Enlarge image

Userid: CPM Schema: Leadpct: 100% Pt. size: 10 Draft Ok to Print

instrx

AH XSL/XML Fileid: … s/i8915f/202301/a/xml/cycle02/source (Init. & Date) _______

Page 1 of 35 10:10 - 30-Mar-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Department of the Treasury

Internal Revenue Service

Instructions for Form 8915-F

(Rev. January 2023)

Qualified Disaster Retirement Plan Distributions and Repayments

Section references are to the Internal Revenue Code distributions, qualified 2023 disaster distributions, etc.)

unless otherwise noted. are also called qualified disaster recovery distributions.

Contents Page Dollar limit. For qualified 2021 and later disasters, the

General Instructions . . . . . . . . . . . . . . . . . . . . . . . . . 1 dollar limit on Form 8915-F for retirement plan

Future Developments . . . . . . . . . . . . . . . . . . . . . 1 distributions is $22,000 per disaster. It was $100,000 but

Helpful Hints . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 that was for qualified 2020 disasters.

How Do I Distinguish My Form 8915-F and Its Determining the qualified disaster distribution peri-

Disasters From Other Forms 8915-F? . . . . . . . 2 od, in Part I, for a disaster. The qualified disaster

Purpose of Form . . . . . . . . . . . . . . . . . . . . . . . . 2 distribution period for each disaster still begins on the day

Purpose of These Instructions . . . . . . . . . . . . . . . 2 the disaster began. The last day of the qualified disaster

distribution period for most qualified 2021 disasters and

When Should I Not Use a Form 8915-F? . . . . . . . . 2

many qualified 2022 disasters is June 26, 2023. But the

Who Must File . . . . . . . . . . . . . . . . . . . . . . . . . . 2 last day of the qualified disaster distribution period for

When and Where To File . . . . . . . . . . . . . . . . . . . 3 qualified 2023 and later disasters, some qualified 2022

What Is a Qualified Disaster Distribution? . . . . . . . 3 disasters, and perhaps even a few qualified 2021

Qualified Disaster Distribution . . . . . . . . . . . . . . . 3 disasters will have to be separately calculated. See

Qualified Distribution for the Purchase or Qualified disaster distribution period, later.

Construction of a Main Home in Qualified Determining the qualified distribution repayment pe-

Disaster Areas . . . . . . . . . . . . . . . . . . . . . . . . 6 riod, in Part IV, for a disaster. The qualified distribution

