Enlarge image

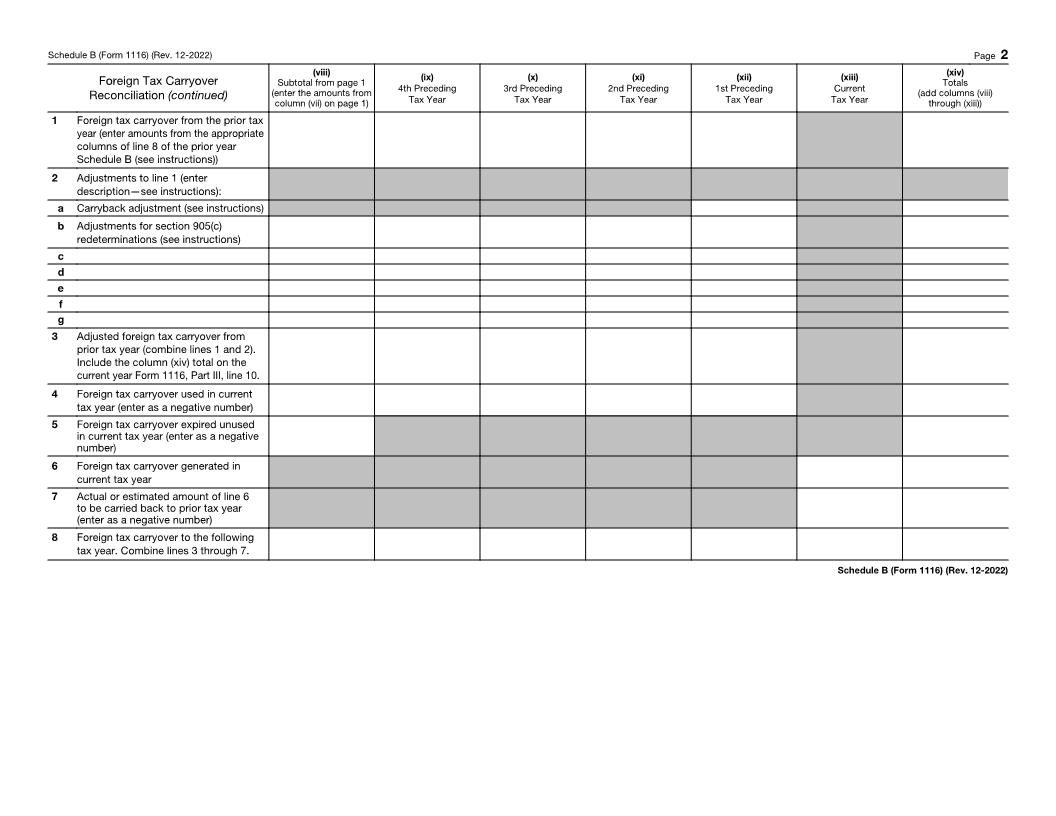

SCHEDULE B Foreign Tax Carryover Reconciliation Schedule

(Form 1116)

For calendar year 20 , or other tax year beginning , 20 , and ending , 20 . OMB No. 1545-0121

(Rev. December 2022) See separate instructions.

Department of the Treasury Attach to Form 1116.

Internal Revenue Service Go to www.irs.gov/Form1116 for instructions and the latest information.

Name Identifying number as shown

on page 1 of your tax return

Use a separate Schedule B (Form 1116) for each applicable category of income listed below. See instructions. Check only one box on each schedule.

Check the box for the same separate category code as that shown on the Form 1116 to which this Schedule B is attached.

a Reserved for future use c Passive category income e Section 901(j) income g Lump-sum distributions

b Foreign branch category income d General category income f Certain income re-sourced by treaty

h If box e is checked, enter the country code for the sanctioned country. See instructions . . . . . . . . . . . . . . . . . . . .

i If box f is checked, enter the country code for the treaty country. See instructions . . . . . . . . . . . . . . . . . . . . . .

Foreign Tax Carryover (i) (ii) (iii) (iv) (v) (vi) (vii)

10th Preceding 9th Preceding 8th Preceding 7th Preceding 6th Preceding 5th Preceding Subtotal

Reconciliation Tax Year Tax Year Tax Year Tax Year Tax Year Tax Year (add columns (i)

through (vi))

1 Foreign tax carryover from the prior tax

year (enter amounts from the appropriate

columns of line 8 of the prior year

Schedule B (see instructions))

2 Adjustments to line 1 (enter

description—see instructions):

a Carryback adjustment (see instructions)

b Adjustments for section 905(c)

redeterminations (see instructions)

c

d

e

f

g

3 Adjusted foreign tax carryover from

prior tax year (combine lines 1 and 2)

4 Foreign tax carryover used in current

tax year (enter as a negative number)

5 Foreign tax carryover expired unused

in current tax year (enter as a negative

number)

6 Foreign tax carryover generated in

current tax year

7 Actual or estimated amount of line 6

to be carried back to prior tax year

(enter as a negative number)

8 Foreign tax carryover to the following

tax year. Combine lines 3 through 7. -0-

For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 75186F Schedule B (Form 1116) (Rev. 12-2022)