Enlarge image

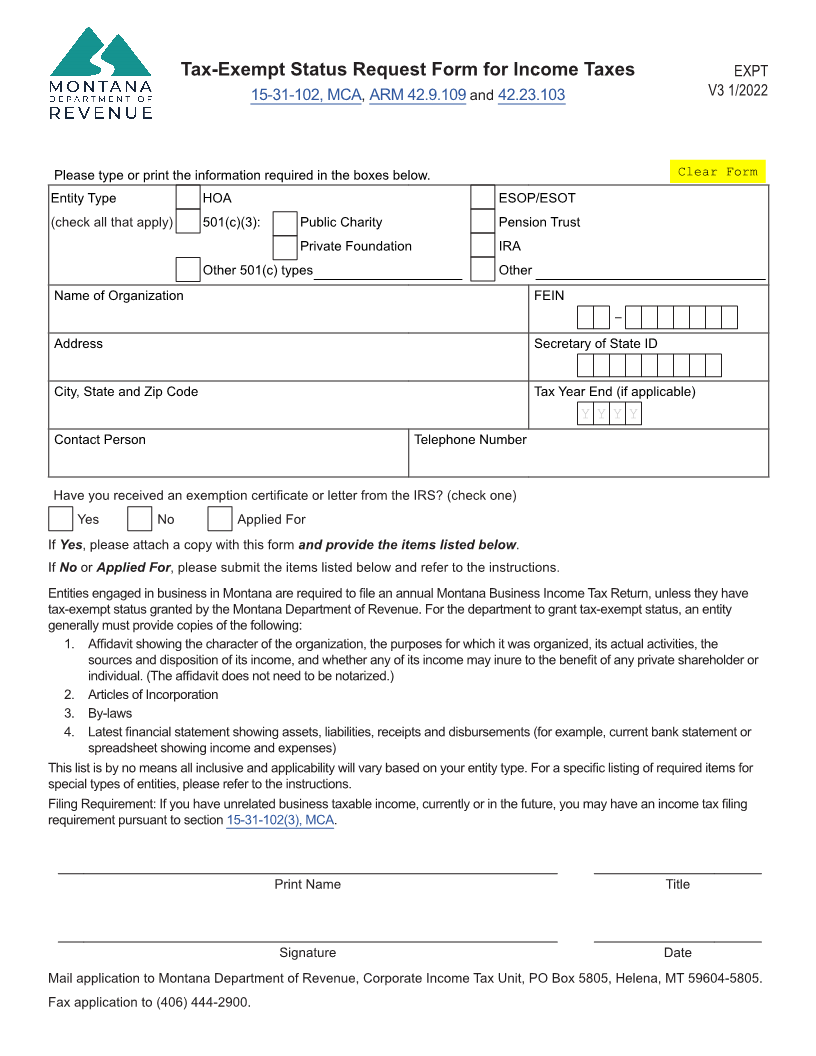

Tax-Exempt Status Request Form for Income Taxes EXPT

15-31-102, MCA, ARM 42.9.109 and 42.23.103 V3 1/2022

Please type or print the information required in the boxes below. Clear Form

Entity Type HOA ESOP/ESOT

(check all that apply) 501(c)(3): Public Charity Pension Trust

Private Foundation IRA

Other 501(c) types ____________________ Other _______________________________

Name of Organization FEIN

-

Address Secretary of State ID

City, State and Zip Code Tax Year End (if applicable)

Y Y Y Y

Contact Person Telephone Number

Have you received an exemption certificate or letter from the IRS? (check one)

Yes No Applied For

If Yes, please attach a copy with this form and provide the items listed below.

If No or Applied For, please submit the items listed below and refer to the instructions.

Entities engaged in business in Montana are required to file an annual Montana Business Income Tax Return, unless they have

tax-exempt status granted by the Montana Department of Revenue. For the department to grant tax-exempt status, an entity

generally must provide copies of the following:

1. Affidavit showing the character of the organization, the purposes for which it was organized, its actual activities, the

sources and disposition of its income, and whether any of its income may inure to the benefit of any private shareholder or

individual. (The affidavit does not need to be notarized.)

2. Articles of Incorporation

3. By-laws

4. Latest financial statement showing assets, liabilities, receipts and disbursements (for example, current bank statement or

spreadsheet showing income and expenses)

This list is by no means all inclusive and applicability will vary based on your entity type. For a specific listing of required items for

special types of entities, please refer to the instructions.

Filing Requirement: If you have unrelated business taxable income, currently or in the future, you may have an income tax filing

requirement pursuant to section 15-31-102(3), MCA.

Print Name Title

Signature Date

Mail application to Montana Department of Revenue, Corporate Income Tax Unit, PO Box 5805, Helena, MT 59604-5805.

Fax application to (406) 444-2900.