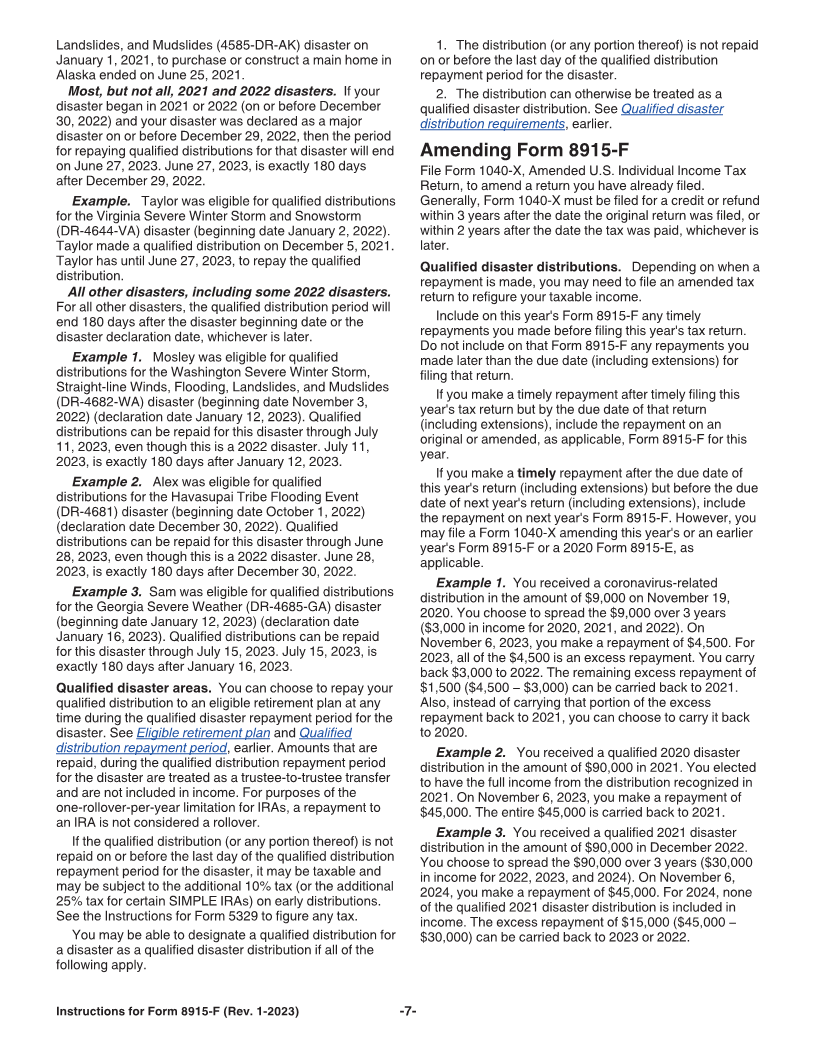

Amending Form 8915-F . . . . . . . . . . . . . . . . . . . 7 repayment period for each disaster still begins on the day

Specific Instructions . . . . . . . . . . . . . . . . . . . . . . . . . 9 the disaster began. The last day of the qualified

Required General Information . . . . . . . . . . . . . . . 9 distribution repayment period for most qualified 2021

disasters and many qualified 2022 disasters is June 27,

Part I—Total Distributions From All

2023. But the last day of the qualified distribution

Retirement Plans (Including IRAs) . . . . . . . . . . 9

repayment period for qualified 2023 and later disasters,

Part II—Qualified Disaster Distributions From some qualified 2022 disasters, and perhaps even a few

Retirement Plans (Other Than IRAs) . . . . . . . 17 qualified 2021 disasters will have to be separately

