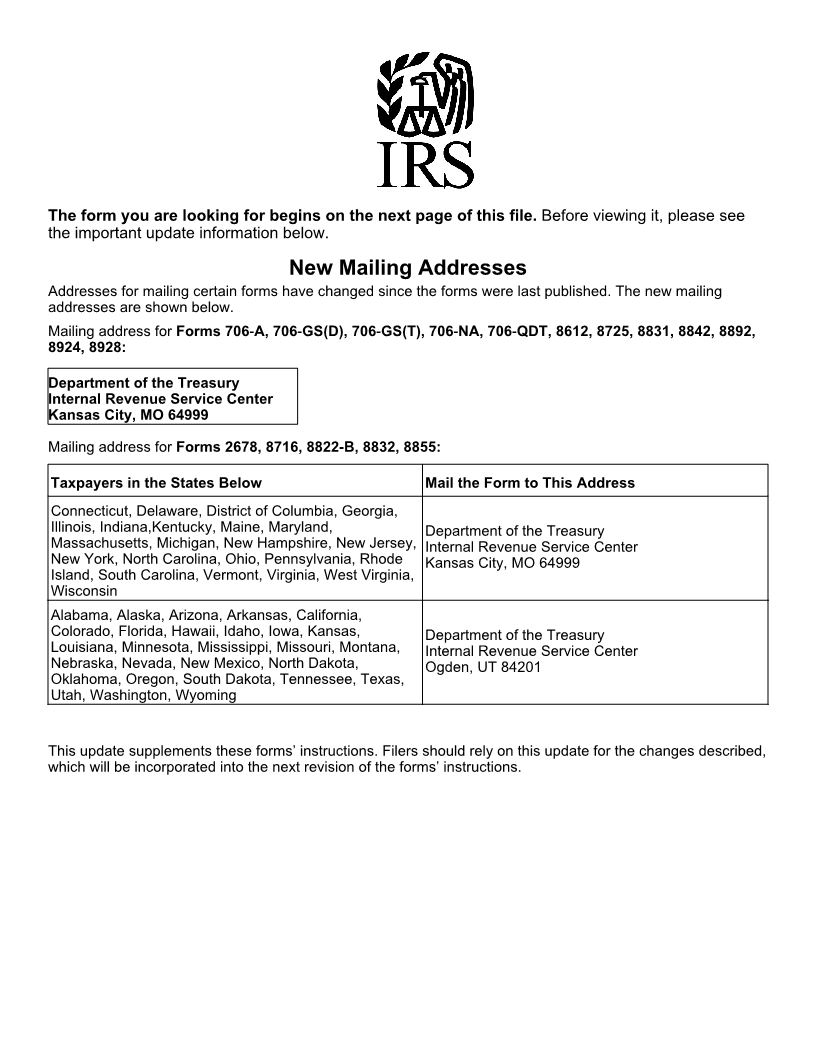

The form you are looking for begins on the next page of this file. Before viewing it, please see

the important update information below.

New Mailing Addresses

Addresses for mailing certain forms have changed since the forms were last published. The new mailing

addresses are shown below.

Mailing address for Forms 706‐ A, 706‐ GS(D), 706‐ GS(T), 706‐ NA, 706‐QDT, 8612, 8725, 8831, 8842, 8892,

8924, 8928:

Department of the Treasury

Internal Revenue Service Center

Kansas City, MO 64999

Mailing address for Forms 2678, 8716, 8822-B, 8832, 8855:

Taxpayers in the States Below Mail the Form to This Address

Connecticut, Delaware, District of Columbia, Georgia,

Illinois, Indiana,Kentucky, Maine, Maryland, Department of the Treasury

Massachusetts, Michigan, New Hampshire, New Jersey, Internal Revenue Service Center

New York, North Carolina, Ohio, Pennsylvania, Rhode Kansas City, MO 64999

Island, South Carolina, Vermont, Virginia, West Virginia,

Wisconsin

Alabama, Alaska, Arizona, Arkansas, California,

Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Department of the Treasury

Louisiana, Minnesota, Mississippi, Missouri, Montana, Internal Revenue Service Center

Nebraska, Nevada, New Mexico, North Dakota, Ogden, UT 84201

Oklahoma, Oregon, South Dakota, Tennessee, Texas,

Utah, Washington, Wyoming

This update supplements these forms’ instructions. Filers should rely on this update for the changes described,

which will be incorporated into the next revision of the forms’ instructions.