Enlarge image

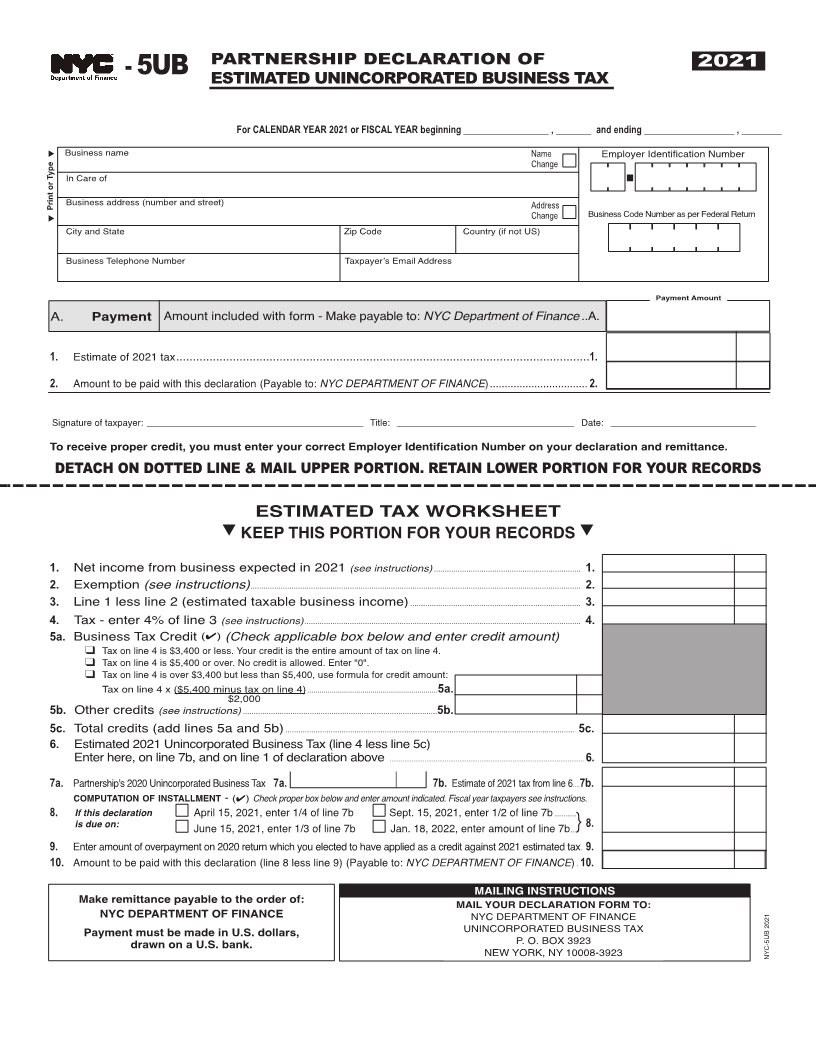

PARTNERSHIP DECLARATION OF 2021

-

5UB ESTIMATED UNINCORPORATED BUSINESS TAX

For CALENDAR YEAR 2021 or FISCAL YEAR beginning _________________ , _______ and ending __________________ , ________

t Business name Name Employer Identification Number

Change n

In Care of

Print or Type Business address (number and street) Address

t Change n Business Code Number as per Federal Return

City and State Zip Code Country (if not US)

Business Telephone Number Taxpayer’s Email Address

Payment Amount

A. Payment Amount included with form - Make payable to: NYC Department of Finance..A.

1. Estimate of 2021 tax............................................................................................................................ 1.

2. Amount to be paid with this declaration (Payable to: NYC DEPARTMENT OF FINANCE)................................. 2.

Signature of taxpayer: _________________________________________________________________________ Title: ______________________________________ Date: ____________________________

To receive proper credit, you must enter your correct Employer Identification Number on your declaration and remittance.

DETACH ON DOTTED LINE & MAIL UPPER PORTION. RETAIN LOWER PORTION FOR YOUR RECORDS

ESTIMATED TAX WORKSHEET

t KEEP THIS PORTION FOR YOUR RECORDS t

1. Net income from business expected in 2021 (see instructions) .................................................................... 1.

2. Exemption (see instructions)......................................................................................................................................................... 2.

3. Line 1 less line 2 (estimated taxable business income) ............................................................................... 3.

4. Tax - enter 4% of line 3 (see instructions) ................................................................................................................................ 4.

