Enlarge image

Userid: CPM Schema: instrx Leadpct: 100% Pt. size: 8.5 Draft Ok to Print

AH XSL/XML Fileid: … s/i8915f/202201/a/xml/cycle04/source (Init. & Date) _______

Page 1 of 13 6:46 - 14-Feb-2022

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Department of the Treasury

Internal Revenue Service

Instructions for Form 8915-F

(Rev. February 2022)

Qualified Disaster Retirement Plan Distributions and Repayments

Contents Page Congress that would elevate certain • You received a qualified distribution

General Instructions . . . . . . . . . . . . . 1 2021 disasters and the 2020 Washington described in Qualified 2020 disaster areas

(4593-DR-WA) disaster to the status of under Qualified Distribution for the Purchase

Future Developments . . . . . . . . . 1 qualified disasters. Go to Recent or Construction of a Main Home in Qualified

Helpful Hints . . . . . . . . . . . . . . 1 Developments under IRS.gov/Form8915F Disaster Areas, later.

How Do I Distinguish My to see whether that legislation was Your form will be called Form 8915-F (2020

Form 8915-F and Its enacted. disasters).

Disasters From Other

Forms 8915-F? . . . . . . . . . . . 1 The year of the form will be the year you

Purpose of Form . . . . . . . . . . . 1 Helpful Hints checked in item A at the top of page 1 of your

Form 8915-F. If you checked the 2021 box in

Purpose of These Form 8915-F can be e-filed. Form 8915-F item A, your form will be called 2021 Form

Instructions . . . . . . . . . . . . . 1 can be completed electronically and e-filed 8915-F (2020 disasters).

When Should I Not Use a with your tax return. Names of disasters and distributions.

Form 8915-F? . . . . . . . . . . . 1

Who Must File . . . . . . . . . . . . . 2 Form 8915-F is a forever form. Form Except when referring to them generally,

When and Where To File . . . . . . 2 8915-F is a redesigned Form 8915. these instructions will refer to the different

What Is a Qualified Disaster Beginning in 2021, additional alphabetical qualified disasters and qualified disaster

Distribution? . . . . . . . . . . . . . 2 Forms 8915 (that is, Form 8915-G, Form distributions by their specific names using

8915-H, etc.) will not be issued. The same the year you checked in item B at the top of

Qualified Disaster Form 8915-F will be used for distributions for page 1 of your Form 8915-F.

Distribution . . . . . . . . . . . . . 2

qualified 2020 disasters (and qualified 2021

Qualified Distribution for the and later disasters, if enacted) and for each Purpose of Form

Purchase or Construction year of reporting of income and repayments Use Form 8915-F to report:

of a Main Home in Qualified 2020 disaster distributions made

Qualified Disaster Areas . . . . 3 of those distributions. The boxes you check •

in items A and B will help us determine the in 2021 (coronavirus-related distributions

Amending Form 8915-F exact year of the form you are filing, and the can't be made after December 30, 2020);

(2020 Disasters) . . . . . . . . . . 4 Repayments of qualified 2020 disaster

year of the qualified disasters, qualified •

Specific Instructions . . . . . . . . . . . . . 5 disaster distributions, and qualified distributions;

Required General distributions you are reporting. Earlier Forms • Income in 2021 and later years from

Information . . . . . . . . . . . . . 5 8915 had a different alphabetical Form 8915 qualified 2020 and later disaster

Part I—Total Distributions for each year of disasters and a different distributions; and

From All Retirement form for each year the alphabetical form • Qualified distributions received on

Plans (Including IRAs) . . . . . . 5 existed. See How Do I Distinguish My Form January 1, 2021, for the Washington

Part II—Qualified Disaster 8915-F and Its Disasters From Other Forms (8593-DR-WA) disaster.

Distributions From 8915-F and When Should I Not Use a Form

Retirement Plans (Other 8915-F, later. Note. To the extent relevant legislation is

Than IRAs) . . . . . . . . . . . . . 6 enacted, Form 8915-F will also be used to

Part III—Qualified Disaster How Do I Distinguish My Form report:

Distributions From 8915-F and Its Disasters From • Qualified 2021 and later disaster

Traditional, SEP, distributions;

SIMPLE, and Roth IRAs . . . . . 7 Other Forms 8915-F? Qualified 2020 disaster distributions that

•

Part IV—Qualified Name of form. These instructions will use can be made in 2022;

Distributions for the different names to refer to your Form 8915-F • Repayments of qualified 2021 and later

Purchase or Construction depending on the boxes you check in items disaster distributions; and

of a Main Home in Other qualified distributions received in

Qualified Disaster Areas . . . . . 8 A and B at the top of page 1 of your Form •

Worksheets . . . . . . . . . . . . . . . 8 8915-F. For example, if you checked the 2021 and qualified distributions received in

2021 box in item A and the 2020 box in item 2022 and later years.

