Enlarge image

Attention:

Copy A of this form is provided for informational purposes only. Copy A appears in red,

similar to the official IRS form. The official printed version of Copy A of this IRS form is

scannable, but the online version of it, printed from this website, is not. Do not print and file

copy A downloaded from this website; a penalty may be imposed for filing with the IRS

information return forms that can’t be scanned. See part O in the current General

Instructions for Certain Information Returns, available at www.irs.gov/form1099, for more

information about penalties.

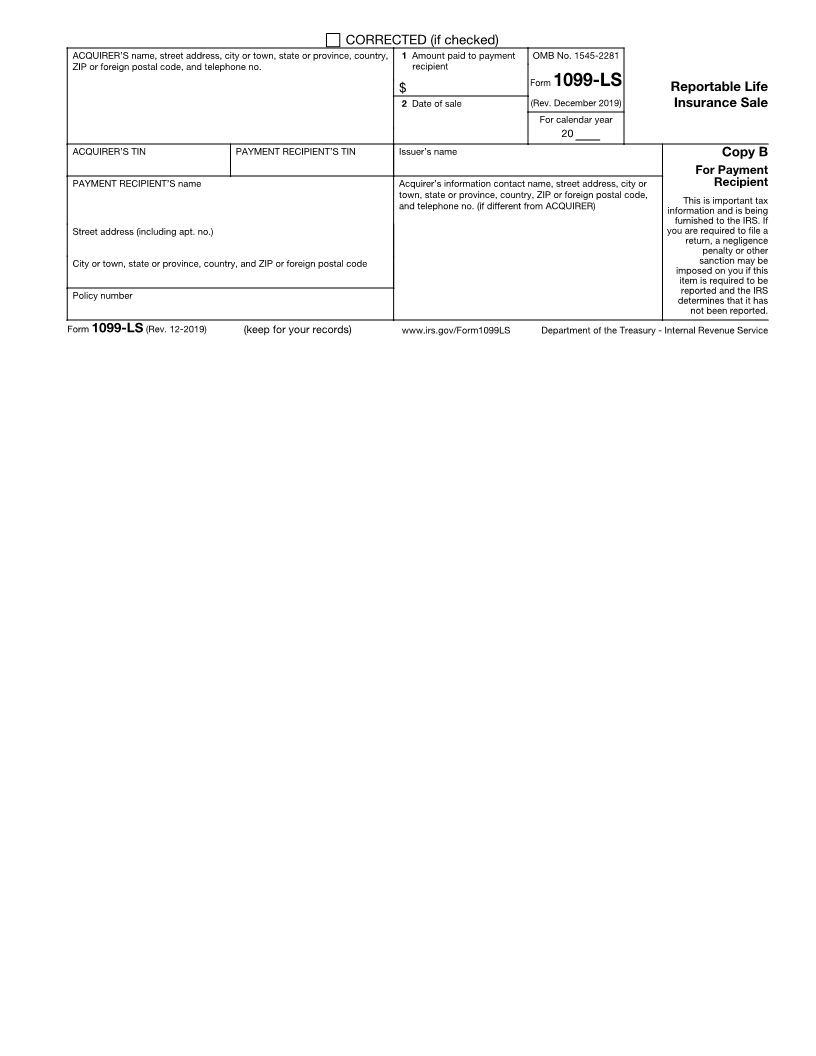

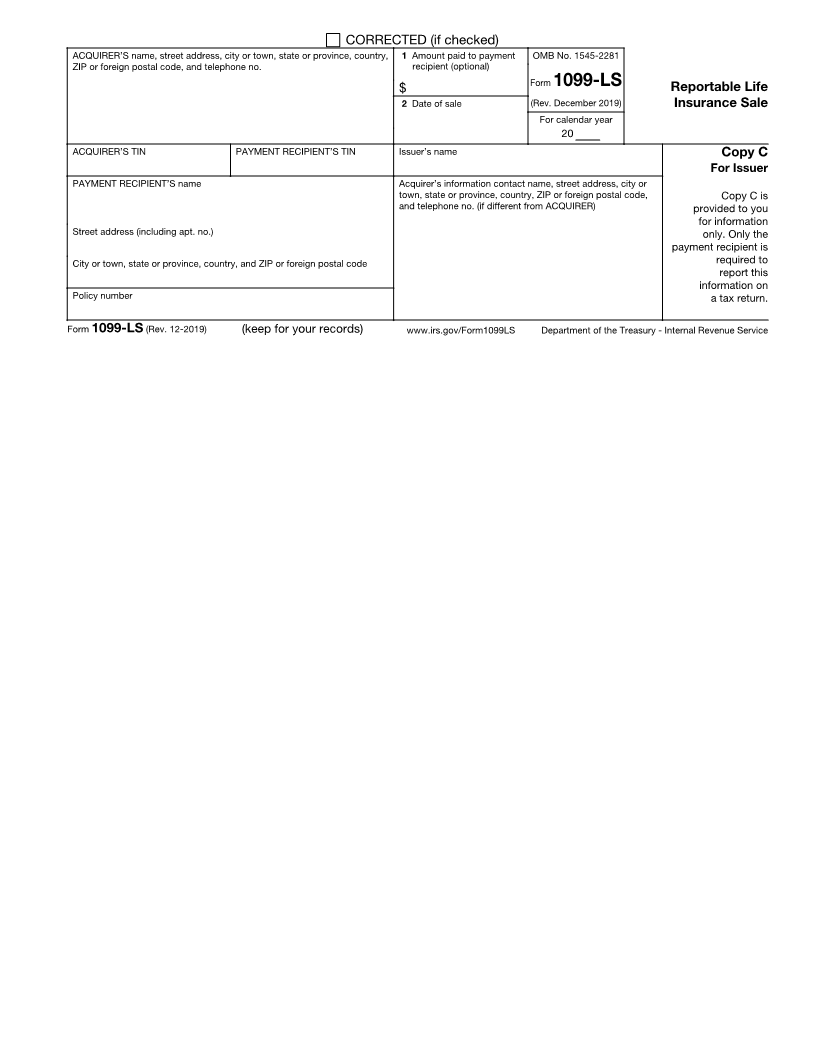

Please note that Copy B and other copies of this form, which appear in black, may be

downloaded and printed and used to satisfy the requirement to provide the information to

the recipient.

To order official IRS information returns, which include a scannable Copy A for filing with

the IRS and all other applicable copies of the form, visit www.IRS.gov/orderforms. Click on

Employer and Information Returns, and we’ll mail you the forms you request and their

instructions, as well as any publications you may order.

Information returns may also be filed electronically using the IRS Filing Information Returns

Electronically (FIRE) system (visit www.IRS.gov/FIRE) or the IRS Affordable Care Act

Information Returns (AIR) program (visit www.IRS.gov/AIR).

See IRS Publications 1141, 1167, and 1179 for more information about printing these tax

forms.