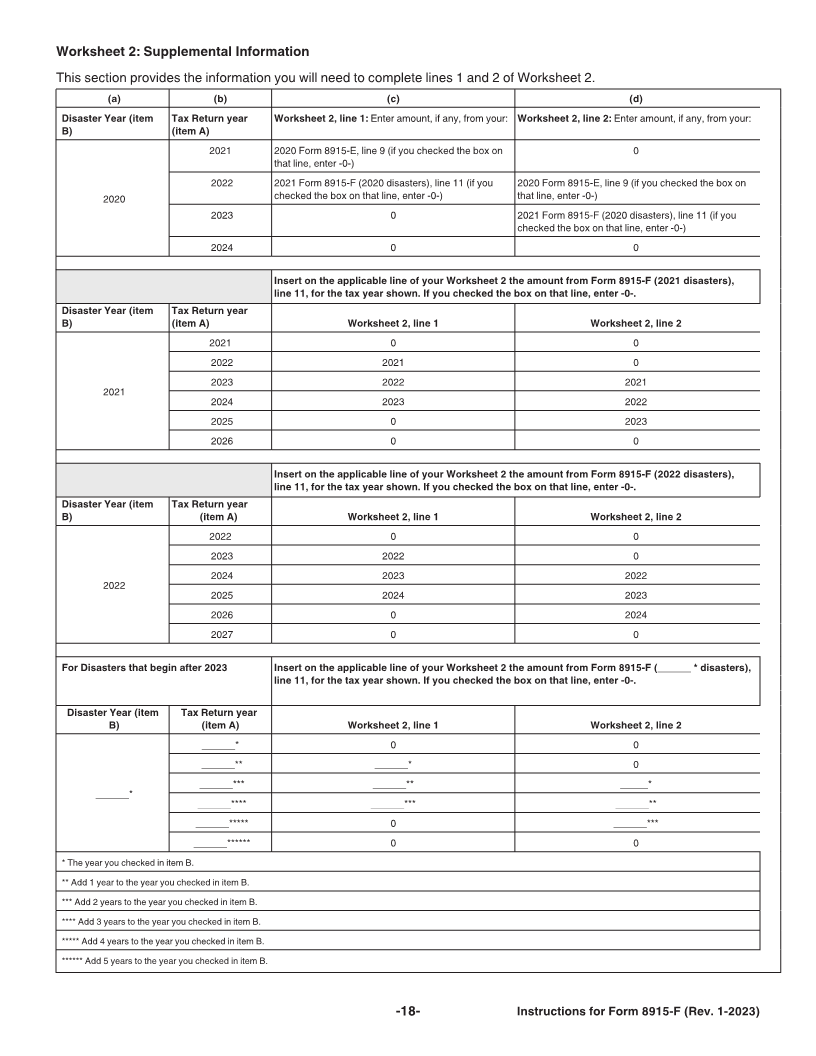

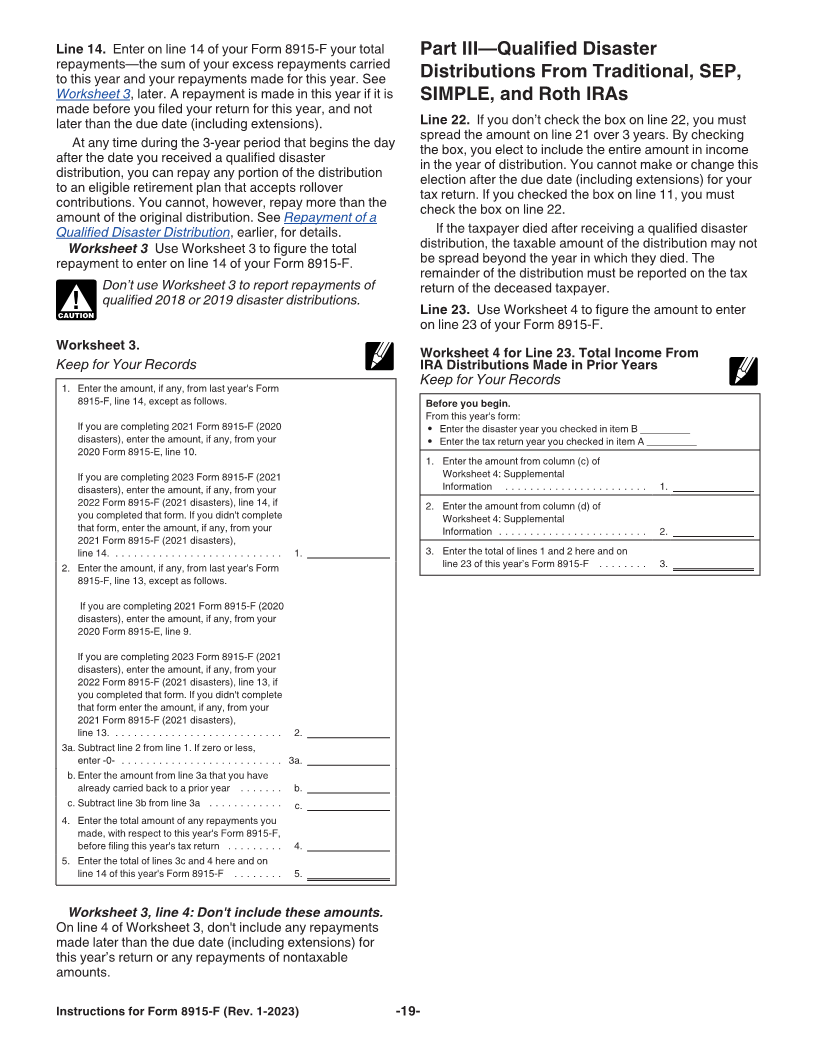

Part III—Qualified Disaster Distributions From calculated. See Qualified disaster distribution period,

Traditional, SEP, SIMPLE, and Roth IRAs . . . . 19 later.

