Enlarge image

Userid: CPM Schema: instrx Leadpct: 100% Pt. size: 9 Draft Ok to Print

AH XSL/XML Fileid: … ns/i8978/202112/a/xml/cycle04/source (Init. & Date) _______

Page 1 of 12 15:09 - 23-Dec-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Department of the Treasury

Internal Revenue Service

Instructions for Form 8978

(Including Schedule A)

(Rev. December 2021)

Partner’s Additional Reporting Year Tax

(For use with Form 8978 (Dec. 2019) and Schedule A (Form 8978) (Dec. 2019))

Contents Page administrative adjustment request (AAR) partnership furnished the Forms 8986 to

What’s New . . . . . . . . . . . . . . . . . . 1 under section 6227. its partners. The date the audited

Purpose of This Form . . . . . . . . . . . . 1 Additional reporting year tax is the partnership furnished Forms 8986 to its

partner’s change in chapter 1 tax for the partners is found on Form 8986, Part II,

Definitions . . . . . . . . . . . . . . . . . . . 1 reporting year after taking into account the item G. For example, if the Form 8986,

General Instructions . . . . . . . . . . . . . 1 adjustments. Part II, item G, date is 06/15/2021 and the

Who Must File . . . . . . . . . . . . . 1 Affected partner is a partner that held an partner receiving the Form 8986 is a

Where and When To File . . . . . . 1 interest in a pass-through partner at any calendar-year-end partner, that partner’s

Completing Form 8978 and time during the tax year of the reporting year is tax year ending

Schedule A . . . . . . . . . . . . . 1 pass-through partner to which the 12/31/2021.

Specific Instructions for Form adjustments in the statement relate. Reviewed year is the audited

8978 . . . . . . . . . . . . . . . . . . . 4 Applicable tax year is any tax year that is partnership’s tax year to which the

Specific Instructions for impacted by the audit adjustments shown partnership adjustment(s) relates.

Schedule A (Form 8978) . . . . . . . 4 on Form 8986. For example, if the Reviewed year partner is any person

Inconsistent Positions . . . . . . . . . . . 5 adjustments are from tax year 2020 (first that held an interest in the audited