Appendix A, Which Lines B, your form will be referred to in these

Should I Use? . . . . . . . . . . . 10 instructions and elsewhere as 2021 Form Purpose of These Instructions

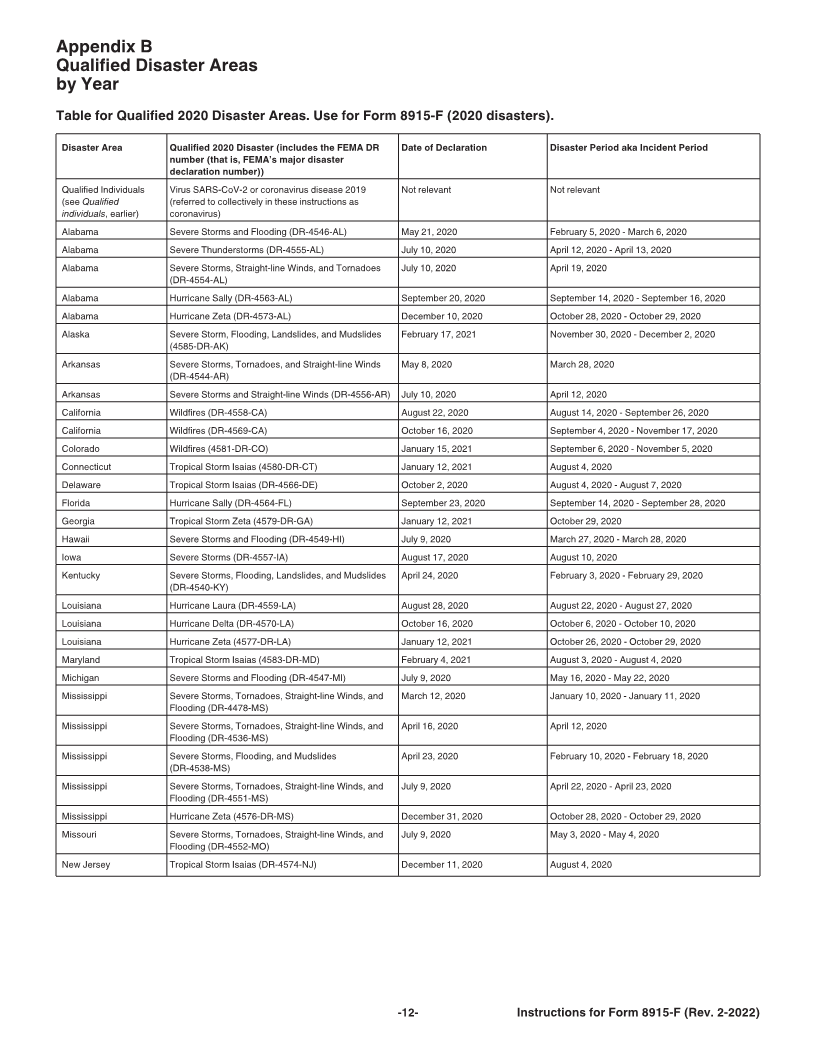

Appendix B, Qualified 8915-F (2020 disasters). See Form 8915-F These instructions provide detailed

Disaster Areas by Year . . . . . 12 (2020 disasters) next. information for use with your 2021 Form

Section references are to the Internal Revenue Code 8915-F. For your convenience, Appendix A,

unless otherwise noted. Form 8915-F (2020 disasters). Check Which Lines Should I Use, later, provides, as

the 2020 box in item B of your Form 8915-F if well, the lines you should complete on your

General Instructions you were adversely affected by a qualified Form 8915-F for all tax years applicable to

2020 disaster listed in Table for Qualified 2020 disasters.

2020 Disaster Areas in Appendix B,

Future Developments Qualified Disaster Areas by Year at the end When Should I Not Use a Form

For the latest information about of these instructions, and: 8915-F?

developments related to Form 8915-F and its • A qualified disaster distribution described

instructions, such as legislation enacted after in Qualified 2020 disaster distribution Reporting coronavirus-related and other

they were published, go to IRS.gov/ requirements, later, was made to you; distributions for qualified 2020 disasters

Form8915F. • You are repaying, or have income from, a made or received in 2020. This form

When these instructions went to coronavirus-related distribution or other replaces Form 8915-E for tax years

qualified 2020 disaster distribution reported beginning after 2020. Do not use a Form

! print, legislation was pending in on Part I of 2020 Form 8915-E; or 8915-F to report qualified 2020 disaster

CAUTION

Feb 11, 2022 Cat. No. 37509G