Enlarge image

MONTANA CHILD SUPPORT SERVICES DIVISION EMPLOYER GUIDE TO NEW HIRE REPORTING • Flexible New Hire Reporting Options • New Hire Reporting Law • State and Federal Contacts

Enlarge image | MONTANA CHILD SUPPORT SERVICES DIVISION EMPLOYER GUIDE TO NEW HIRE REPORTING • Flexible New Hire Reporting Options • New Hire Reporting Law • State and Federal Contacts |

Enlarge image |

Montana Child Support Services Division New

Hire Reporting Program

The Montana Child Support Services Division (CSSD) was

established in 1975. Since then, employers have helped to

collect an estimated $1 billion dollars in child support

payments for Montana families by participating in programs

such as the New Hire Reporting Program (NHRP).

The NHRP was established through the Personal

Responsibility and Work Opportunity Reconciliation Act

(PRWORA) of 1996 with the purpose of locating a non-

custodial parent’s income source for collection of child

support. This law requires employers to report all newly hired

and rehired employees to the CSSD within certain time

frames.

Employers are a vital part of the CSSD’s

mission to diligently pursue and ultimately achieve financial

and medical support for children by establishing, enforcing

and increasing public awareness of parental obligations.

Thank you to all the employers who help make

Montana a better place for the children of our great state!

Sincerely,

New Hire Reporting Program

Montana Child Support Services Division

|

Enlarge image |

Definitions & Terms

MCA § 40-5-901 Definitions

Date of Hire

The first day that an employee starts work for which the employee is owed

compensation by the payor of income.

Employer

A person, firm corporation,, association, governmental entity, or labor organization

that engages an employee for compensation and withholds federal or state tax

liabilities from the employee's compensation.

Employee

A person 18 years of age or older who performs labor in this state for an employer

in this state for compensation and for whom the employer withholds federal or state

tax liabilities from the employee's compensation.

Rehire

The first day, following a termination of employment that an employee begins to

again perform work or prov dei services for a payor Termination. of employment

does not include temporary separations of less than 60 days from employment,

such as unpaid medical leave an,unpaid leave of absence or a temporary, or

seasonal layoff.

Other terms

CSSD (Montana) Child Support Services Division

DHHS Federal Department of Health & Human Services

DPHHS Department of Public Health & Human Services

EDI Electronic Data Interchange

FEIN Federal Employer Identification Number

NDNH National Directory of New Hires

NHRP New Hire Reporting Program

OCSE Federal Office of Child Support Enforcement

PRWORA Personal Responsibility & Work Opportunity Reconciliation

Act of 1996

SDNH State Directory of New Hires

UIC Unemployment Insurance Claimant

https://dphhs.mt.gov/cssd/employerinfo/newhirereporting

1

|

Enlarge image |

Overview

This guide is intended to provide Montana Employers with the information needed to be

in compliance with federal and state laws, to help choose a New Hire Reporting option,

and to make available contacts who can help employers with the new hire reporting

process.

42 USC § 653(a) State Directory of New Hires and MCA § 40-5-922 Directory of New

Hires require employers to report all employees hired / rehired on or after October 1,

1997 within twenty (20) days of the employee’s first day of work. In 2013, federal and

state legislation defined the term “rehire” as an individual that has been separated

from employment for more than sixty (60) days. (MCA § 40-5-901(12) Definitions)

Required Information

Employer Employee

• Federal Identification Number • Full legal name

• Business name • Date of hire

• Business address • Social Security Number

• Mailing & Home address

Optional Information

Employers are encouraged, but not required, to report the information below:

Employer Employee

• Work phone number • Home phone number

• Fax number • Work phone number

• State of Hire • Date of Birth

• Health Insurance Availability

New Hire Reporting Deadlines

• Reports must be submitted within twenty (20) days of the date the employee

is hired or rehired.

• Reports submitted by electronic media must be submitted not less than 12 nor

more than 16 days apart.

2

|

Enlarge image |

Options for Reporting New Hires

New hires may be reported by any of the following means:

• Online New Hire Reporting System*

• State of Montana File Transfer System*

• Electronic Media

• Facsimile

• Mail

• Phone

*Recommended reporting method

Online New Hire Reporting System*

The quickest and easiest option for reporting new hires.

Get started by using your existing Okta Montana account or create one at

https://okta.loginmt.com/. Then call the Montana New Hire Reporting

Specialist at 406.444.9290 or at 1.888.866.0327 for assistance with setup.