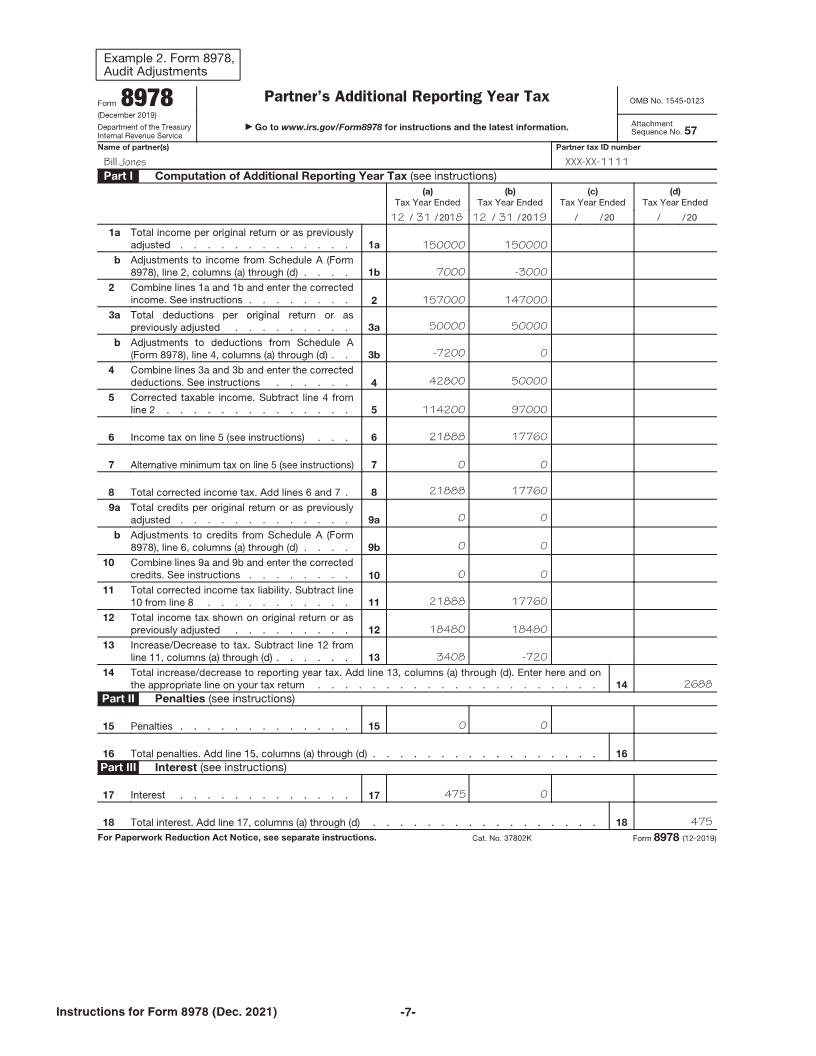

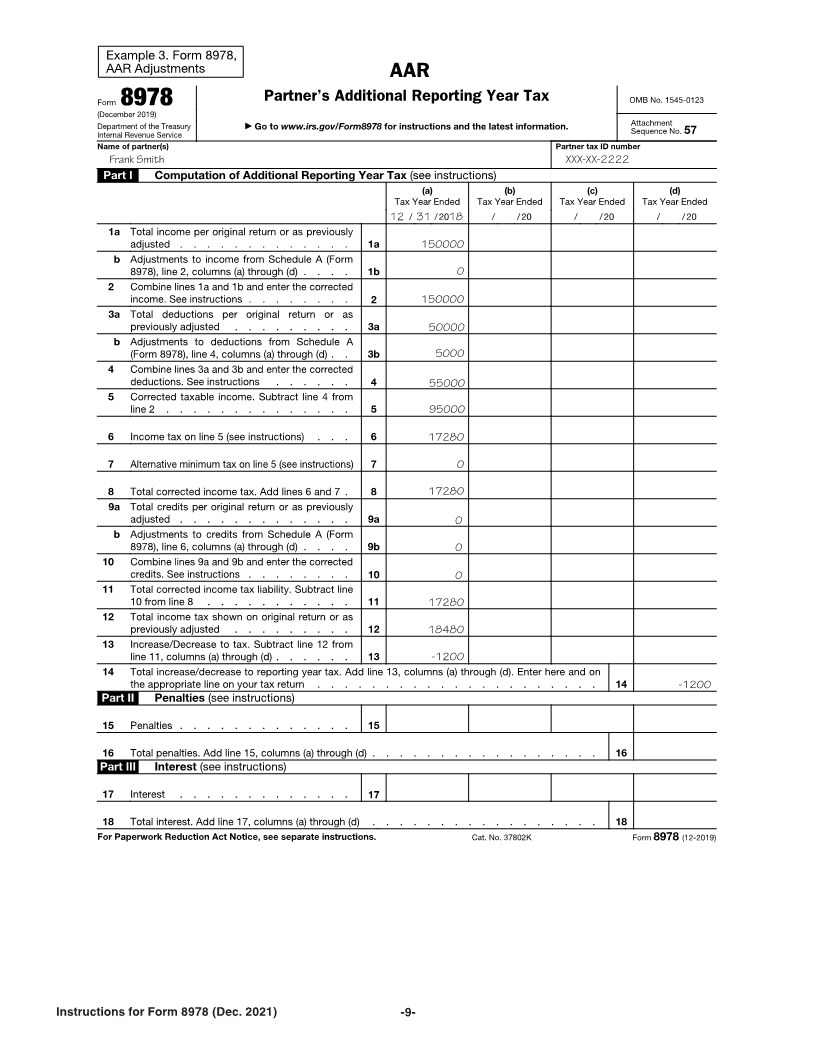

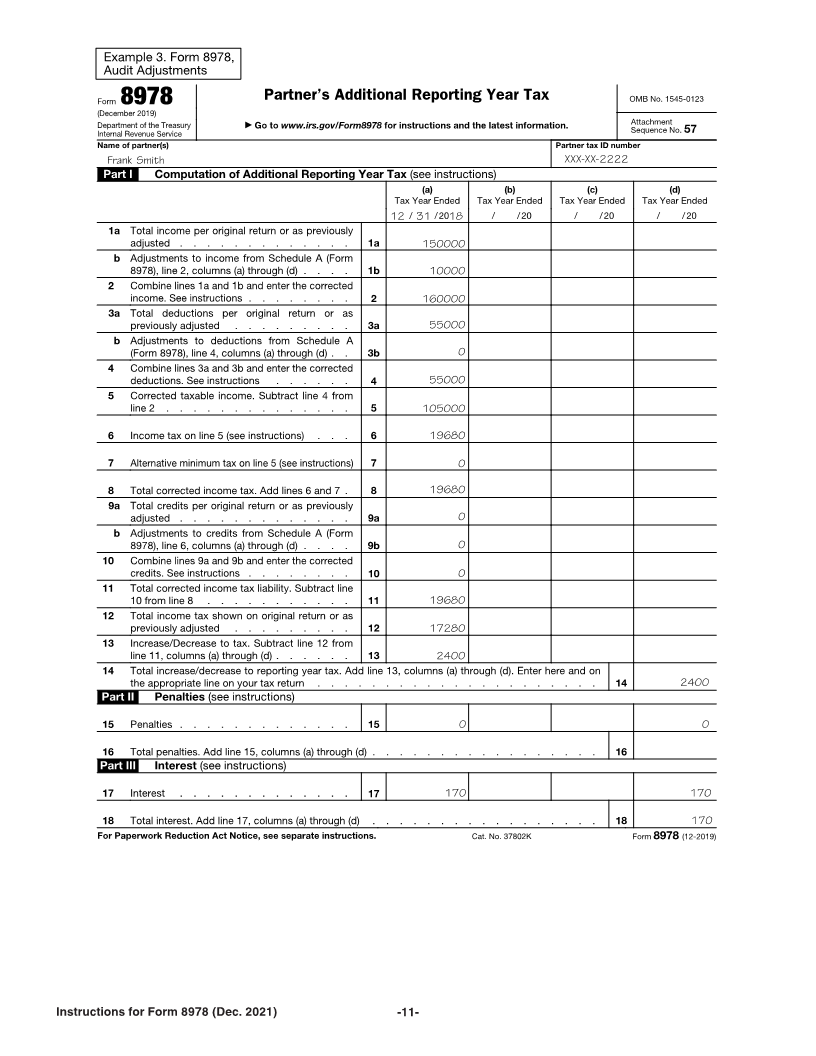

Illustrations for Examples . . . . . . . . . 6 affected year), that year would be partnership at any time during the

Section references are to the Internal Revenue impacted as well as any year between the partnership’s reviewed year.

Code unless otherwise noted.

first affected year and the reporting year

that had related changes to partner-level General Instructions

Future Developments tax attributes.

For the latest information about Audited partnership, for purposes of Who Must File

developments related to Form 8978 and Form 8978, is a BBA partnership that Every partner (except pass-through

its instructions, such as legislation made the election under section 6226 to partners) that receives a Form 8986 from

enacted after they were published, go to have its partners take into account their a pass-through entity must file Form 8978

IRS.gov/Form8978. share of adjustments for to report any additional reporting year tax

partnership-related items. as a result of taking into account the

What’s New BBA AAR is an administrative adjustment partner’s share of the reviewed year(s)

Updates are provided on how positive and request filed by a BBA partnership. adjustments.

negative adjustments received by partners BBA partnership is a partnership that is

on Forms 8986 should be reported on subject to the centralized partnership audit Where and When To File

Form 8978 and its Schedule A. Updates regime that was enacted into law by A reviewed year partner or affected

are also provided on reporting a section section 1101 of the Bipartisan Budget Act partner must file Form 8978 with a federal

199A qualified business income deduction of 2015 (BBA). income tax return for the partner’s

on Form 8978 and its Schedule A. First affected year is the partner’s tax reporting year.

year that includes the end of the audited Example 1. Where and when to file.

Purpose of This Form partnership’s reviewed year(s). Each On March 1, 2020, an audited partnership

reviewed year of an audited partnership

Partners (other than pass-through furnishes Forms 8986 to its two partners.

