Enlarge image

Userid: CPM Schema: instrx Leadpct: 100% Pt. size: 9 Draft Ok to Print

AH XSL/XML Fileid: … ns/i8990/202212/a/xml/cycle08/source (Init. & Date) _______

Page 1 of 17 9:42 - 23-Jan-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Department of the Treasury

Internal Revenue Service

Instructions for Form 8990

(Rev. December 2022)

Limitation on Business Interest Expense Under Section 163(j)

Section references are to the Internal Revenue provide certain information so that the

Code unless otherwise noted. Who Must File

A taxpayer (including, for example, an partner or shareholder can complete their

individual, corporation, partnership, S return. See Ownership of pass-through

Future Developments corporation) with business interest entities not subject to the section 163(j)

For the latest information about expense; a disallowed business interest limitation, later.

developments related to Form 8990 and expense carryforward; or current year or

its instructions, such as legislation prior year excess business interest Coordination With Other

enacted after they were published, go to expense must generally file Form 8990, Limitations

IRS.gov/Form8990. unless an exclusion from filing applies.

Categorization and allocation of inter-

A pass-through entity allocating excess est expense. Current year interest

What’s New taxable income or excess business expense must be categorized under

Change in adjusted taxable income interest income to its owners must file Temporary Regulations section 1.163-8T

(ATI) computation. For tax years Form 8990, regardless of whether it has (for example, as investment interest,

beginning after 2021, the computation for any interest expense. personal interest, or business interest)

before computing the section 163(j)

ATI is computed with the deductions for A regulated investment company that limitation on the deduction for business

depreciation, amortization, and depletion. pays section 163(j) interest dividends (see interest expense. Also, see Proposed

Do not add back the deductions for Regulations sections 1.163(j)-1(b)(22)(iii) Regulations section 1.163-14 ((85 FR

depreciation, amortization, or depletion (F) and 1.163(j)-1(b)(35)) must file Form 56846) (2020 Proposed Regulations) for

