Enlarge image

Corporate and Real Estate Investment Trust (REIT) Report of Net 965

Form 965-B OMB No. 1545-0123

(Rev. January 2020) Tax Liability and Electing REIT Report of 965 Amounts

Department of the Treasury ▶ Go to www.irs.gov/Form965B for instructions and the latest information.

Internal Revenue Service

Check this box if this is an amended report . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ▶

Name of taxpayer or REIT Identifying number Taxable year of reporting

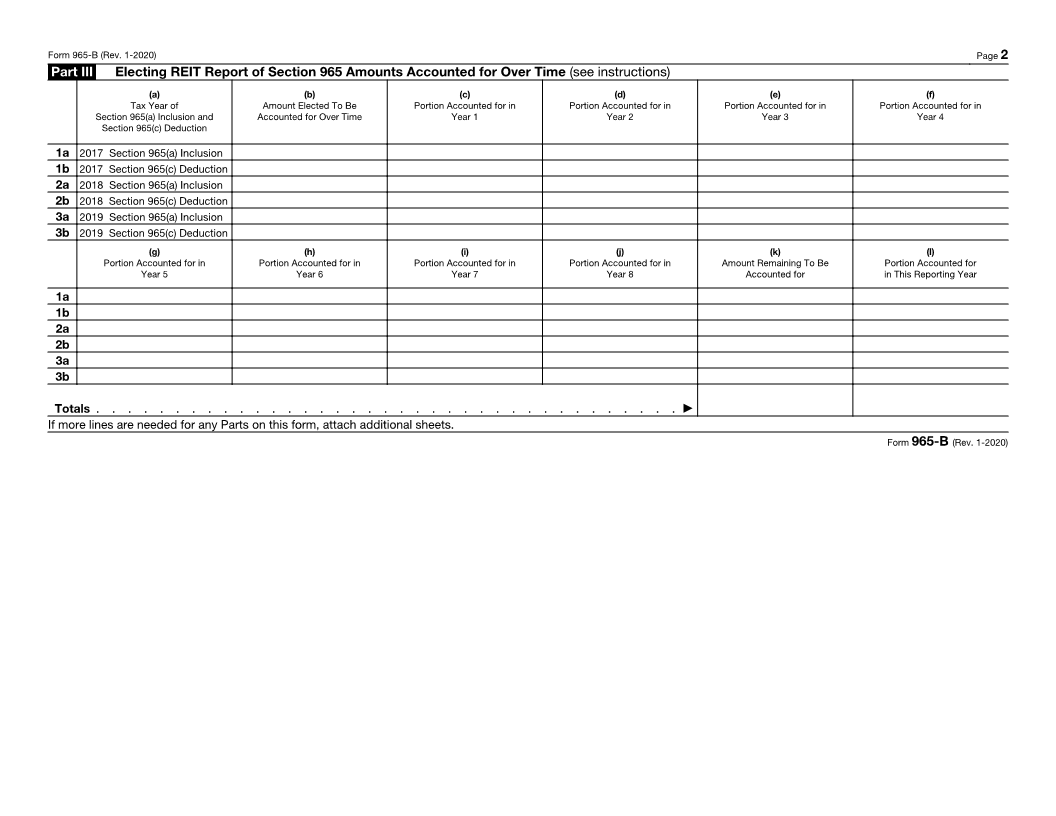

REITs Electing To Account for Section 965 Amounts Over Time Must Fill Out Part III.

Part I Report of Net 965 Tax Liability and Election To Pay in Installments

(a) (b) (c) (d) (e) (f) (g) (h) (i)

Year of Taxpayer’s Net Tax Liability Taxpayer’s Net Tax Liability Net 965 Tax Liability Installment Net 965 Tax Liability Net 965 Tax Liability Net 965 Tax Liability Tax

Section Identification

965(a) With all Without (subtract column (c) Election To Be Paid in Full in Year 1 To Be Paid in Installments Transferred (Out), Number

Inclusion or 965 Amounts 965 Amounts from column (b)) Made (if column (e) is “No,” enter (if column (e) is “Yes,” enter Transferred In, or of Buyer/

Liability (see instructions) (see instructions) amount from column (d)) amount from column (d) Subsequent Adjustments, Transferee or

Assumed and see instructions) if any (see instructions) Seller/

(see instructions) Yes No Transferor

1 2017

2 2018

3 2019

4

5

6

7

8

Part II Record of Amount of Net 965 Tax Liability Paid by the Taxpayer (see instructions)

(a)

Year of Section 965(a) (b) (c) (d) (e) (f)

Inclusion or Paid for Year 1 Paid for Year 2 Paid for Year 3 Paid for Year 4 Paid for Year 5

Liability Assumed

(see instructions)

1 2017

2 2018

3 2019

4

5

6

7

8

(g) (h) (i) (j) (k)

Paid for Year 6 Paid for Year 7 Paid for Year 8 Net 965 Tax Liability Net 965 Tax Liability

Remaining Unpaid (see instructions) Paid for the Reporting Year

1

2

3

4

5

6

7

8

Totals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ▶

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 71278S Form 965-B (Rev. 1-2020)