Enlarge image

Form 8996 Qualified Opportunity Fund OMB No. 1545-0123

(Rev. January 2021) ▶ Go to www.irs.gov/Form8996 for instructions and the latest information. Attachment

Department of the Treasury

Internal Revenue Service ▶ Attach to your tax return. See instructions. Sequence No. 996

Name Employer identification number

Part I General Information and Certification

1 Type of taxpayer: Corporation Partnership

2 Is the taxpayer organized for the purpose of investing in qualified opportunity zone (QOZ) property (other than another qualified

opportunity fund (QOF))?

No. STOP. Do not file this form with your tax return.

Yes. Go to line 3.

3 Is this the first period the taxpayer is a QOF?

Yes. By checking this box, you certify that by the end of the taxpayer’s first QOF year, the taxpayer’s organizing

documents include a statement of the entity’s purpose of investing in QOZ property and a description of the trade or

business(es) that the QOF is engaged in either directly or through a QOZ business. See instructions.

No.

4 If you checked “Yes” on line 3, provide the first month in which the fund chose to be a QOF . . . . . . ▶

5 Did any investor dispose of, in part or in whole, their equity interest in the fund?

Yes. Attach a statement with each investor’s name, the date of disposal, and the interest that they transferred during the

QOF’s tax year.

No.

6 Do not check this box. Reserved for future use.

Part II Investment Standard Calculation

7 Enter the amount from Part VI, line 2, for total QOZ property held by the taxpayer on the last day of

the first 6-month period of the taxpayer’s tax year. See instructions if Part I, line 3, is “Yes” . . . . 7

8 Total assets held by the taxpayer on the last day of the first 6-month period of the taxpayer’s tax year.

See instructions if Part I, line 3, is “Yes” . . . . . . . . . . . . . . . . . . . . . 8

9 Divide line 7 by line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Enter the amount from Part VI, line 3, for total QOZ property held by the taxpayer on the last day of the

taxpayer’s tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Total assets held by the taxpayer on the last day of the taxpayer’s tax year . . . . . . . . . 11

12 Divide line 10 by line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Part III Qualified Opportunity Fund Average and Penalty

13 Add lines 9 and 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Divide line 13 by 2.0. See instructions if Part I, line 3, is “Yes” . . . . . . . . . . . . . 14

15 Is line 14 equal to or more than 0.90?

Yes. Enter -0- on this line and file this form with your tax return.

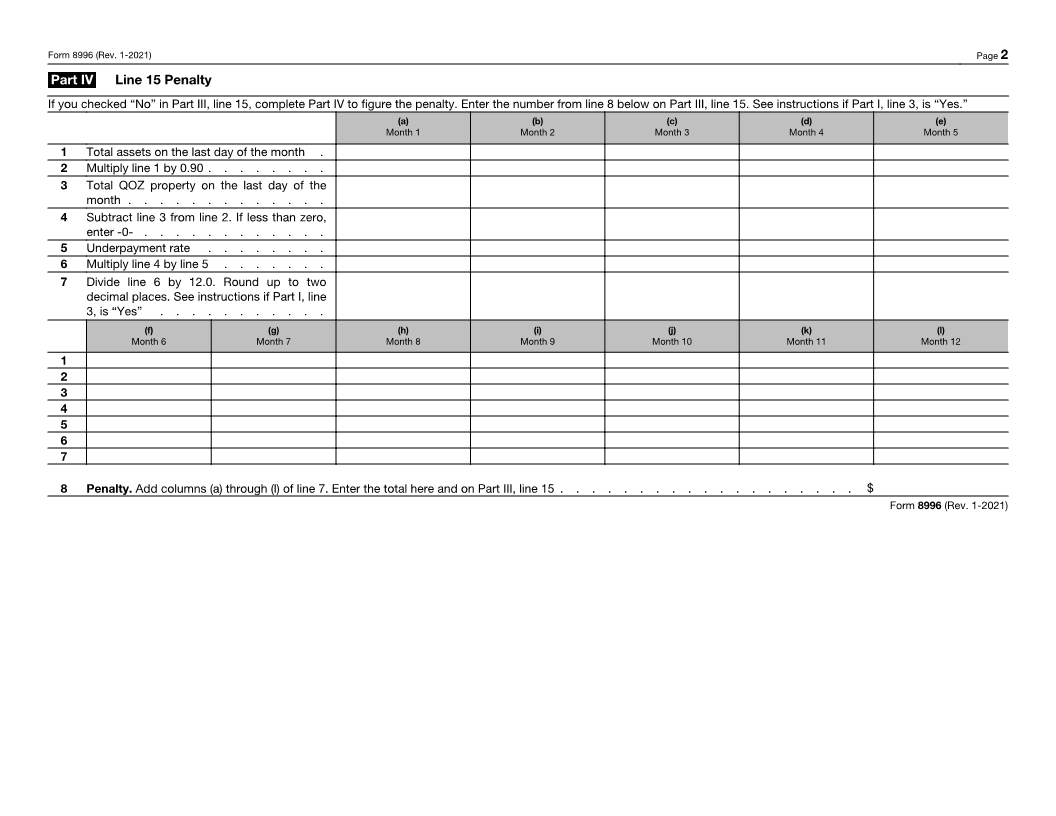

No. The fund has failed to maintain the investment standard. Complete Part IV to figure the penalty.

Enter the penalty from line 8 of Part IV on this line. See instructions . . . . . . . . . . . 15

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 37820G Form 8996 (Rev. 1-2021)