attributable to a trade or business. 8990. rules on allocating interest expense

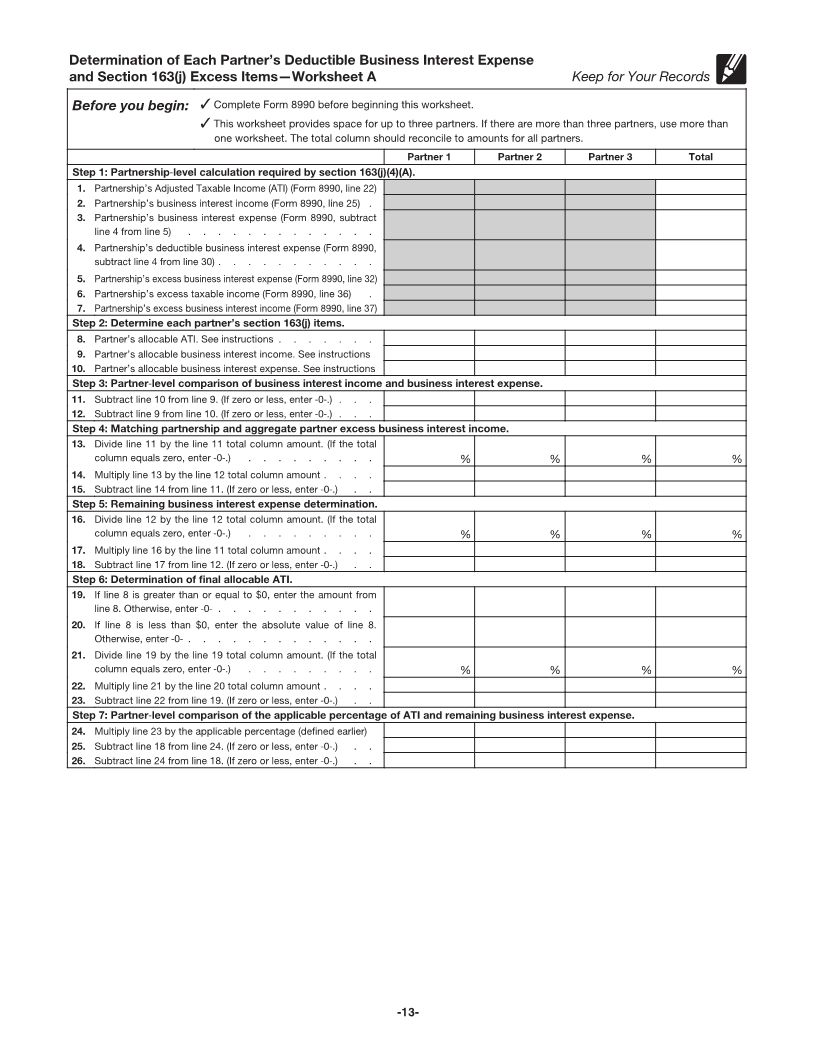

New worksheet. A new worksheet has A taxpayer that is a U.S. shareholder of associated with debt proceeds for

been added to the instructions. Worksheet an applicable controlled foreign pass-through entities. Only business

C is used to determine eligibility for the corporation (CFC) that has business interest expense is subject to the section

safe-harbor election under Regulations interest expense, disallowed business 163(j) limitation.

section 1.163(j)-7(h). See Worksheet interest expense carryforward, or is part of For purposes of the section 163(j)

C—Stand-Alone Applicable CFC/CFC a CFC group must generally apply section limitation only, business interest expense

Group Safe Harbor Election, later. 163(j) to the applicable CFC and attach a refers to interest expense properly

Form 8990 with each Form 5471. See allocable to trades or businesses that are

General Instructions Regulations section 1.163(j)-7(b). not excepted trades or businesses. See

Taxpayers with both excepted and

For a CFC group, an additional Form non-excepted trades or businesses, later,

Purpose of Form 8990 must be filed for the CFC group to for allocating interest expense between

Use Form 8990 to figure the amount of report the combined limitations of all CFC excepted and non-excepted trades or

business interest expense you can deduct group members. See Specified Group businesses before computing the section

and the amount to carry forward to the Parent, later. 163(j) limitation.

next year. For more information, see

Regulations sections 1.163(j)-1 through If a safe-harbor election is made for a Interest expense limitations. An

1.163(j)-11. CFC group, Form 8990 does not need to expense that has been disallowed,

be filed for each CFC group member, but deferred, or capitalized in the current tax

Computation of section 163(j) limita- Form 8990 must be filed for the CFC year, or which has not yet been accrued,

tion. If section 163(j) applies to you, the group. is not taken into account for section 163(j)

business interest expense deduction

allowed for the tax year is limited to the Exclusions from filing. A taxpayer is not purposes. Section 163(j) applies after any

sum of: required to file Form 8990 if the taxpayer basis limitation and before the operation of

is a small business taxpayer and does not the at-risk, passive activity loss, or excess

1. Business interest income, have excess business interest expense business loss limitations. See Regulations

2. Applicable percentage of the from a partnership. A taxpayer is also not section 1.163(j)-3 for additional

adjusted taxable income (ATI), and required to file Form 8990 if it only has information on interactions of section

3. Floor plan financing interest interest expense from one or more of 163(j) with other code provisions relating

expense. these excepted trades or businesses: to interest expense.

• The trade or business of providing If a taxpayer’s deduction for business

Carryforward of disallowed business services as an employee, interest expense is limited under section

interest. The amount of any business • An electing real property trade or 163(j) and such taxpayer has more than

interest expense that is not allowed as a business, one business activity for purposes of

deduction under section 163(j) for the tax • An electing farming business, or either the at-risk (section 465) or passive

year is carried forward to the following • Certain regulated utility businesses. activity loss (section 469) limitation

year as a disallowed business interest If a pass-through entity is not required provisions, then the section 163(j)

expense carryforward. However, see to file Form 8990 because it is a small limitation will apply to the overall business

Special Rules for partnership treatment of business taxpayer, but a partner or interest expense from all the business

disallowed business interest expense, shareholder is required to file Form 8990, activities of the taxpayer. The proportion of

later. the pass-through entity is required, upon each activity’s business interest expense

request by the partner or shareholder, to that is disallowed is the same proportion

Jan 23, 2023 Cat. No. 71420E