Enlarge image

SCHEDULE B-2 Election Out of the Centralized

(Form 1065)

(December 2018) Partnership Audit Regime OMB No. 1545-0123

▶

Department of the Treasury Attach to Form 1065 or Form 1066.

Internal Revenue Service ▶ Go to www.irs.gov/Form1065 for instructions and the latest information.

Name of Partnership Employer Identification Number (EIN)

Certain partnerships with 100 or fewer partners can elect out of the centralized partnership audit regime if each partner is an individual,

a C corporation, a foreign entity that would be treated as a C corporation were it domestic, an S corporation, or an estate of a deceased

partner. For purposes of determining whether the partnership has 100 or fewer partners, the partnership must include all shareholders of

any S corporation that is a partner. By completing Part I, you are making an affirmative statement that all of the partners in the

partnership are eligible partners under section 6221(b)(1)(C) and you have provided all of the information on this schedule. See the

instructions, including the instructions for the treatment of real estate mortgage investment conduits (REMICs), for more details.

Part I List of Eligible Partners

Use the following codes under Type of Eligible Partner:

I – Individual C – Corporation E – Estate of Deceased Partner F – Eligible Foreign Entity S – S corporation

Name of Partner Taxpayer Identification Number (TIN) Type of Eligible

Partner (Code)

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

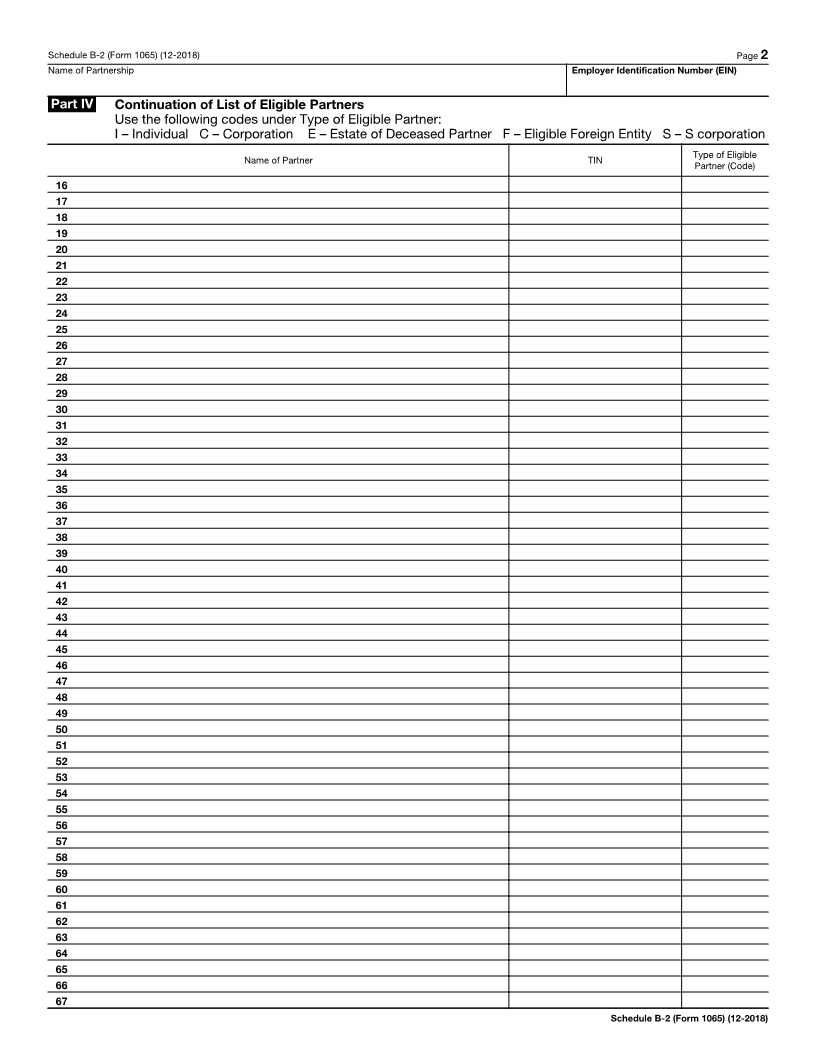

Continued on Part IV

Part II List of S Corporation Shareholders (For each S corporation partner, complete a separate Part II and

separate Part V, if needed.)

Use the following codes under Type of Person:

I – Individual E – Estate of Deceased Shareholder T – Trust O – Other

Name of

S Corporation Partner © TIN of Partner ©

Name of Shareholder Shareholder TIN Type of Person

(Code)

1

2

3

4

5

6

7

8

9

10

11

12

Continued on Part V

Part III Total Number of Schedules K-1 Required To Be Issued. See instructions.

1 Total of Part I and all Parts IV Schedules K-1 required to be issued by the partnership . . . . 1

2 Total of Part II and all Parts V Schedules K-1 required to be issued by any S corporation partners . 2

3 Total. Add line 1 and line 2 . . . . . . . . . . . . . . . . . . . . . . . . 3

Note: If line 3 is more than 100, the partnership cannot make the election under section 6221(b).

For Paperwork Reduction Act Notice, see the Instructions for Form 1065. Cat. No. 69658K Schedule B-2 (Form 1065) (12-2018)