Enlarge image

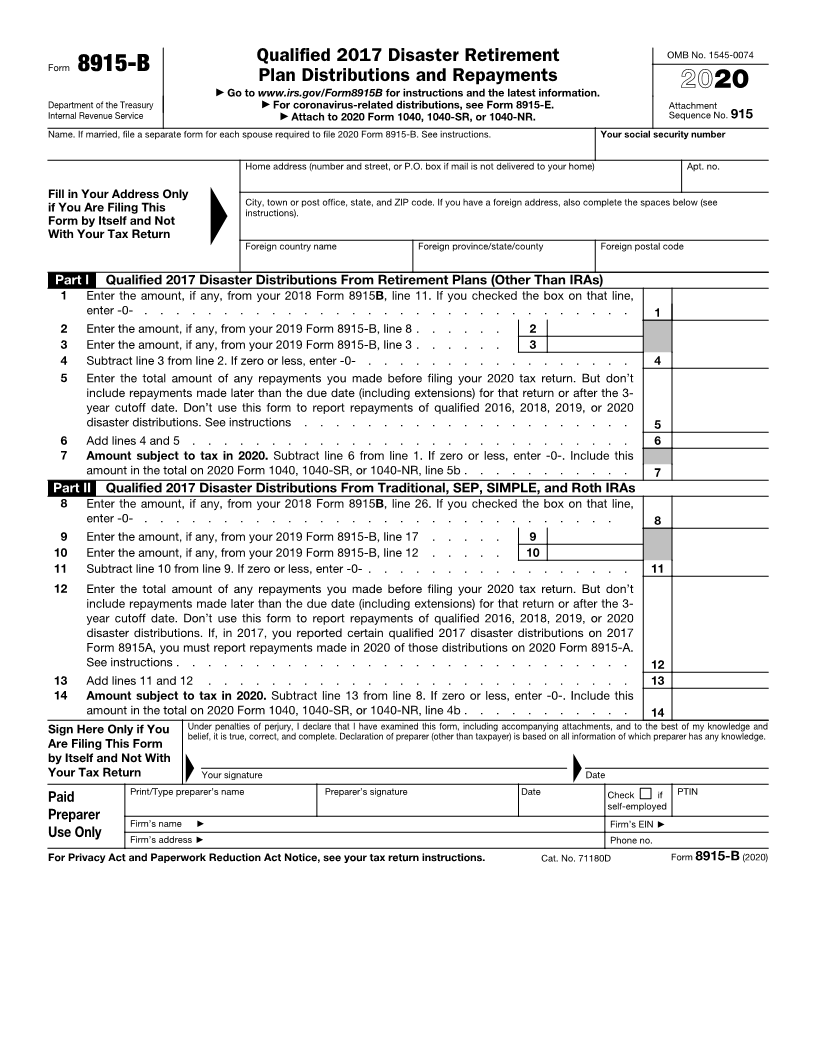

Qualified 2017 Disaster Retirement OMB No. 1545-0074

Form 8915-B

Plan Distributions and Repayments

▶ Go to www.irs.gov/Form8915B for instructions and the latest information. 2020

Department of the Treasury ▶ For coronavirus-related distributions, see Form 8915-E. Attachment

Internal Revenue Service ▶ Attach to 2020 Form 1040, 1040-SR, or 1040-NR. Sequence No. 915

Name. If married, file a separate form for each spouse required to file 2020 Form 8915-B. See instructions. Your social security number

Home address (number and street, or P.O. box if mail is not delivered to your home) Apt. no.

▲

Fill in Your Address Only

if You Are Filing This City, town or post office, state, and ZIP code. If you have a foreign address, also complete the spaces below (see

instructions).

Form by Itself and Not

With Your Tax Return

Foreign country name Foreign province/state/county Foreign postal code

Part I Qualified 2017 Disaster Distributions From Retirement Plans (Other Than IRAs)

1 Enter the amount, if any, from your 2018 Form 8915 , lineB 11. If you checked the box on that line,

enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Enter the amount, if any, from your 2019 Form 8915-B, line 8 . . . . . . 2

3 Enter the amount, if any, from your 2019 Form 8915-B, line 3 . . . . . . 3

4 Subtract line 3 from line 2. If zero or less, enter -0- . . . . . . . . . . . . . . . . . 4

5 Enter the total amount of any repayments you made before filing your 2020 tax return. But don’t

include repayments made later than the due date (including extensions) for that return or after the 3-

year cutoff date. Don’t use this form to report repayments of qualified 2016, 2018, 2019, or 2020

disaster distributions. See instructions . . . . . . . . . . . . . . . . . . . . . 5

6 Add lines 4 and 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Amount subject to tax in 2020. Subtract line 6 from line 1. If zero or less, enter -0-. Include this

amount in the total on 2020 Form 1040, 1040-SR, or 1040-NR, line 5b . . . . . . . . . . . 7

Part II Qualified 2017 Disaster Distributions From Traditional, SEP, SIMPLE, and Roth IRAs

8 Enter the amount, if any, from your 2018 Form 8915 , lineB 26. If you checked the box on that line,

enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Enter the amount, if any, from your 2019 Form 8915-B, line 17 . . . . . 9

10 Enter the amount, if any, from your 2019 Form 8915-B, line 12 . . . . . 10

11 Subtract line 10 from line 9. If zero or less, enter -0- . . . . . . . . . . . . . . . . . 11

12 Enter the total amount of any repayments you made before filing your 2020 tax return. But don’t

include repayments made later than the due date (including extensions) for that return or after the 3-

year cutoff date. Don’t use this form to report repayments of qualified 2016, 2018, 2019, or 2020

disaster distributions. If, in 2017, you reported certain qualified 2017 disaster distributions on 2017

Form 8915A, you must report repayments made in 2020 of those distributions on 2020 Form 8915-A.

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Add lines 11 and 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Amount subject to tax in 2020. Subtract line 13 from line 8. If zero or less, enter -0-. Include this

amount in the total on 2020 Form 1040, 1040-SR, or 1040-NR, line 4b . . . . . . . . . . . 14

Sign Here Only if You Under penalties of perjury, I declare that I have examined this form, including accompanying attachments, and to the best of my knowledge and

belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Are Filing This Form ▲ ▲

by Itself and Not With

Your Tax Return Your signature Date

Print/Type preparer’s name Preparer’s signature Date

Paid Check if PTIN

self-employed

Preparer Firm’s name ▶ Firm’s EIN ▶

Use Only Firm’s address ▶ Phone no.

For Privacy Act and Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 71180D Form 8915-B (2020)