Part IV—Qualified Distributions for the

Purchase or Construction of a Main Home Determining the disaster's FEMA number and other

in Qualified Disaster Areas . . . . . . . . . . . . . . 21 information. Appendix B, Qualified Disaster Areas by

Year, is being discontinued. See Qualified disaster area,

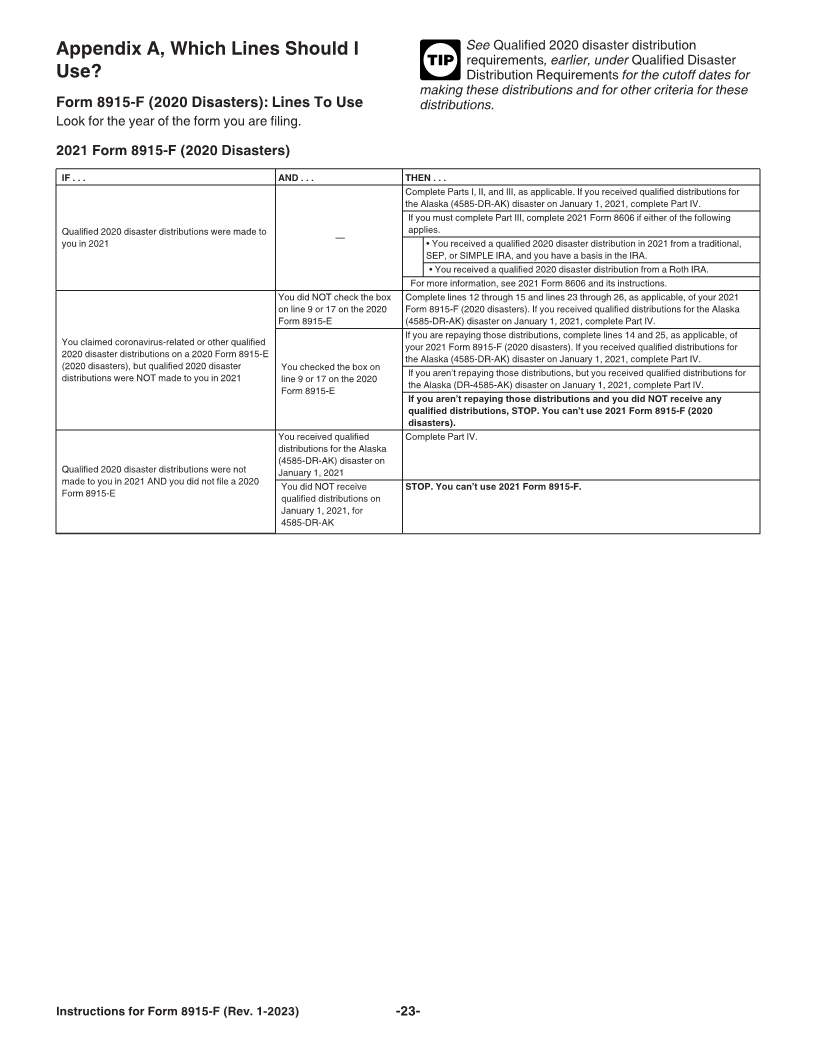

Appendix A, Which Lines Should I Use? . . . . . . . 23 later, for information on where to find a disaster’s FEMA

Appendix B, Worksheets . . . . . . . . . . . . . . . . . . 27 number, beginning date, and declaration date.

New line 1a. New Line 1a explains the criteria set forth

General Instructions in Form 8915-F, line 1a, including “If all of the distributions

for this year occurred within the qualified disaster

Future Developments distribution period for each of the disasters listed” in the

For the latest information about developments related to table at the top of Part I.