5a. Business Tax Credit (4) (Check applicable box below and enter credit amount)

q Tax on line 4 is $3,400 or less. Your credit is the entire amount of tax on line 4.

q Tax on line 4 is $5,400 or over. No credit is allowed. Enter "0".

q Tax on line 4 is over $3,400 but less than $5,400, use formula for credit amount:

Tax on line 4 x ($5,400 minus tax on line 4) ................................................................5a.

$2,000

5b. Other credits (see instructions) ..........................................................................................5b.

5c. Total credits (add lines 5a and 5b) ...................................................................................................................................... 5c.

6. Estimated 2021 Unincorporated Business Tax (line 4 less line 5c)

Enter here, on line 7b, and on line 1 of declaration above .......................................................................................................... 6.

7a. Partnership's 2020 Unincorporated Business Tax 7a. 7b. Estimate of 2021 tax from line 6....7b.

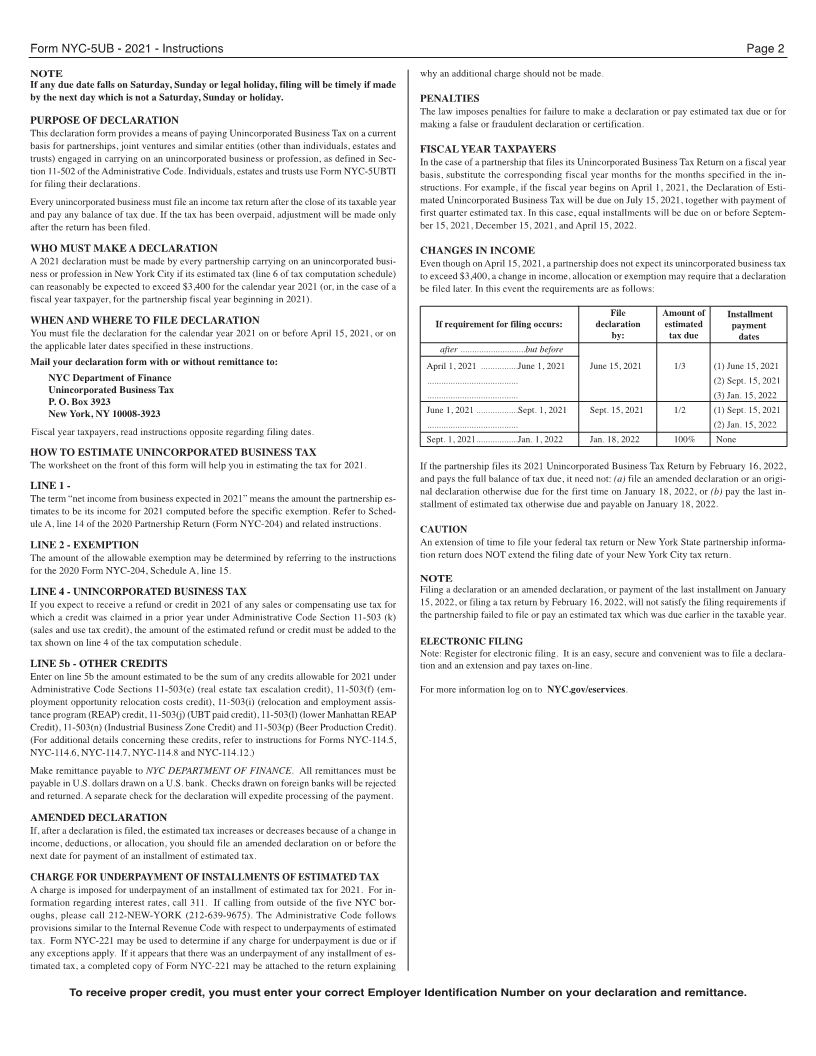

COMPUTATION OF INSTALLMENT -(4) Check proper box below and enter amount indicated. Fiscal year taxpayers see instructions.

8. If this declaration n April 15, 2021, enter 1/4 of line 7b n Sept. 15, 2021, enter 1/2 of line 7b ............

is due on: n June 15, 2021, enter 1/3 of line 7b n Jan. 18, 2022, enter amount of line 7b...} 8.

9. Enter amount of overpayment on 2020 return which you elected to have applied as a credit against 2021 estimated tax. 9.

10. Amount to be paid with this declaration (line 8 less line 9) (Payable to: NYC DEPARTMENT OF FINANCE).10.

MAILING INSTRUCTIONS

Make remittance payable to the order of: MAIL YOUR DECLARATION FORM TO:

NYC DEPARTMENT OF FINANCE NYC DEPARTMENT OF FINANCE

Payment must be made in U.S. dollars, UNINCORPORATED BUSINESS TAX

drawn on a U.S. bank. P. O. BOX 3923

NEW YORK, NY 10008-3923 NYC-5UB 2021