- 2 -

Enlarge image

|

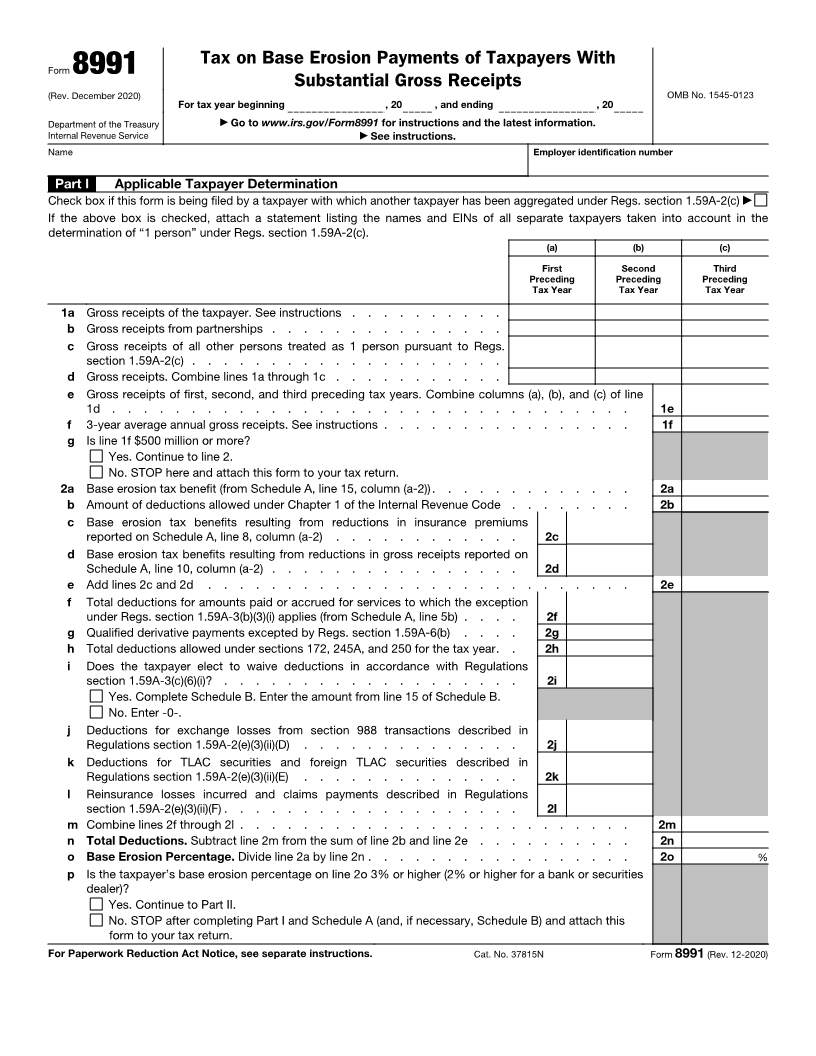

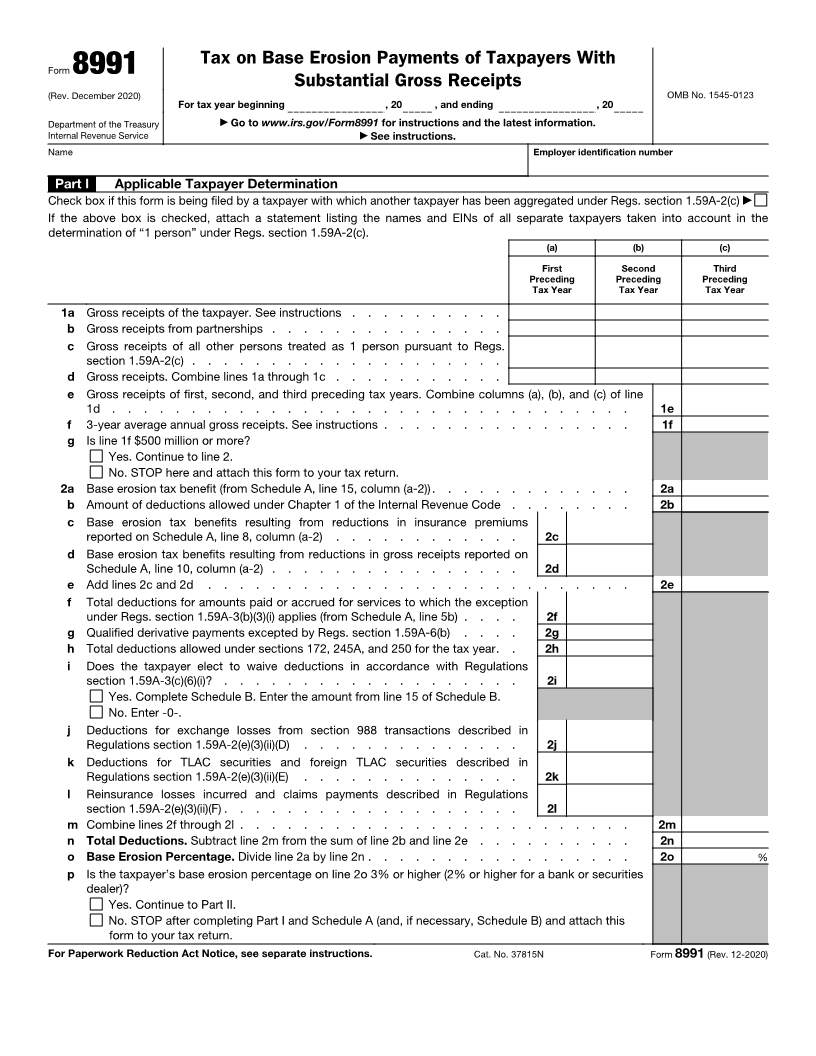

Tax on Base Erosion Payments of Taxpayers With

Form 8991

Substantial Gross Receipts

(Rev. December 2020) OMB No. 1545-0123

For tax year beginning , 20 , and ending , 20

Department of the Treasury ▶ Go to www.irs.gov/Form8991 for instructions and the latest information.

Internal Revenue Service ▶ See instructions.

Name Employer identification number

Part I Applicable Taxpayer Determination

Check box if this form is being filed by a taxpayer with which another taxpayer has been aggregated under Regs. section 1.59A-2(c) ▶

If the above box is checked, attach a statement listing the names and EINs of all separate taxpayers taken into account in the

determination of “1 person” under Regs. section 1.59A-2(c).

(a) (b) (c)

First Second Third

Preceding Preceding Preceding

Tax Year Tax Year Tax Year

1a Gross receipts of the taxpayer. See instructions . . . . . . . . . .

b Gross receipts from partnerships . . . . . . . . . . . . . . .

c Gross receipts of all other persons treated as 1 person pursuant to Regs.

section 1.59A-2(c) . . . . . . . . . . . . . . . . . . . .

d Gross receipts. Combine lines 1a through 1c . . . . . . . . . . .

e Gross receipts of first, second, and third preceding tax years. Combine columns (a), (b), and (c) of line

1d . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1e

f 3-year average annual gross receipts. See instructions . . . . . . . . . . . . . . . . 1f

g Is line 1f $500 million or more?

Yes. Continue to line 2.

No. STOP here and attach this form to your tax return.

2a Base erosion tax benefit (from Schedule A, line 15, column (a-2)). . . . . . . . . . . . . 2a

b Amount of deductions allowed under Chapter 1 of the Internal Revenue Code . . . . . . . . 2b

c Base erosion tax benefits resulting from reductions in insurance premiums