Form 8915-F and its instructions, such as legislation

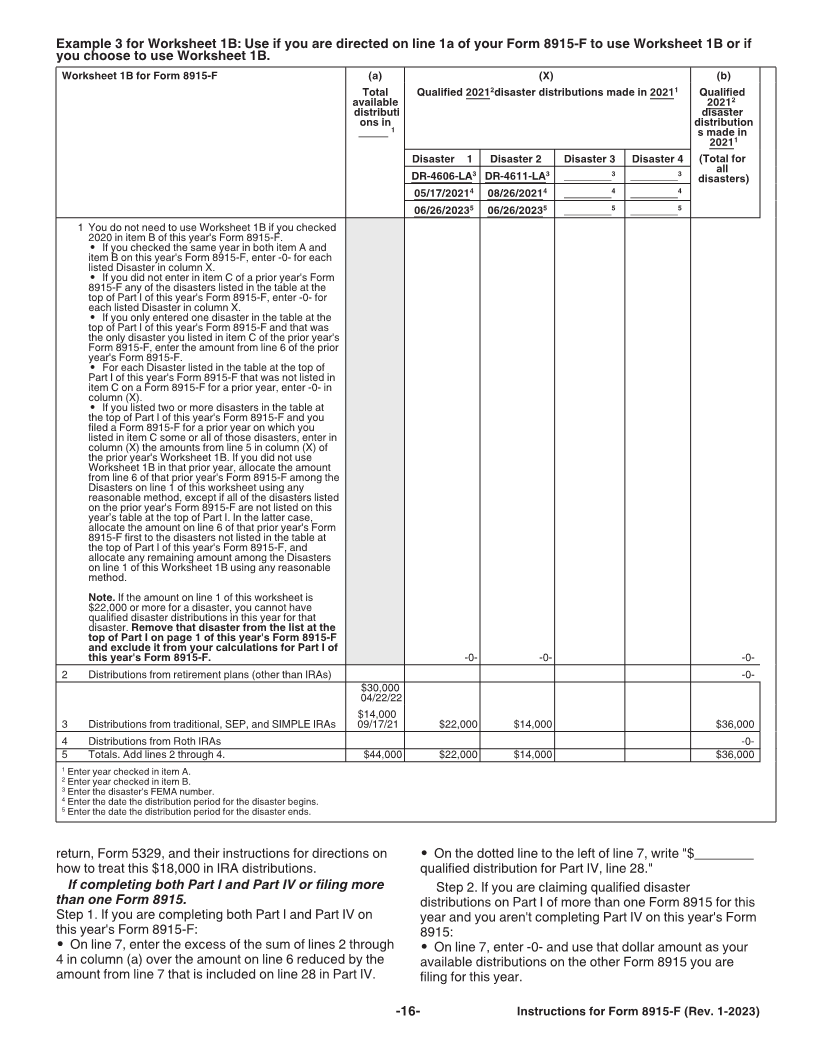

New Worksheet 1B. New Worksheet 1B is a tool you

enacted after they were published, go to IRS.gov/

may have to use in figuring amounts for lines 1a through 5

Form8915F.

of Form 8915-F. See Worksheet 1B, later, to determine

What’s New whether you must use Worksheet 1B. You can choose to

use Worksheet 1B even if you are not required to do so.

Qualified 2021 and later disaster distributions (also

known as qualified disaster recovery distributions). Helpful Hints

As a result of section 331 of the Secure 2.0 Act of 2022,

Form 8915-F can be e-filed. Form 8915-F can be

enacted December 29, 2022, you are now eligible for the

completed electronically and e-filed with your tax return.

benefits of Form 8915-F if you were adversely affected by

a qualified 2021 or later disaster and you received a Form 8915-F is a forever form. Form 8915-F is a

distribution described in Qualified Disaster Distribution redesigned Form 8915. Beginning in 2021, additional

Requirements or Qualified Distribution Requirements, alphabetical Forms 8915 (that is, Form 8915-G, Form

later. Qualified disaster distributions (such as qualified 8915-H, etc.) will not be issued. The same Form 8915-F

2021 disaster distributions, qualified 2022 disaster will be used for distributions for qualified 2020 disasters

Mar 30, 2023 Cat. No. 37509G