Enlarge image

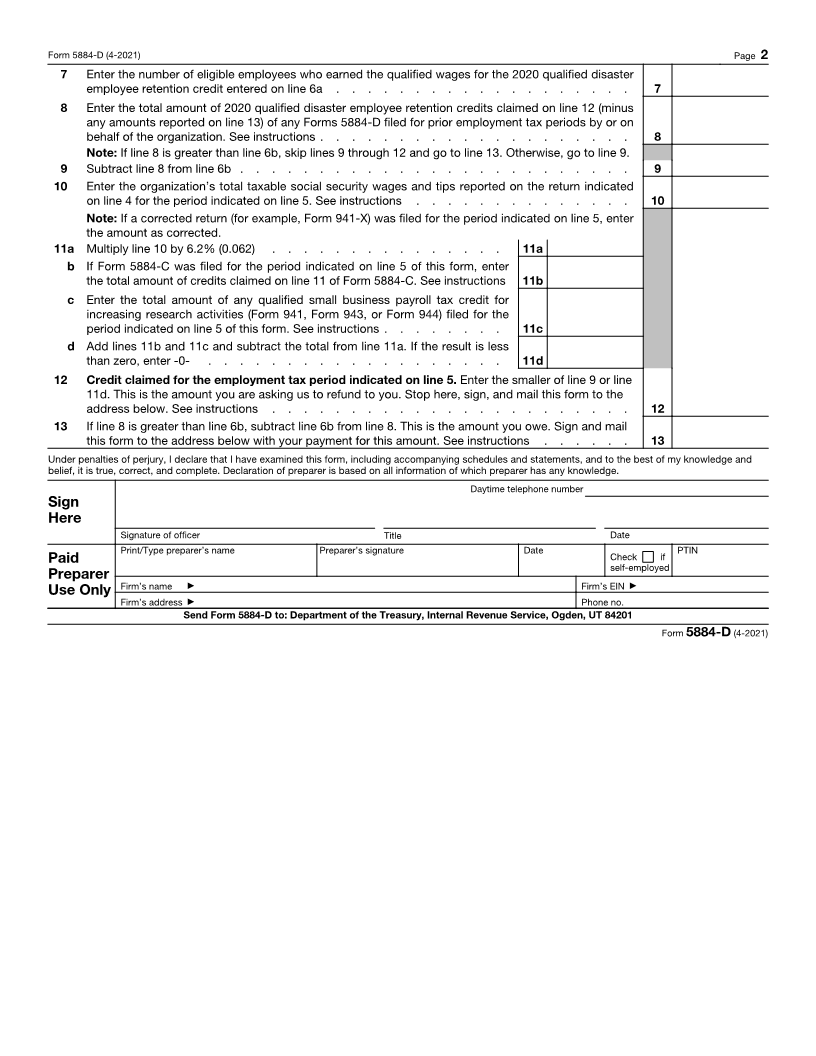

Employee Retention Credit for Certain Tax-Exempt

Form 5884-D

(April 2021) Organizations Affected by Qualified Disasters OMB No. 1545-2298

▶

Department of the Treasury File this form separately; do not attach it to your return.

Internal Revenue Service ▶ Go to www.irs.gov/Form5884D for instructions and the latest information.

Name (not trade name) shown on Form 941 or other employment tax return Employer identification number

Trade name (if any)

Number, street, and room or suite no. If a P.O. box, see instructions.

City or town, state, and ZIP code

1 If filed by a third-party payer, identify the qualified tax-exempt organization here. See instructions. Check if not applicable.

Name Employer identification number

Number, street, and room or suite no. If a P.O. box, see instructions.

City or town, state, and ZIP code

2 a Is the organization a qualified tax-exempt organization (an organization described in section 501(c) and

exempt from tax under section 501(a))? See instructions . . . . . . . . . . . . . . . . . Yes No

b Is the organization a federally chartered corporation, or is it a federal, state, or local college, university,

hospital, or medical care entity? See instructions . . . . . . . . . . . . . . . . . . . . Yes No

If you checked “Yes” on either line 2a or 2b, go to line 3. If you checked “No” on both lines 2a and 2b, do

not file this form; the organization cannot claim this credit.

3 Applicable 2020 qualified disaster zone(s) (see instructions):

(a) (b) (c)

Disaster declaration Description County, parish, or municipality name(s)

number

DR - -

DR - -

DR - -

DR - -

4 Check a box to indicate the employment tax return filed:

a Form 941 b Form 941-PR c Form 941-SS d Form 943 e Form 943-PR

f Form 944 (or 944(SP)) g Form 944-PR h Form 944-SS

5 Check a box or boxes to indicate the employment tax period for which the organization is claiming this credit. See instructions:

a Check year: 2019 2020 2021 (enter year)

b Check quarter (if applicable):

1st: January, February, March 2nd: April, May, June

3rd: July, August, September 4th: October, November, December

6 a Enter the organization’s total qualified wages for the 2020 qualified disaster

employee retention credit paid in all employment tax periods through the end of

the employment tax period indicated on line 5 to all eligible employees (up to

$6,000 each). See instructions . . . . . . . . . . . . . . . . 6a

b Multiply line 6a by 40% (0.40) . . . . . . . . . . . . . . . . . . . . . . . . 6b

For Paperwork Reduction Act Notice, see instructions. Cat. No. 75321C Form 5884-D (4-2021)