Enlarge image

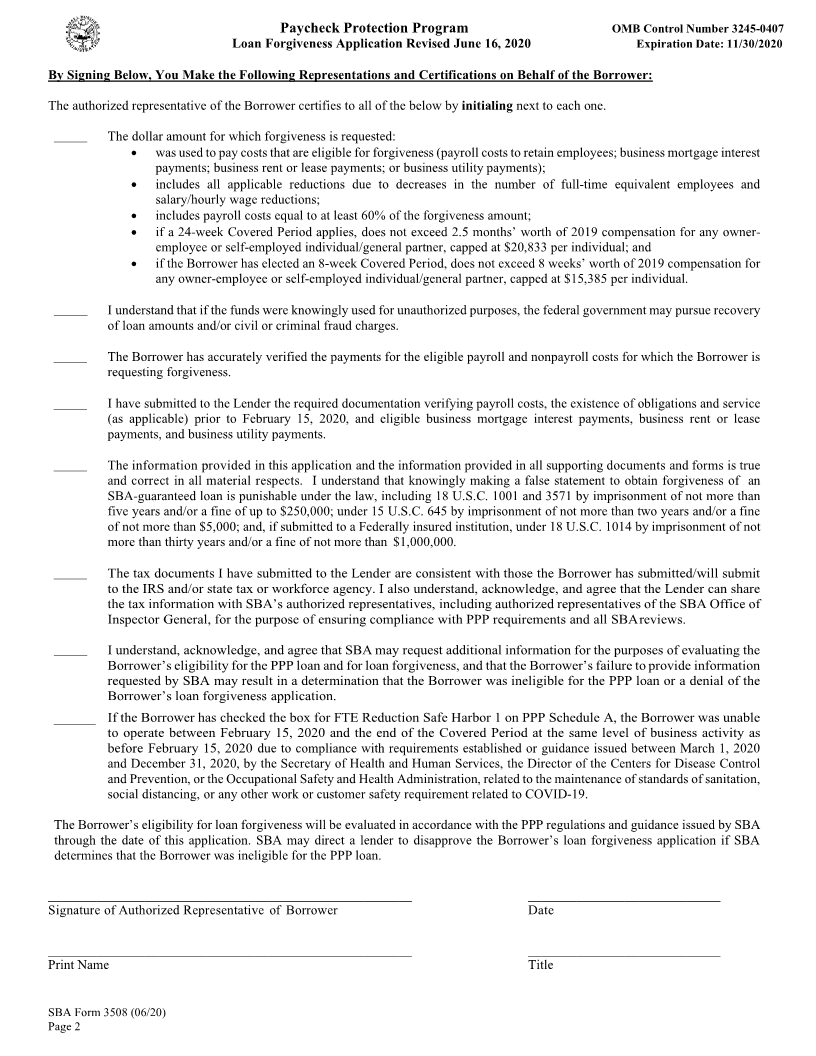

Paycheck Protection Program OMB Control Number 3245-0407

Loan Forgiveness Application Revised June 16, 2020 Expiration Date: 11/30/2020

PPP Loan Forgiveness Calculation Form

Business Legal Name (“Borrower”) DBA or Tradename, if applicable

Business Address Business TIN (EIN, SSN) Business Phone

( ) -

Primary Contact E-mail Address

SBA PPP Loan Number: Lender PPP Loan Number:

PPP Loan Amount: PPP Loan Disbursement Date:

Employees at Time of Loan Application: ___________ Employees at Time of Forgiveness Application:

EIDL Advance Amount: EIDL Application Number:

Payroll Schedule: The frequency with which payroll is paid to employees is:

☐ Weekly ☐ Biweekly (every other week) ☐ Twice a month ☐ Monthly ☐ Other

Covered Period: to

Alternative Payroll Covered Period, if applicable: to

If Borrower (together with affiliates, if applicable) received PPP loans in excess of $2 million, check here: ☐

Forgiveness Amount Calculation:

Payroll and Nonpayroll Costs

Line 1. Payroll Costs (enter the amount from PPP Schedule A, line 10):

Line 2. Business Mortgage Interest Payments:

Line 3. Business Rent or Lease Payments:

Line 4. Business Utility Payments:

Adjustments for Full-Time Equivalency (FTE) and Salary/Hourly Wage Reductions

Line 5. Total Salary/Hourly Wage Reduction (enter the amount from PPP Schedule A, line3):

Line 6. Add the amounts on lines 1, 2, 3, and 4, then subtract the amount entered in line5:

Line 7. FTE Reduction Quotient (enter the number from PPP Schedule A, line13):

Potential Forgiveness Amounts

Line 8. Modified Total (multiply line 6 by line 7):

Line 9. PPP Loan Amount:

Line 10. Payroll Cost 60% Requirement (divide line 1 by 0.60):

Forgiveness Amount

Line 11. Forgiveness Amount (enter the smallest of lines 8, 9, and 10):

SBA Form 3508 (06/20)

Page 1