Enlarge image

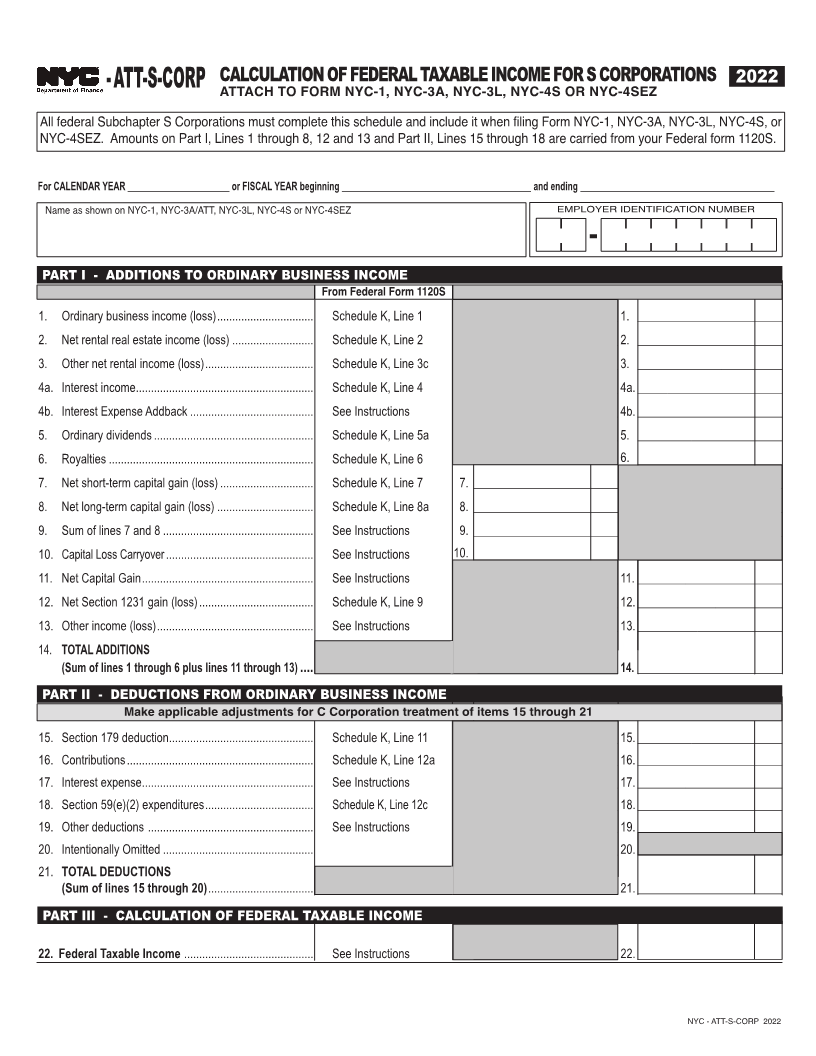

CALCULATION OF FEDERAL TAXABLE INCOME FOR S CORPORATIONS 2022

-ATT-S-CORP ATTACH TO FORM NYC-1, NYC-3A, NYC-3L, NYC-4S OR NYC-4SEZ

All federal Subchapter S Corporations must complete this schedule and include it when filing Form NYC-1, NYC-3A, NYC-3L, NYC-4S, or

NYC-4SEZ. Amounts on Part I, Lines 1 through 8, 12 and 13 and Part II, Lines 15 through 18 are carried from your Federal form 1120S.

For CALENDAR YEAR ______________________ or FISCAL YEAR beginning _____________________________________ and ending ______________________________________

Name as shown on NYC-1, NYC-3A/ATT, NYC-3L, NYC-4S or NYC-4SEZ EMPLOYER IDENTIFICATION NUMBER

PART I - ADDITIONS TO ORDINARY BUSINESS INCOME

From Federal Form 1120S

1. Ordinary business income (loss)................................ Schedule K, Line 1 ________________________ 1. ________________________

2. Net rental real estate income (loss) ........................... Schedule K, Line 2 ________________________ 2. ________________________

3. Other net rental income (loss).................................... Schedule K, Line 3c ________________________ 3. ________________________

4a. Interest income........................................................... Schedule K, Line 4 ________________________ 4a. ________________________

4b. Interest Expense Addback ......................................... See Instructions ________________________ 4b. ________________________

5. Ordinary dividends..................................................... Schedule K, Line 5a ________________________ 5. ________________________

6. Royalties .................................................................... Schedule K, Line 6 ________________________ 6. ________________________

7. Net short-term capital gain (loss) ............................... Schedule K, Line 7 7. ________________________ ________________________

8. Net long-term capital gain (loss) ................................ Schedule K, Line 8a 8. ________________________ ________________________

9. Sum of lines 7 and 8 .................................................. See Instructions 9. ________________________ ________________________

10. Capital Loss Carryover ................................................. See Instructions 10. ________________________ ________________________

11. Net Capital Gain......................................................... See Instructions ________________________ 11. ________________________

12. Net Section 1231 gain (loss)...................................... Schedule K, Line 9 ________________________ 12. ________________________

13. Other income (loss).................................................... See Instructions ________________________ 13. ________________________

14. TOTAL ADDITIONS

(Sum of lines 1 through 6 plus lines 11 through 13) .... _____________________ 14. __________________

PART II - DEDUCTIONS FROM ORDINARY BUSINESS INCOME

Make applicable adjustments for C Corporation treatment of items 15 through 21

15. Section 179 deduction................................................ Schedule K, Line 11 ________________________ 15. ________________________

16. Contributions.............................................................. Schedule K, Line 12a ________________________ 16. ________________________

17. Interest expense......................................................... See Instructions ________________________ 17. ________________________

18. Section 59(e)(2) expenditures.................................... Schedule K, Line 12c ________________________ 18. ________________________

19. Other deductions ....................................................... See Instructions ________________________ 19. ________________________

20. Intentionally Omitted .................................................. ________________________ 20. ________________________

21. TOTAL DEDUCTIONS

(Sum of lines 15 through 20)................................... ________________________ 21. ________________________

PART III - CALCULATION OF FEDERAL TAXABLE INCOME

22. Federal Taxable Income ........................................... See Instructions ________________________ 22. ________________________

NYC - ATT-S-CORP 2022