Enlarge image

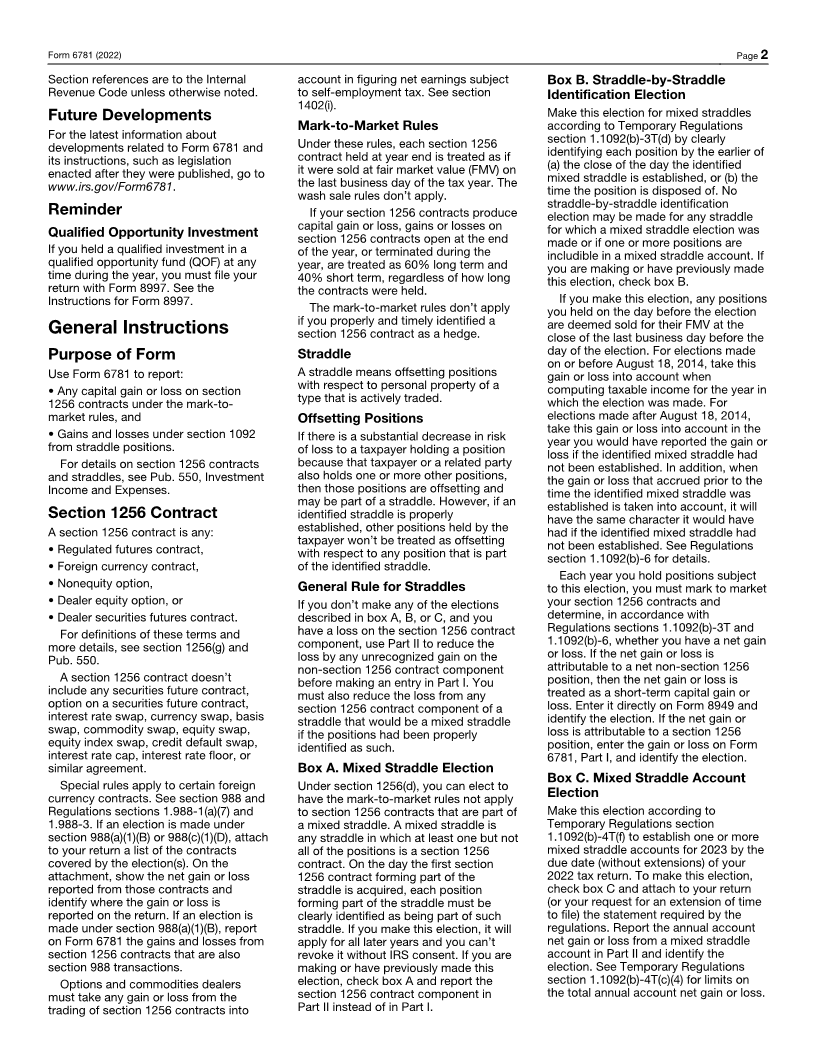

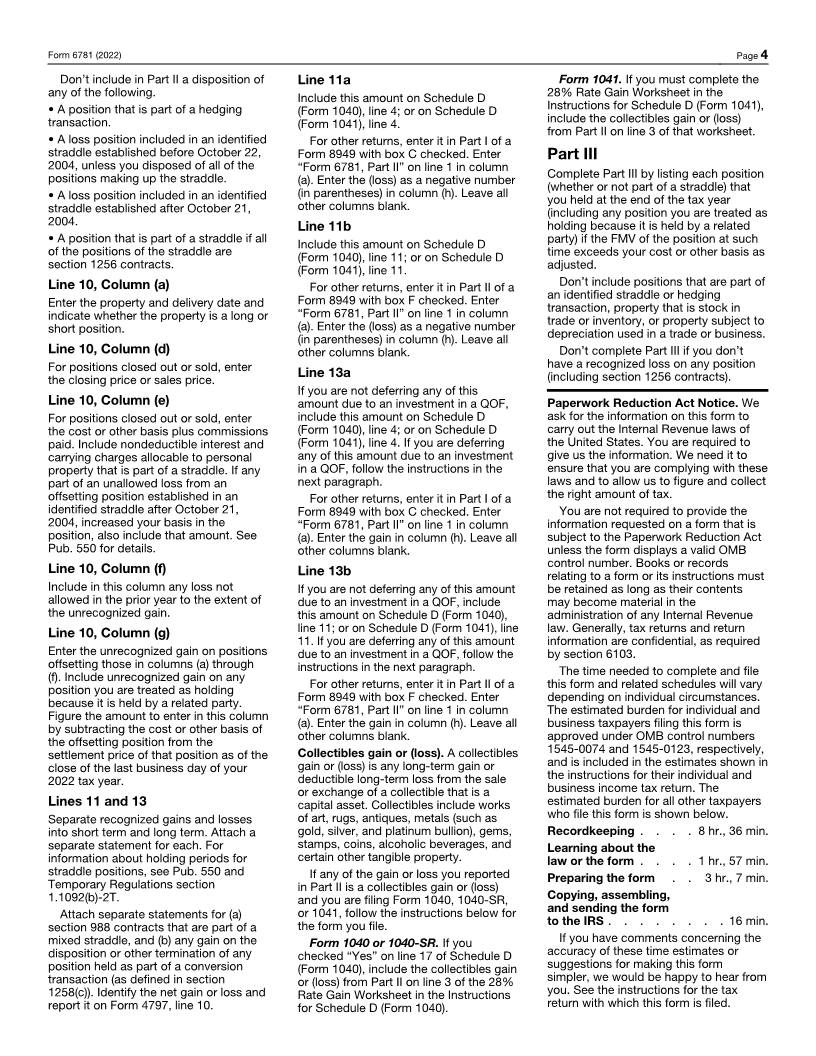

Gains and Losses From Section 1256 OMB No. 1545-0644

Form 6781 Contracts and Straddles

Department of the Treasury Go to www.irs.gov/Form6781 for the latest information. Attachment2022

Internal Revenue Service Attach to your tax return. Sequence No. 82

Name(s) shown on tax return Identifying number

Check all applicable boxes. A Mixed straddle election C Mixed straddle account election

See instructions. B Straddle-by-straddle identification election D Net section 1256 contracts loss election

Part I Section 1256 Contracts Marked to Market

(a) Identification of account (b) (Loss) (c) Gain

1

2 Add the amounts on line 1 in columns (b) and (c) . . . . . . 2 ( )

3 Net gain or (loss). Combine line 2, columns (b) and (c) . . . . . . . . . . . . . . . . 3

4 Form 1099-B adjustments. See instructions and attach statement . . . . . . . . . . . . 4

5 Combine lines 3 and 4 . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Note: If line 5 shows a net gain, skip line 6 and enter the gain on line 7. Partnerships and S corporations,

see instructions.

6 If you have a net section 1256 contracts loss and checked box D above, enter the amount of loss to

be carried back. Enter the loss as a positive number. If you didn’t check box D, enter -0- . . . . 6

7 Combine lines 5 and 6 . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Short-term capital gain or (loss). Multiply line 7 by 40% (0.40). Enter here and include on line 4 of

Schedule D or on Form 8949. See instructions . . . . . . . . . . . . . . . . . . . 8

9 Long-term capital gain or (loss). Multiply line 7 by 60% (0.60). Enter here and include on line 11 of

Schedule D or on Form 8949. See instructions . . . . . . . . . . . . . . . . . . 9

Part II Gains and Losses From Straddles. Attach a separate statement listing each straddle and its components.

