Enlarge image

Userid: CPM Schema: Leadpct: 100% Pt. size: 10 Draft Ok to Print

instrx

AH XSL/XML Fileid: … ns/I8994/202101/A/XML/Cycle08/source (Init. & Date) _______

Page 1 of 10 14:46 - 22-Jan-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Department of the Treasury

Internal Revenue Service

Instructions for Form 8994

(Rev. January 2021)

Employer Credit for Paid Family and Medical Leave

Section references are to the Internal Revenue Code Eligible Employer

unless otherwise noted.

An eligible employer is an employer with a written policy in

Future Developments place that provides paid family and medical leave and

satisfies minimum paid leave requirements (see Minimum

For the latest information about developments related to

Paid Leave Requirements, later). In addition, if the

Form 8994 and its instructions, such as legislation

employer employs any qualifying employees who aren’t

enacted after they were published, go to IRS.gov/

covered by title I of the Family and Medical Leave Act

Form8994.

(FMLA), the employer’s written policy must include

What’s New “non-interference” language.

Periodic updating. Form 8994 and its instructions will no Non-interference language. If an employer employs at

longer be updated annually. Instead, they’ll only be least one qualifying employee who isn’t covered by title I

updated when necessary. See Which Revision To Use. of the FMLA (including any employee who isn’t covered

by title I of the FMLA because he or she works less than

New employment tax credits. You may have claimed 1,250 hours per year), the employer must include

coronavirus (COVID-19)-related employment credits on “non-interference” language in its written policy and

an employment tax return such as Form 941, Employer’s comply with this language to be an eligible employer. This

QUARTERLY Federal Tax Return. Wages used to figure requirement applies to:

these employment credits can’t also be used to figure a • An employer subject to title I of the FMLA that has at

credit on Form 8994. For more information, see Wages least one qualifying employee who isn’t covered by title I

defined under How To Figure the Credit. of the FMLA, and

Credit extension. The Taxpayer Certainty and Disaster • An employer not subject to title I of the FMLA (that has

Tax Relief Act of 2019 extended the credit for paid family no employees covered by title I of the FMLA).

and medical leave to cover tax years beginning in 2020. The “non-interference” language must ensure that the

The Taxpayer Certainty and Disaster Tax Relief Act of employer will not interfere with, restrain, or deny the

2020 extended the credit to cover tax years beginning in exercise of, or the attempt to exercise, any right provided

2021 through 2025. under the policy, and will not discharge, or in any other

manner discriminate against any individual for opposing

any practice prohibited by the policy. The following

General Instructions “non-interference” language is an example of a written

Purpose of Form provision that would satisfy this requirement: [Employer]

will not interfere with, restrain, or deny the exercise of, or

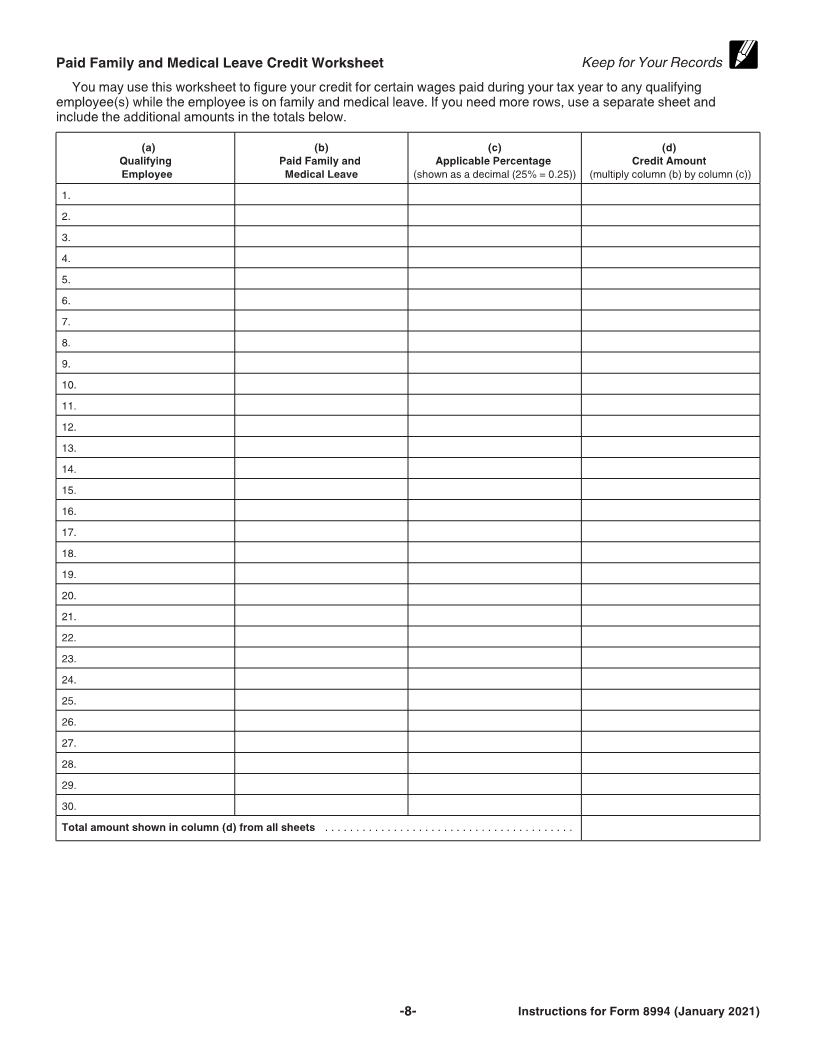

An eligible employer (defined below) uses Form 8994 to the attempt to exercise, any right provided under this

figure the employer credit for paid family and medical policy. [Employer] will not discharge, or in any other

leave. The credit ranges from 12.5% to 25% of certain manner discriminate against, any individual for opposing

wages paid to a qualifying employee while the employee any practice prohibited by this policy.

is on family and medical leave.

Written policy documentary requirements. An eligible

You can claim or elect not to claim the employer credit employer’s written policy may be set forth in a single

for paid family and medical leave any time within 3 years document or in multiple documents. For example, an

from the due date of your return on either your original employer may maintain different documents to cover

return or an amended return. different classifications of employees or different types of

Partnerships and S corporations must file this leave, and those documents will collectively constitute the

TIP form to claim the credit. All other taxpayers must employer’s written policy. An eligible employer’s written

not complete or file this form if their only source for policy may also be included in the same document that

this credit is a partnership or S corporation. Instead, they governs the employer’s other leave policies.

must report this credit directly on line 4j in Part III of Form Written policy in place. The employer’s written policy

3800, General Business Credit. must be in place before the paid family and medical leave

for which the employer claims the credit is taken. The

Which Revision To Use written policy is considered to be in place on the later of

Use the January 2021 revision of Form 8994 for tax years the following dates.

beginning in 2020 or later, until a later revision is issued. • The policy’s adoption date.

Use prior revisions of the form and instructions for earlier • The policy’s effective date.

tax years. All revisions are available at IRS.gov/ Example. You adopt a written policy that satisfies all of

Form8994. the requirements discussed in these instructions on June

15, 2020, with an effective date of July 1, 2020. Assuming

Jan 22, 2021 Cat. No. 69663D