reported on Schedule A, line 8, column (a-2) . . . . . . . . . . . . 2c

d Base erosion tax benefits resulting from reductions in gross receipts reported on

Schedule A, line 10, column (a-2) . . . . . . . . . . . . . . . . 2d

e Add lines 2c and 2d . . . . . . . . . . . . . . . . . . . . . . . . . . . 2e

f Total deductions for amounts paid or accrued for services to which the exception

under Regs. section 1.59A-3(b)(3)(i) applies (from Schedule A, line 5b) . . . . 2f

g Qualified derivative payments excepted by Regs. section 1.59A-6(b) . . . . 2g

h Total deductions allowed under sections 172, 245A, and 250 for the tax year. . 2h

i Does the taxpayer elect to waive deductions in accordance with Regulations

section 1.59A-3(c)(6)(i)? . . . . . . . . . . . . . . . . . . . 2i

Yes. Complete Schedule B. Enter the amount from line 15 of Schedule B.

No. Enter -0-.

j Deductions for exchange losses from section 988 transactions described in

Regulations section 1.59A-2(e)(3)(ii)(D) . . . . . . . . . . . . . . 2j

k Deductions for TLAC securities and foreign TLAC securities described in

Regulations section 1.59A-2(e)(3)(ii)(E) . . . . . . . . . . . . . . 2k

l Reinsurance losses incurred and claims payments described in Regulations

section 1.59A-2(e)(3)(ii)(F) . . . . . . . . . . . . . . . . . . . 2l

m Combine lines 2f through 2l . . . . . . . . . . . . . . . . . . . . . . . . . 2m

n Total Deductions. Subtract line 2m from the sum of line 2b and line 2e . . . . . . . . . . 2n

o Base Erosion Percentage. Divide line 2a by line 2n . . . . . . . . . . . . . . . . . 2o %

p Is the taxpayer’s base erosion percentage on line 2o 3% or higher (2% or higher for a bank or securities

dealer)?

Yes. Continue to Part II.

No. STOP after completing Part I and Schedule A (and, if necessary, Schedule B) and attach this

form to your tax return.

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 37815N Form 8991 (Rev. 12-2020)

|