Section A—Losses From Straddles

(a) Description of property (b) Date (c) Date (d) Gross (e) Cost or (f) Loss. (g) (h) Recognized loss.

entered into closed out sales price other basis If column (e) is Unrecognized If column (f) is

or acquired or sold plus expense more than (d), gain on more than (g),

of sale enter difference. offsetting enter difference.

Otherwise, positions Otherwise, enter -0-.

enter -0-.

10

11 a Enter the short-term portion of losses from line 10, column (h), here and include on line 4 of Schedule

D or on Form 8949. See instructions . . . . . . . . . . . . . . . . . . . . . . 11a ( )

b Enter the long-term portion of losses from line 10, column (h), here and include on line 11 of Schedule

D or on Form 8949. See instructions . . . . . . . . . . . . . . . . . . . . . . 11b ( )

Section B—Gains From Straddles

(a) Description of property (b) Date (c) Date (d) Gross (e) Cost or (f) Gain.

entered into closed out sales price other basis If column (d) is

or acquired or sold plus expense more than (e),

of sale enter difference.

Otherwise, enter -0-.

12

13 a Enter the short-term portion of gains from line 12, column (f), here and include on line 4 of Schedule D

or on Form 8949. See instructions . . . . . . . . . . . . . . . . . . . . . . . 13a

b Enter the long-term portion of gains from line 12, column (f), here and include on line 11 of Schedule

D or on Form 8949. See instructions . . . . . . . . . . . . . . . . . . . . . . 13b

Part III Unrecognized Gains From Positions Held on Last Day of Tax Year. Memo entry only (see instructions)

(a) Description of property (b) Date (c) Fair market (d) Cost or (e) Unrecognized

acquired value on last other basis gain. If column (c)

business day as adjusted is more than (d),

of tax year enter difference.

Otherwise, enter -0-.

14

For Paperwork Reduction Act Notice, see instructions. Cat. No. 13715G Form 6781 (2022)