Enlarge image

Department of Taxation and Finance

Individual Purchaser’s Annual Report of Sales and Use Tax ST-140

You may use this form if you are an individual, estate, or trust that owes sales or use tax for calendar year 2023. You must use this form if you have

already filed your New York State personal income tax return for 2023 and you need to report sales or use tax that was not reported on your personal

income tax return. Do not use this form if you are required to register for sales tax purposes with the New York State Tax Department or if you are

reporting the purchase of a motor vehicle, trailer, all-terrain vehicle, vessel, or snowmobile that must be registered or titled by the New York State

Department of Motor Vehicles. See Form ST-140-I (2023), Instructions for Form ST-140, for more information.

For office use only

Type or print clearly

Tax jurisdiction code

Purchaser’s name Social Security number

Location code

Purchaser’s address (number and street or rural route) Employer identification number (if any)

Taxable sales

City County State ZIP code

Sales and use tax

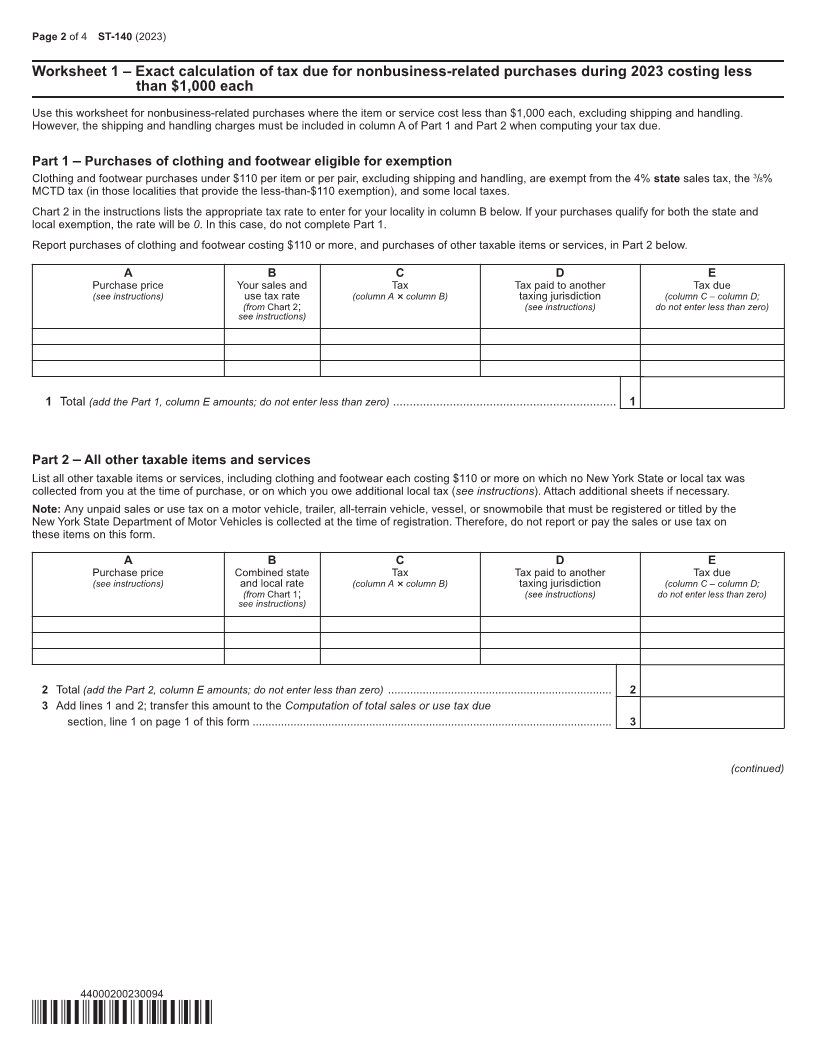

Complete the Computation of total sales or use tax due section below. Form ST-140 offers individuals two ways to compute their sales and use taxes for

nonbusiness-related purchases of items or services costing less than $1,000 each, excluding shipping and handling. For these purchases, individuals may

elect to use Worksheet 1 on page 2 or the Sales and use tax chart below to determine the tax due. See Example below. You must compute your tax due on

nonbusiness-related items costing $1,000 or more, and for any business-related purchases, using Worksheets 2 and 3 on page 3.

Description of items or services purchased:

Computation of total sales or use tax due

1 Tax due on nonbusiness-related items or services costing less than $1,000 each, excluding shipping and

handling (Enter your tax due on all nonbusiness-related purchases where the price of each item or service was

under $1,000. You may enter the amount from line 3 of Worksheet 1, on page 2 or you may elect to determine the

amount by using the Sales and use tax chart below.) ................................................................................................ 1

2 Tax due on nonbusiness-related items or services costing $1,000 or more each (from line 1 of Worksheet 2

on page 3) .......................................................................................................................................................... 2

3 Tax due on business-related purchases – federal schedules C, and F or E (Part I)(from line 3 ofWorksheet 3

on page 3) .......................................................................................................................................................... 3

4 Total sales or use tax due (add lines 1, 2, and 3) .................................................................................................... 4

5 Penalty and interest if you are filing or paying late (see instructions) ..................................................................... 5

6 Total amount due (add lines 4 and 5). .................................................................................................................... 6

7 Amount paid (enter your payment amount; this amount should match the amount due on line 6)..................................... 7

Example: You live in Monroe County in New York State.

Sales and use tax chart

(for line 1 computation only) Over the course of the year, you purchased several items for less than

If your recomputed federal adjusted $1,000 each (excluding shipping and handling) over the Internet and by

gross income (AGI) for 2023 is: Tax amount catalog. You know that you did not pay any tax on the items purchased.

You may elect to use the Sales and use tax chart to determine the tax

up to $15,000* ........................................................ $3 due on these purchases.

$15,001 - $30,000 .................................................. $5 Also, on August 15, 2023, you received a computer that you ordered

$30,001 - $50,000 .................................................. $9 from a retailer located in Michigan for $1,500 including the retailer’s

$50,001 - $75,000 .................................................. $13 $100 charge for shipping and handling. The Michigan retailer did not

collect any New York or Michigan sales or use tax.

$75,001 - $100,000 ................................................ $18

$100,001 - $150,000 .............................................. $26 Your recomputed federal AGI for the year is $53,400. You determine the

amount of tax due as follows:

$150,001 - $200,000 .............................................. $32 For line 1 of the Computation of total sales or use tax due, you elect

$200,001 and greater ............................................. 0.0165% (.000165) to use the Sales and use tax chart and select the amount based on

of income, or $125, your recomputed federal AGI of $53,400. Enter this amount on line 1 of the

whichever amount is smaller Computation of total sales or use tax due .................................... $13.00

* This may be any amount up to $15,000, including 0 or a negative amount. For line 2 of the Computation of total sales or use tax due, you use

Worksheet 2 to calculate your tax liability on the computer purchase.

If you maintained a permanent place of abode in New York State for $1,500 × 8% (state and local combined rate in Monroe County from

sales and use tax purposes for only part of the year, multiply the tax Form ST-140-I, Instructions for Form ST-140, Chart 1). Enter this

amount from the chart (based on your total recomputed federal AGI amount on line 2 of the Computation of total sales or use

for 2023) by the number of months you maintained the permanent tax due .......................................................................................... 120.00

place of abode in New York State and divide the result by 12. (Count

any period you maintained the abode for more than one-half month Total sales or use tax due ............................................................ $133.00

as one month. Do not count a period of one-half month or less.) Enter

that amount on line 1.

44000100230094