Montana File Transfer System via

https://okta.loginmt.com/

Submit reports using the Excel Template or ASCII file format

Format for both is found at:

https://dphhs.mt.gov/cssd/employerinfo/newhirereporting.

An example of ASCII file format is also found on page 9 of this brochure.

It’s recommended to call the New Hire Reporting Specialist to assist with

setup for both Excel & ASCII at 406.444.9290 or 1.888.866.0327.

Scanned new hire reports may be submitted via Montana File Transfer

Service. Please include your name and email address in case there is a

question regarding a report.

DO NOT EMAIL NEW HIRE REPORTS

KEEP YOUR EMPLOYEE’S INFORMATION SAFE

USE THE MONTANA FILE TRANSFER SYSTEM

3

|

Enlarge image |

Other Options for Reporting New Hires

Electronic Media

Employers may submit reports on CD using the ASCII format found on pages 9 -11. You will need

to mail the CD to the NHRP at the address below.

Facsimile

Fax reports using the New Hire Reporting form or a copy of the employee's W-4 form to the NHR

program. Please make sure all required information found on page 2 is included on the report. Fax

#s: 1.406.444.0745 or 1.888.272.1990

Mail

Employers may mail a hard copy of their report using the New Hire Reporting form, W-4 form or

any other reporting form. All required information must be typed or printed legibly.

Montana New Hire Reporting Program

PO Box 8013

Helena, MT 59604-8013

Phone

Employers with only a few new hires to report may do so by calling 1.888.866.0327 or

406.444.9290. You may leave a message with the required information found on page 2.

Tips for New Hire Reporting

Include a contact name and phone number for your company with your new

hire reports.

Do not use any punctuation when reporting new hires online or electronically.

When naming your electronic files, please use your company name and the

current date. For example: CompanyNameMMDDYYYY

If your company's FEIN changes and your employee(s) are being paid under

the new FEIN, you must submit a new hire report for each employee under

the new FEIN number with the date of hire as the first day the employee

started working under the company's new FEIN.

The employee's name should match the name on the employee's social

security card. If it does not, there is a good chance the report will be rejected.

Only report valid Social Security Numbers to the NHRP. Do not report fake

numbers or Alien Identification Numbers. Reports containing such numbers

will be rejected.

If an employee is rehired, use the date the employee was rehired as the date

of hire.

4

|

Enlarge image |

New Hire Reporting Law

In 1997 Montana passed legislation in response to passage of the Federal Personal

Responsibility and Work Opportunity Reconciliation Act (PRWORA). This created

the Montana Directory of New Hires (NHRP).

State statute MCA § 40-5-922 requires Montana employers to report all employees

hired or rehired within twenty (20) days after the date of hire. "Rehire" is defined as

an individual that has been separated from employment for more than sixty (60)

days.

The NHRP matches New Hire reports against child support records to locate

parents, establish a child support order, or enforce an existing order.

All Employees must be reported

All newly hired or rehired employees are required to be reported to the NHRP

regardless of whether they have a child support obligation. The NHRP not only

serves as a way to locate the income source of non-custodial parents to provide

families with child support payments, but also as a way to combat unemployment

and public assistance fraud.

If an employee quits or is terminated before a new hire is reported you must still

report them to the NHRP. Reporting these individuals may help child support

agencies locate them for services.

Confidentiality & New Hire Reporting Data

NHR information is confidential and may only be shared on a limited basis with

other agencies. The Montana NHRP will match new hire information against the

Montana Department of Public Health and Human Services (DPHHS), Child

Support Services Division (CSSD) case records to locate parents, establish an

order, or enforce an existing order. Montana will also transmit the NHRP

information to the National Directory of New Hires (NDNH) in order to cross

reference the information against that of other child support agencies across the

country.

State agencies operating Employment Security and Workers' Compensation

programs may also have access to Montana's NHRP information to detect and

prevent erroneous or fraudulent benefit payments. Montana may conduct

matches between the NHRP database and the public assistance and Medicaid

agencies for the purpose of determining eligibility, continued eligibility, and fraud.

The CSSD is required to maintain NHR records for twenty-four (24) months from

the date the report is entered into the State Directory of New Hires (SDNH).

After the retention timeframe has lapsed, physical records are shredded and the

5

|

Enlarge image |

SDNH database is purged and records are deleted.

