Enlarge image

Department of Taxation and Finance

Supplement to Corporation Tax Instructions CT-1

• the fund name Meals On Wheels For Seniors was changed to

Home Delivered Meals for Seniors.

Up-to-date information affecting your

Capital base tax rate – For tax periods beginning on or after

tax return January 1, 2020, and before January 1, 2021, the capital base tax

Visit our website for the tax law changes or forms corrections rate was reduced to 0.019% for qualified New York manufacturers

that occurred after the forms and instructions were finalized (see and QETCs and 0.025% for all remaining taxpayers (including

Need help?). qualified cooperative housing corporations).

Decoupling from increase in interest deduction allowed pursuant

Contents of this form to Internal Revenue Code (IRC) section 163(j)(10)(A)(i) – Due to

Form CT-1 contains both changes for the current tax year and changes in the Tax Law as part of the 2020-2021 New York State

general instructional information, serving as a supplement to budget, the amendment made to the IRC by the addition of new

corporation tax instructions. section 163(j)(10)(A)(i) under section 2306 of the federal CARES

Act which allows the use of 50% of adjusted taxable income (ATI),

This form contains information on the following topics: will not apply when computing the business income base tax.

• Changes for the current tax year (non-legislative and legislative) When you compute your entire net income (ENI) and interest

expense deductions that are reported to New York State, you

• Business information (how to enter and update) must

use 30% rather than 50% when computing this federal limitation.

• Entry formats New addition modification A-511 for Forms CT-225 and CT-225-A

– Dates was added. See Forms CT-225-I, Instructions for Form CT-225, and

– Negative amounts CT-225-A-I, Instructions for Forms CT-225-A and CT-225-A/B.

– Percentages Net operating loss deduction (NOLD) – Form CT-3.4, Net

– Whole dollar amounts Operating Loss Deduction (NOLD), and its instructions were

• Are you claiming an overpayment? updated to clarify certain topics:

• NAICS business code number and NYS principal business activity • New lines 5f, 5g, and 7a through 7d were added to aid in the

computation of the net operating loss (NOL) to be used in the

• Limitation on tax credit eligibility current year and the NOL available to be carried forward.

• Third-party designee • NOLs limited under IRC sections 381-384 and/or separate

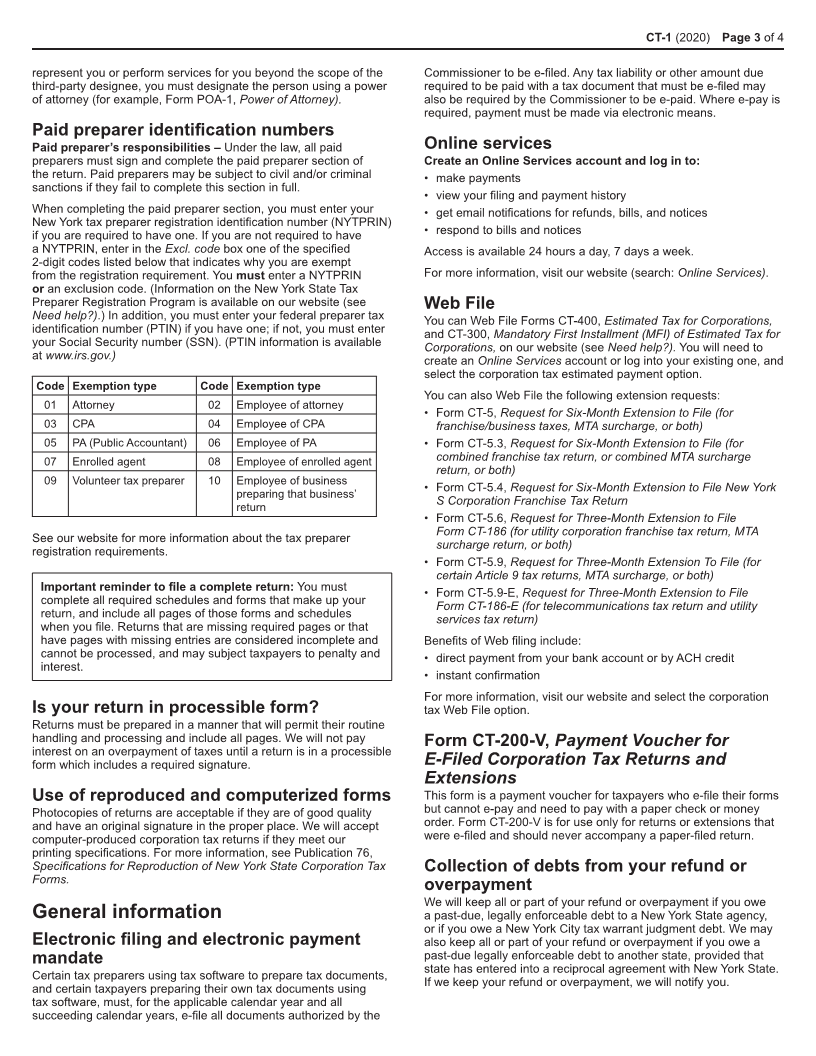

• Paid preparer identification numbers return limitation year (SRLY) – The NOLD must not include

• Is your return in processible form? carryforwards that are unavailable to be used in the current year

due to these federal limitations.

• Use of reproduced and computerized forms

• Electronic filing and electronic payment mandate Empire State film production credit – This credit, previously

due to expire for periods after 2024, was extended through 2025.

• Online services The amount of the credit allowed was reduced from 30% to 25%

• Web File of qualified production costs paid or incurred in the production of a

• Form CT-200-V qualified film and the definition of a qualified film was amended. For

• Collection of debts from your refund or overpayment more information, see Form CT-248, Claim for Empire State Film

Production Credit, and its instructions.

• Fee for payments returned by banks

• Reporting requirements for tax shelters Empire State film post-production credit – This credit, previously

due to expire for periods after 2024, was extended through 2025.

• Tax shelter penalties The amount of the credit allowed was reduced from 30% to 25% of

• Voluntary Disclosure and Compliance Program qualified post-production costs paid or incurred in the production

• Your rights under the Tax Law of a qualified film in the Metropolitan Commuter Transportation

District (MCTD) and from 35% to 30% elsewhere in the state.

• Need help? For more information, see Form CT-261, Claim for Empire State

• Privacy notification Post-Production Credit, and its instructions.

Metropolitan transportation business tax (MTA surcharge)

Changes for 2020 rate and deriving receipts thresholds – For tax years beginning

The following forms (and separate instructions, as applicable) are on or after January 1, 2020, and before January 1, 2021, the

new this year: Commissioner has adjusted the MTA surcharge rate to 29.4%.

CT-651, Recovery Tax Credit The Commissioner must also annually review the thresholds at

CT-652, Employer-Provided Child Care Credit which a corporation is deemed to be deriving receipts from activity

in the MCTD for purposes of imposing the MTA surcharge. For tax

The following form (and separate instructions, as applicable) was years beginning on or after January 1, 2020, and before January 1,

discontinued this year: 2021, the thresholds were not changed. For more information, see

CT-243, Claim for Biofuel Production Credit TSB-M-19(6)C, 2020 MTA Surcharge Rate and Deriving Receipts

Thresholds.

Article 9-A

Form CT-227, New York State Voluntary Contributions – There are Articles 9-A and 33

two updates to this form as follows: Decoupling from changes to the IRC enacted after March 1,

2020 for partnerships – If you are a partner in a partnership(s)

• a new contribution, Leukemia, Lymphoma, and Myeloma Fund, and the distributive share of your partnership’s ordinary business

was added; and income (loss) included in your federal taxable income (FTI) reflects