Enlarge image

IRS Paid Preparer Tax Identification Number (PTIN)

Form W-12 OMB No. 1545-2190

(Rev. October 2022) Application and Renewal

Department of the Treasury

Internal Revenue Service Go to www.irs.gov/FormW12 for instructions and the latest information.

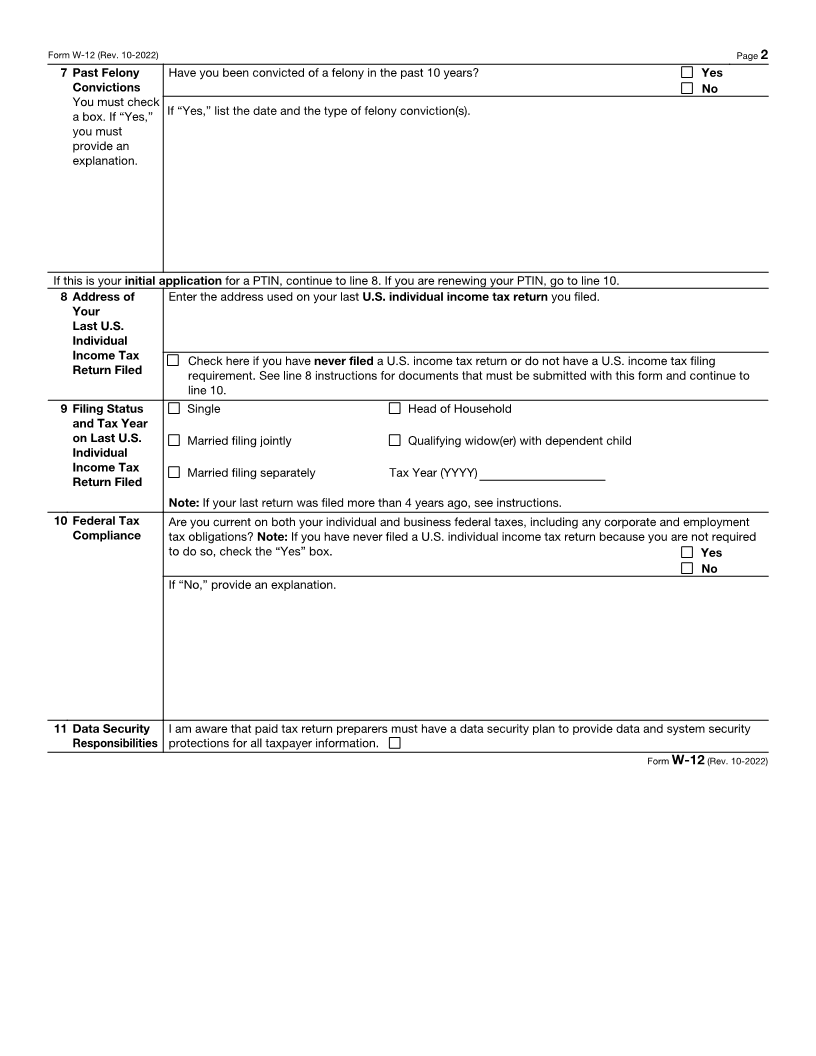

1 Name and PTIN First name Middle name Last name

(Print in ink or

Type)

Initial application Renewal application (Enter PTIN: P )

2 Year of If you checked the “Initial application” box and are submitting this form between October 1 and December 31,

Application/ indicate below whether you want your PTIN to be valid for the current calendar year or the next calendar year.

Renewal

Current calendar year Next calendar year

Prior year(s) (YYYY): If you are applying for a prior year(s), write each year(s) below. Use the following format.

(YYYY) See line 2 instructions for additional guidance

Prior year(s)

3 SSN and Date Provide your Social Security Number (SSN). If you SSN Date of birth (MM/DD/YYYY)

of Birth have an SSN, you are required to provide it. If you

- - / /

You must do not have an SSN, then check the N/A box.

provide your N/A

SSN or check Failure to provide your SSN or check the N/A

the N/A box box will result in your PTIN application being

rejected.

4 Personal Street address. Use a P.O. box number only if the post office does not deliver mail to your street address.

Mailing

Address and

Phone Number City or town, state or province, country, and ZIP or foreign postal code. Do not abbreviate name of country.

Phone Number ( ) -

5a Business Business address Check here if your business address is the same as your personal mailing address. If

Mailing different, enter it below.

Address and

Phone Number

City or town, state or province, country, and ZIP or foreign postal code. Do not abbreviate name of country.

Domestic business phone number International business phone number

( ) - EXT. +

b Business Are you self-employed or an owner, partner, or officer of a tax return preparation business? Yes No

Identification If “Yes,” then complete this line. If “No,” go to line 6.

Enter the business name.

Your CAF Number EIN EFIN

-

Website address (optional)

6 Email Address Enter the email address that should be used to contact you.

For Privacy Act and Paperwork Reduction Act Notice, see instructions. Cat. No. 55469F Form W-12 (Rev. 10-2022)

For Internal Use Only

PTIN

Case#

Date