Enlarge image

OMB No. 1545-0074

Residential Energy Credits

Form 5695

Go to www.irs.gov/Form5695 for instructions and the latest information.

Department of the Treasury 2022

Internal Revenue Service Attach to Form 1040, 1040-SR, or 1040-NR. Attachment

Sequence No. 158

Name(s) shown on return Your social security number

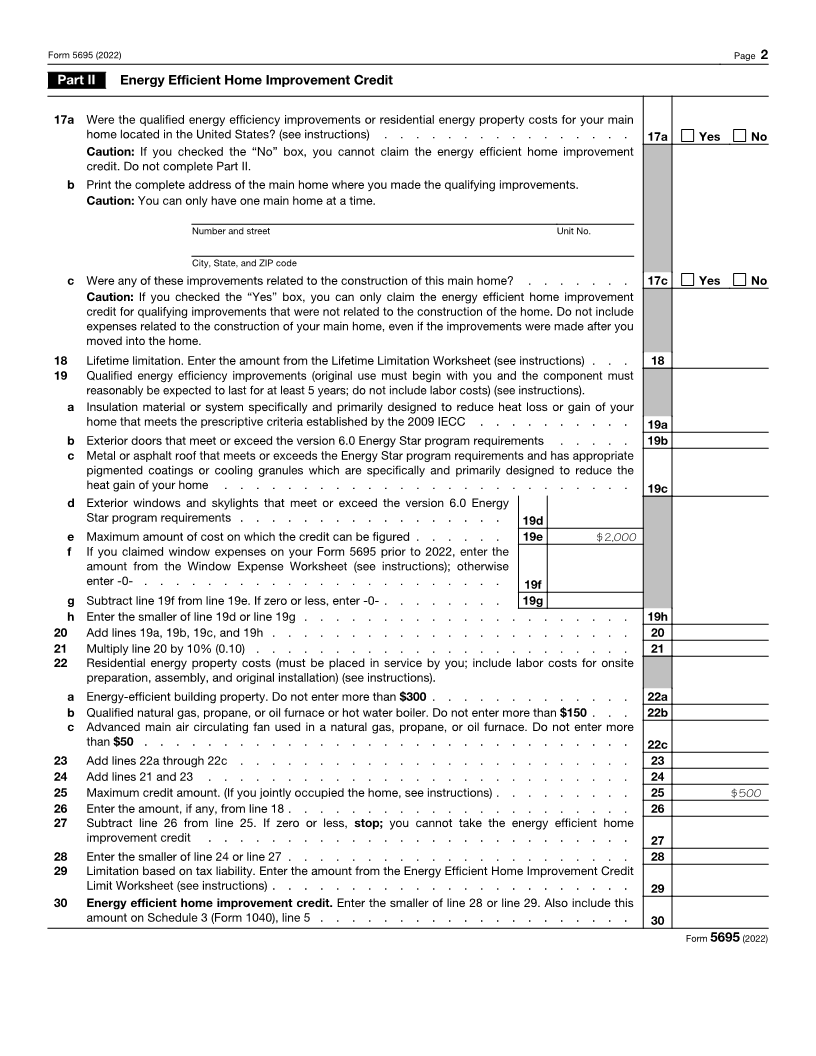

Part I Residential Clean Energy Credit (See instructions before completing this part.)

Note: Skip lines 1 through 11 if you only have a credit carryforward from 2021.

1 Qualified solar electric property costs . . . . . . . . . . . . . . . . . . . . . 1

2 Qualified solar water heating property costs . . . . . . . . . . . . . . . . . . . 2

3 Qualified small wind energy property costs . . . . . . . . . . . . . . . . . . . . 3

4 Qualified geothermal heat pump property costs . . . . . . . . . . . . . . . . . . 4

5 Qualified biomass fuel property costs . . . . . . . . . . . . . . . . . . . . . 5

6a Add lines 1 through 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . 6a

b Multiply line 6a by 30% (0.30) . . . . . . . . . . . . . . . . . . . . . . . . 6b

7 a Qualified fuel cell property. Was qualified fuel cell property installed on, or in connection with, your

main home located in the United States? (See instructions.) . . . . . . . . . . . . . . 7a Yes No

Caution: If you checked the “No” box, you cannot take a credit for qualified fuel cell property. Skip

lines 7b through 11.

b Print the complete address of the main home where you installed the fuel cell property.

Number and street Unit No.

City, State, and ZIP code

8 Qualified fuel cell property costs . . . . . . . . . . . . . . . 8

9 Multiply line 8 by 30% (0.30) . . . . . . . . . . . . . . . . 9

10 Kilowatt capacity of property on line 8 above . . . . x $1,000 10

11 Enter the smaller of line 9 or line 10 . . . . . . . . . . . . . . . . . . . . . . 11

12 Credit carryforward from 2021. Enter the amount, if any, from your 2021 Form 5695, line 16 . . . 12

13 Add lines 6b, 11, and 12 . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Limitation based on tax liability. Enter the amount from the Residential Clean Energy Credit Limit

Worksheet (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Residential clean energy credit. Enter the smaller of line 13 or line 14. Also include this amount on

Schedule 3 (Form 1040), line 5 . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Credit carryforward to 2023. If line 15 is less than line 13, subtract line 15

from line 13 . . . . . . . . . . . . . . . . . . . . . . 16

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 13540P Form 5695 (2022)