Enlarge image

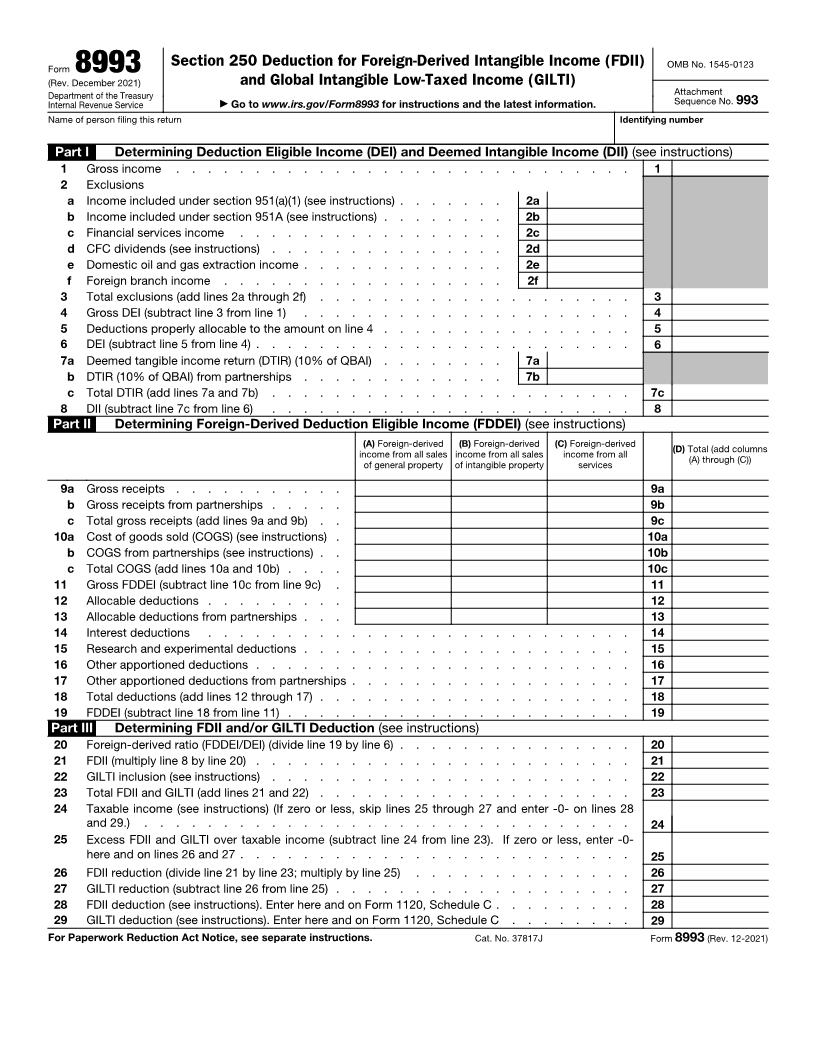

Section 250 Deduction for Foreign-Derived Intangible Income (FDII) OMB No. 1545-0123

Form 8993

(Rev. December 2021) and Global Intangible Low-Taxed Income (GILTI)

Department of the Treasury Attachment

Internal Revenue Service ▶ Go to www.irs.gov/Form8993 for instructions and the latest information. Sequence No. 993

Name of person filing this return Identifying number

Part I Determining Deduction Eligible Income (DEI) and Deemed Intangible Income (DII) (see instructions)

1 Gross income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Exclusions

a Income included under section 951(a)(1) (see instructions) . . . . . . . 2a

b Income included under section 951A (see instructions) . . . . . . . . 2b

c Financial services income . . . . . . . . . . . . . . . . . 2c

d CFC dividends (see instructions) . . . . . . . . . . . . . . . 2d

e Domestic oil and gas extraction income . . . . . . . . . . . . . 2e

f Foreign branch income . . . . . . . . . . . . . . . . . . 2f

3 Total exclusions (add lines 2a through 2f) . . . . . . . . . . . . . . . . . . . . 3

4 Gross DEI (subtract line 3 from line 1) . . . . . . . . . . . . . . . . . . . . . 4

5 Deductions properly allocable to the amount on line 4 . . . . . . . . . . . . . . . . 5

6 DEI (subtract line 5 from line 4) . . . . . . . . . . . . . . . . . . . . . . . . 6

7a Deemed tangible income return (DTIR) (10% of QBAI) . . . . . . . . 7a

b DTIR (10% of QBAI) from partnerships . . . . . . . . . . . . . 7b

c Total DTIR (add lines 7a and 7b) . . . . . . . . . . . . . . . . . . . . . . . 7c

8 DII (subtract line 7c from line 6) . . . . . . . . . . . . . . . . . . . . . . . 8

Part II Determining Foreign-Derived Deduction Eligible Income (FDDEI) (see instructions)

(A) Foreign-derived (B) Foreign-derived (C) Foreign-derived (D) Total (add columns

income from all sales income from all sales income from all (A) through (C))

of general property of intangible property services

9a Gross receipts . . . . . . . . . . . 9a

b Gross receipts from partnerships . . . . . 9b

c Total gross receipts (add lines 9a and 9b) . . 9c

10a Cost of goods sold (COGS) (see instructions) . 10a

b COGS from partnerships (see instructions) . . 10b

c Total COGS (add lines 10a and 10b) . . . . 10c

11 Gross FDDEI (subtract line 10c from line 9c) . 11

12 Allocable deductions . . . . . . . . . 12

13 Allocable deductions from partnerships . . . 13

14 Interest deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Research and experimental deductions . . . . . . . . . . . . . . . . . . . . . 15

16 Other apportioned deductions . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Other apportioned deductions from partnerships . . . . . . . . . . . . . . . . . . 17

18 Total deductions (add lines 12 through 17) . . . . . . . . . . . . . . . . . . . . 18

19 FDDEI (subtract line 18 from line 11) . . . . . . . . . . . . . . . . . . . . . . 19

Part III Determining FDII and/or GILTI Deduction (see instructions)

20 Foreign-derived ratio (FDDEI/DEI) (divide line 19 by line 6) . . . . . . . . . . . . . . . 20

21 FDII (multiply line 8 by line 20) . . . . . . . . . . . . . . . . . . . . . . . . 21

22 GILTI inclusion (see instructions) . . . . . . . . . . . . . . . . . . . . . . . 22

23 Total FDII and GILTI (add lines 21 and 22) . . . . . . . . . . . . . . . . . . . . 23

24 Taxable income (see instructions) (If zero or less, skip lines 25 through 27 and enter -0- on lines 28

and 29.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

25 Excess FDII and GILTI over taxable income (subtract line 24 from line 23). If zero or less, enter -0-

here and on lines 26 and 27 . . . . . . . . . . . . . . . . . . . . . . . . . 25

26 FDII reduction (divide line 21 by line 23; multiply by line 25) . . . . . . . . . . . . . . 26

27 GILTI reduction (subtract line 26 from line 25) . . . . . . . . . . . . . . . . . . . 27

28 FDII deduction (see instructions). Enter here and on Form 1120, Schedule C . . . . . . . . . 28

29 GILTI deduction (see instructions). Enter here and on Form 1120, Schedule C . . . . . . . . 29

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 37817J Form 8993 (Rev. 12-2021)