National Directory of New Hires

The federal Office of Child Support Enforcement (OCSE) estimates that over 30% of

child support cases involve parents who do not live in the same state as their children.

By matching NHRP data with child support participant information at the national

level, the OCSE will be able to assist states in locating parents who are living in other

states. Upon receipt of NHRP information, the CSSD will be able to take the

necessary steps to establish paternity, issue child support orders or enforce existing

orders.

Personal Responsibility & Work Opportunity Reconciliation Act

(PRWORA) of 1996

A major focus of PRWORA is parents sharing the responsibility of supporting their

children. It contains strict work requirements for custodial parents receiving public

assistance and increases the effectiveness of child support programs by including the

development of NHRP in each state.

Employer Impact

The majority of the information employers are required to submit to the NHRP will be

found on the employee W-4 form. Montana offers a variety of reporting methods to

ensure efficiency and convenience for employers to report their newly hired and

rehired employees.

For quick and cost-effective reporting for employers, the NHRP recommends

submitting reports using one of the electronic methods listed on page 3.

Benefits to Employers

A direct benefit to employers is the reduction and prevention of fraudulent

unemployment and workers' compensation payments. Timely receipt of NHRP data

allows Montana and other states to cross-match this data against their active

unemployment claimant (UIC) files which may result in stopping erroneous or

fraudulent payments.

Independent Contractors & Subcontractors

As an employer, you must first make the determination of whether or not an

employer/employee relationship exists. If the work being performed is based on a

contract rather than an employer/employee relationship, you are not required to report.

In such a circumstance, the contractor is responsible for reporting his/her employees.

6

|

Enlarge image |

Temporary Employment Agencies

If your agency is paying wages to the individual, you must submit a new hire report.

If your agency simply refers individuals for employment and does not pay the individual

directly, a new hire report is not necessary. However, the employer who actually hires

and pays the individual will be required to submit a new hire report.

Labor Organizations & Hiring Halls

Labor organizations and hiring halls must report their own employees - individuals who

work directly for the labor organization or hiring hall - to the NHRP.

If the labor organization or hiring hall simply refers individuals for employment, a new

hire report does not need to be filed.

New Hire Reporting Information Safeguards

Security and privacy of new hire report data are important issues for all those involved

in this vital program. Federal law requires all states to establish safeguards for

confidential information handled by the state agency. All Montana NHRP data is

transmitted to the NDNH over secure and dedicated lines. Federal law also requires

that the Secretary of the Department of Health and Human Services (DHHS)

establish and implement safeguards to protect the integrity and security of

information in the NDNH and to restrict access to and use of the information to

authorized persons and purposes.

Multistate Employers

An employer who has employees in two or more states and who transmits reports

electronically may comply with the NHRP by designating one of the states in which

they have an employee to transmit their new hire reports to electronically. See

Format for Electronic Reporting on pages 9 -11.

A multistate employer who elects to report to only one state should give written or

electronic notice to the Secretary of DHHS notifying them of which state they plan to

electronically transmit their new hire reports to.

The Secretary of DHHS will need the following information:

• Federal Employer Identification Number (FEIN)

• Company Name, Address, and Telephone Number

• State you will be electronically transmitting NHR to

• List of states in which your company has employees

• Contact Person Name and Telephone Number

Register as a multistate employer online at:

Office of Child Support Enforcement Employer Information

7

|

Enlarge image |

Or mail all multistate employer information to:

Office of Child Support Enforcement

Multistate Employer Program

PO Box 509 Randallstown, MD 21133

Montana NHRP Contact Information

Additional information and materials regarding the New

Hire Reporting Program can be found online at:

https://dphhs.mt.gov/cssd/employerinfo/newhirereporting.

Here you will find further instructions on reporting your new hires to

the New Hire Reporting Program as well as useful tools such as:

• Online New Hire Reporting System

• Okta Instructions for File Transfer

• ASCII Format for Electronic Reporting

• Spreadsheet Template for Electronic Reporting

• New Hire Reporting Forms

• New Hire Reporting FAQs

• Montana Employer Guide

If you have further questions after reviewing the information on our website, please

contact the NHRP using the contact information below.

Email: NewHireReporting@mt gov.

Telephone: 1.888.866.0327 or 1.406.444.9290

Employers are a vital part of the Montana NHRP. The CSSD appreciates you for

all that you do to make a difference in the lives of children across the state of

Montana and the country. If you have any questions regarding New Hire Reporting,

please do not hesitate to contact us.

