Enlarge image

!

Rev. 4/24

Effective June 1 2024Effective June 1 2024Effective June 1 2024Effective June 1 2024Effective June 1 2024Effective June 1 2024Effective June 1 2024Effective June 1, 2024Effective June 1, 2024Effective June 1 2024Effective June 1 2024Effective June 1 2024EffEffEffEffEffEffEffective June 1 2024Effective June 1, 2024Effective June 1 2024EffectiveEffectiveEffective June 1 2024tititi tititi JJJJJJJJJune 1une 1 , 1 20241 20241 20241 2021 20241 2024,, 202, 202,,,,44

210 North 1950 West

Salt Lake City, Utah 84134

801-297-2200

The income tax withholding tables in 1-800-662-4335

this revision are eff ective for pay periods

beginning on or after June 1, 2024

!

"#

$%

Contents

Electronic Filing Requirements ........................................................ 2 Changing or Closing an Account ............................................... 6

General Information ......................................................................... 2 Agencies .......................................................................................... 6

Employment Tax Workshops ...................................................... 2 Internal Revenue Service .......................................................... 6

Who Must Withhold Taxes .......................................................... 2 Utah State Tax Commission ....................................................... 6

Employer Withholding Exemption ......................................... 2 Social Security Administration ................................................... 6

Employee Withholding Exclusions ............................................. 2 Utah Dept. of Workforce Services .............................................. 6

Nonresident Employees Working Temporarily in Utah .......... 2 Labor Commission of Utah ........................................................ 6

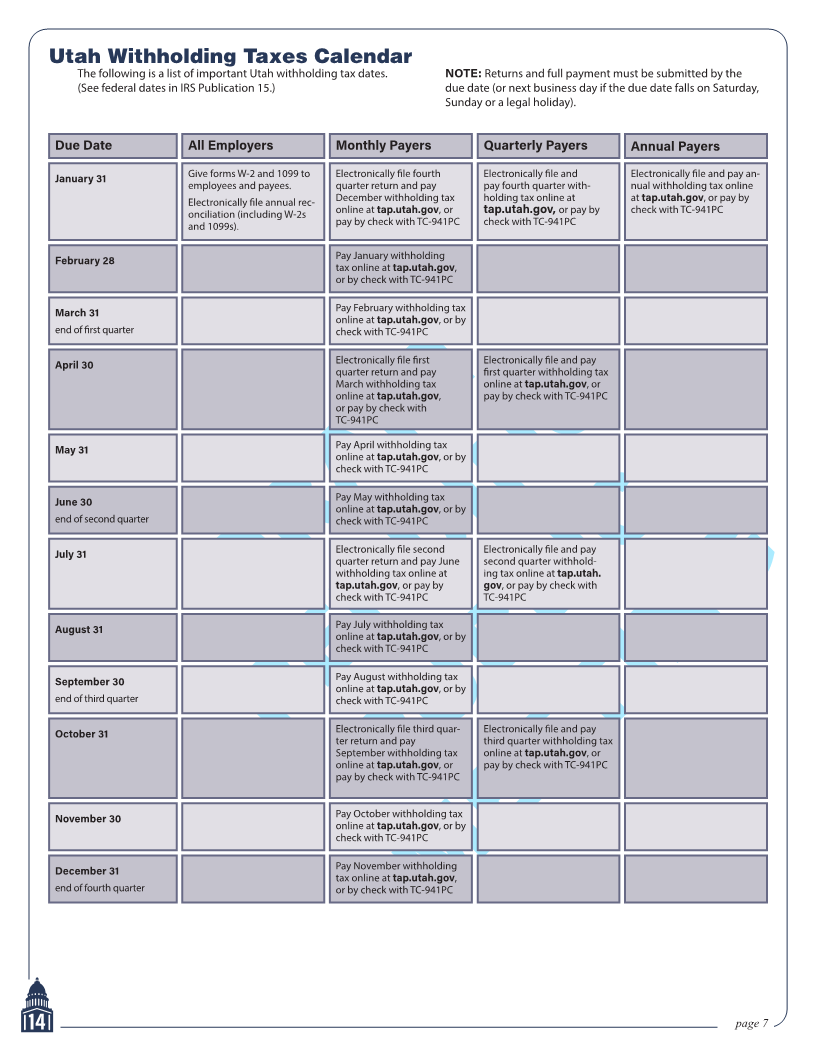

Interstate Transportation Wages ........................................... 2 Utah Withholding Taxes Calendar .................................................... 7

Active Duty Service Member’s Nonresident Utah Withholding Schedules............................................................ 8

Spouse Wages .................................................................. 3 Instructions ................................................................................ 8

Definitions .................................................................................. 3 Utah Schedules 1-4 – Weekly, Biweekly,

Wages ................................................................................... 3 Semimonthly, Monthly ............................................................. 9

Utah Taxable Wages ............................................................. 3 Utah Schedules 5-8 – Quarterly, Semiannual,

Household Employees .......................................................... 3 Annual, Daily ......................................................................... 10

How to Get a Withholding Account ............................................ 3 Examples of Utah Withholding Calculations ............................ 11

Federal Employer Identification Number ............................... 3DRAFT Utah Withholding Tables ................................................................ 12

Bond Requirements for Utah ................................................ 3 Weekly and Biweekly Payroll Periods ...................................... 12

How Much to Withhold ............................................................... 3 Semimonthly and Monthly Payroll Periods ............................... 13

How to File Returns ................................................................... 3 Quarterly and Semiannual Payroll Periods .............................. 14

Filing with No Tax Liability (Zero Returns) ............................ 3 Annual and Daily/Miscellaneous Payroll Periods ..................... 15

Amended Returns ................................................................. 3

How to Make Payments ............................................................. 3

Payroll Service Providers ...................................................... 4

Liability .................................................................................. 4

Annual Reconciliation ................................................................ 4PENDING

Amended Reconciliations ..................................................... 4

Late and/or Incorrect Filings ................................................. 4

Balancing the Reconciliation ................................................. 4 PUBLIC

Withholding Filing Record .......................................................... 4

Due Dates .................................................................................. 4

Annual Returns with Annual Payments ................................. 5

Quarterly Returns with Quarterly Payments ......................... 5

Quarterly Returns with Monthly Payments ........................... 5

Annual Reconciliations, W-2s and 1099s .............................. 5

Filing Status Changes ................................................................ 5 E-Verify for Employers

W-2 and 1099 Requirements ..................................................... 5 MEETINGEmployers can help prevent identity theft by verifying the

Amending W-2s ......................................................................... 5 social security numbers of job applicants. E-Verify is a free

Penalties and Interest ................................................................ 5 service of the U.S. Department of Homeland Security that

Late Filing and Late Payments ............................................. 5 verifi es employment eligibility through the Internet. Employ-

Annual Reconciliation ........................................................... 5 ers can use E-Verify at

.

Interest .................................................................................. 6