Enlarge image

OMB No. 1545-0123

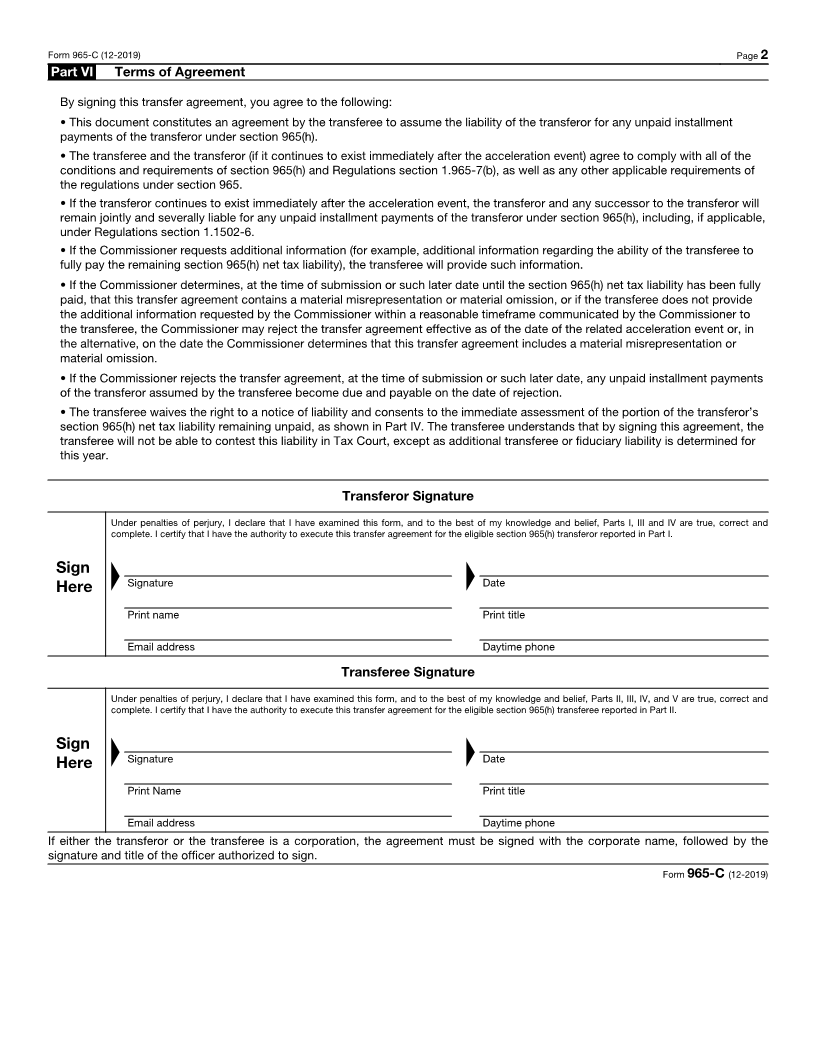

Transfer Agreement Under Section 965(h)(3)

Form 965-C File in Duplicate

(December 2019)

Department of the Treasury ▶ Go to www.irs.gov/Form965C for instructions and the latest information. (see When and Where To File

Internal Revenue Service in the separate instructions)

Part I Transferor Information

Name of eligible section 965(h) transferor (see instructions for definition) Taxpayer identification number

Address (number, street, room, suite, or P.O. box number)

City or town, state or province, country, and ZIP or foreign postal code

Part II Transferee Information

Name of eligible section 965(h) transferee (see instructions for definition) Taxpayer identification number

Address (number, street, room, suite, or P.O. box number)

City or town, state or province, country, and ZIP or foreign postal code

Part III Acceleration Event

1 Select the acceleration event leading to this transfer agreement:

a A liquidation, sale, exchange, or other disposition of substantially all of the assets of the transferor (other

than by reason of death)

(1) Did the transferee acquire substantially all of the transferor’s assets? . . . . . . . . . . . . . Yes No

(2) Is the acceleration event a qualifying consolidated group member transaction? . . . . . . . . . Yes No

(3) If the event is a qualifying consolidated group member transaction, is the transferee the departing member

or a qualified successor? . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes No

b Transferor became a member of a consolidated group

c Transferor is a consolidated group that ceased to exist or otherwise discontinued filing a consolidated

return resulting from (check the box below that applies)

(1) Acquisition of a consolidated group in which the acquired consolidated group members joined a

different consolidated group as of the day following the acquisition

If the box on line 1c(1) is checked, is the transferee the agent (within the meaning of Regulations section

1.1502‐ 77) of the consolidated group? . . . . . . . . . . . . . . . . . . . . . . Yes No

(2) Consolidated group ceasing to exist due to the transfer of the assets of one or more members to other

members with one entity (the successor entity) remaining

If the box on line 1c(2) is checked, is the transferee the successor entity? . . . . . . . . . . Yes No

(3) Consolidated group ceasing to exist due to the termination of the subchapter S election (pursuant to

section 1362(d)) of a shareholder of the common parent of the group, and, for the shareholder’s tax

year immediately following the termination, the shareholder joins in the filing of a consolidated return as

a consolidated group that includes all of the members of the former consolidated group.

If the box on line 1c(3) is checked, is the transferee the agent of the consolidated group that the

shareholder whose subchapter S election was terminated and all of the members of the former

consolidated group joined? . . . . . . . . . . . . . . . . . . . . . . . . . Yes No

2 Enter the date of the acceleration event . . . . . . . . . . . . . . . . . . . . . ▶

3 Provide a detailed description of the acceleration event:

Part IV Report of Unpaid Section 965(h) Net Tax Liability Being Assumed

4 Enter the amount of the transferor’s section 965(h) net tax liability remaining unpaid (see instructions) $

5 Enter the date on which the next installment payment is due . . . . . . . . . . . . . . ▶

Part V Transferee’s Ability to Pay Remaining Liability

6 Is the transferee able to make the remaining payments required under section 965(h) with respect to the

section 965(h) net tax liability being assumed? . . . . . . . . . . . . . . . . . . . . . Yes No

7 Does the transferee’s leverage ratio exceed 3:1? . . . . . . . . . . . . . . . . . . . . . Yes No

8 Provide any additional information pertaining to the transferee’s ability to pay:

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 72022G Form 965-C (12-2019)