should have a corresponding first affected

partners such as partnerships or S One of these reviewed year partners is a

year for each partner.

corporations) use Form 8978 and calendar year individual and the other is a

Intervening years include the partner’s

Schedule A (Form 8978) to report pass-through partner. On January 15,

tax years that end after the first affected

adjustments shown on Forms 8986 2021, the pass-through partner, in turn,

year and before the reporting year.

received from partnerships that have furnishes Forms 8986 to its two partners

Non-pass-through partner is a partner

elected to push out adjustments to who are calendar year individuals. The

that is other than a pass-through partner.

partnership-related items to their partners. reporting year for all three individuals is

Pass-through partner is a pass-through the tax year that includes March 1, 2020.

The Schedule A (Form 8978) lists all entity that holds an interest in a Because the partners all have a calendar

the adjustments a partner receives on partnership. Pass-through entities include year end, the reporting year is the 2020

Form 8986. Schedule A is also used to partnerships required to file a return under tax year. The partners must each attach a

report any related amounts and section 6031(a), S corporations, trusts completed Form 8978 to their individual

adjustments not reported on Form 8986 (other than wholly owned trusts income tax returns which are due April 15,

which may result from changes to disregarded as separate from their owners 2021 (without regard to extensions).

partner-level tax attributes as a result of for federal tax purposes), and decedents’

adjustments from Form 8986. estates. For this purpose, a pass-through Completing Form 8978 and

entity is not a wholly owned entity Schedule A

Definitions disregarded as separate from its owner for

AAR partnership is a BBA partnership federal tax purposes. What to report on Form 8978 and

(see below) which has filed an Reporting year is the partner’s tax Schedule A (Form 8978). The specific

year(s) that includes the date the audited adjustments listed on Form 8986 received

Dec 23, 2021 Cat. No. 69657Z