New Hire Reporting Program

Montana Child Support Services Division

8

|

Enlarge image |

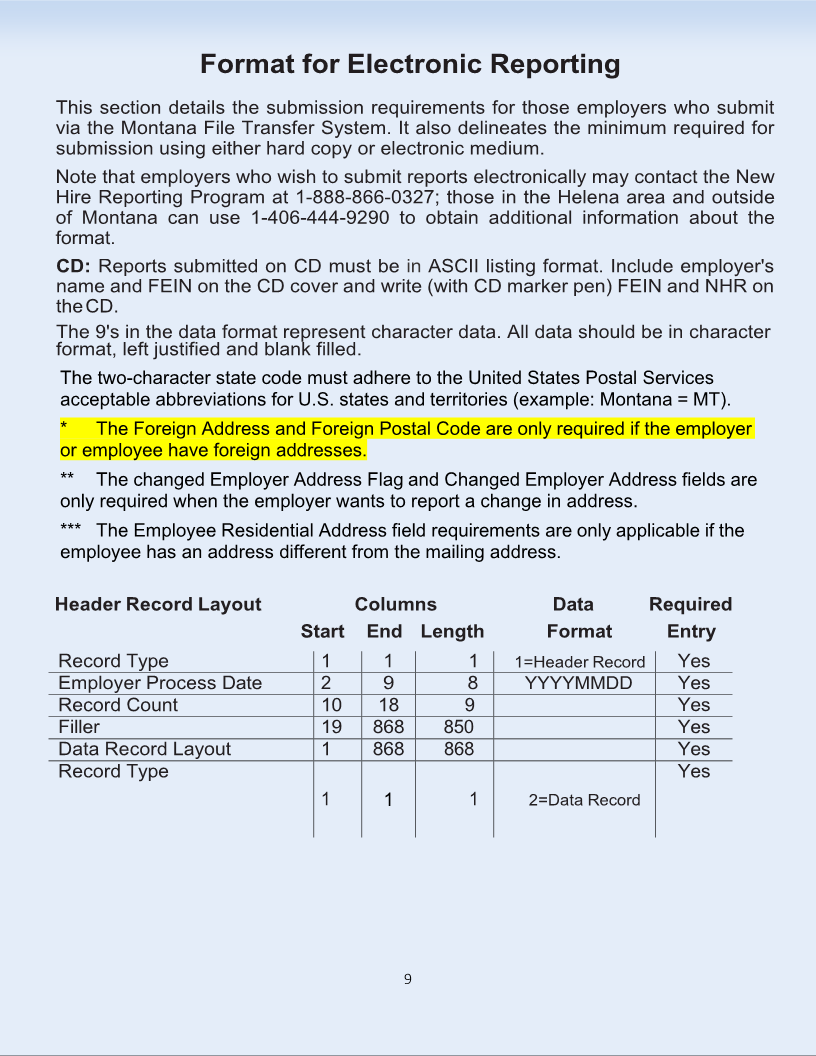

Format for Electronic Reporting

This section details the submission requirements for those employers who submit

via the Montana File Transfer System. It also delineates the minimum required for

submission using either hard copy or electronic medium.

Note that employers who wish to submit reports electronically may contact the New

Hire Reporting Program at 1-888-866-0327; those in the Helena area and outside

of Montana can use 1-406-444-9290 to obtain additional information about the

format.

CD: Reports submitted on CD must be in ASCII listing format. Include employer's

name and FEIN on the CD cover and write (with CD marker pen) FEIN and NHR on

the CD.

The 9's in the data format represent character data. All data should be in character

format, left justified and blank filled.

The two-character state code must adhere to the United States Postal Services

acceptable abbreviations for U.S. states and territories (example: Montana = MT).

* The Foreign Address and Foreign Postal Code are only required if the employer

or employee have foreign addresses.

** The changed Employer Address Flag and Changed Employer Address fields are

only required when the employer wants to report a change in address.

*** The Employee Residential Address field requirements are only applicable if the

employee has an address different from the mailing address.

Header Record Layout Columns Data Required

Start End Length Format Entry

Record Type 1 1 1 1=Header Record Yes

Employer Process Date 2 9 8 YYYYMMDD Yes

Record Count 10 18 9 Yes

Filler 19 868 850 Yes

Data Record Layout 1 868 868 Yes

Record Type Yes

1 1 1 2=Data Record

9

|

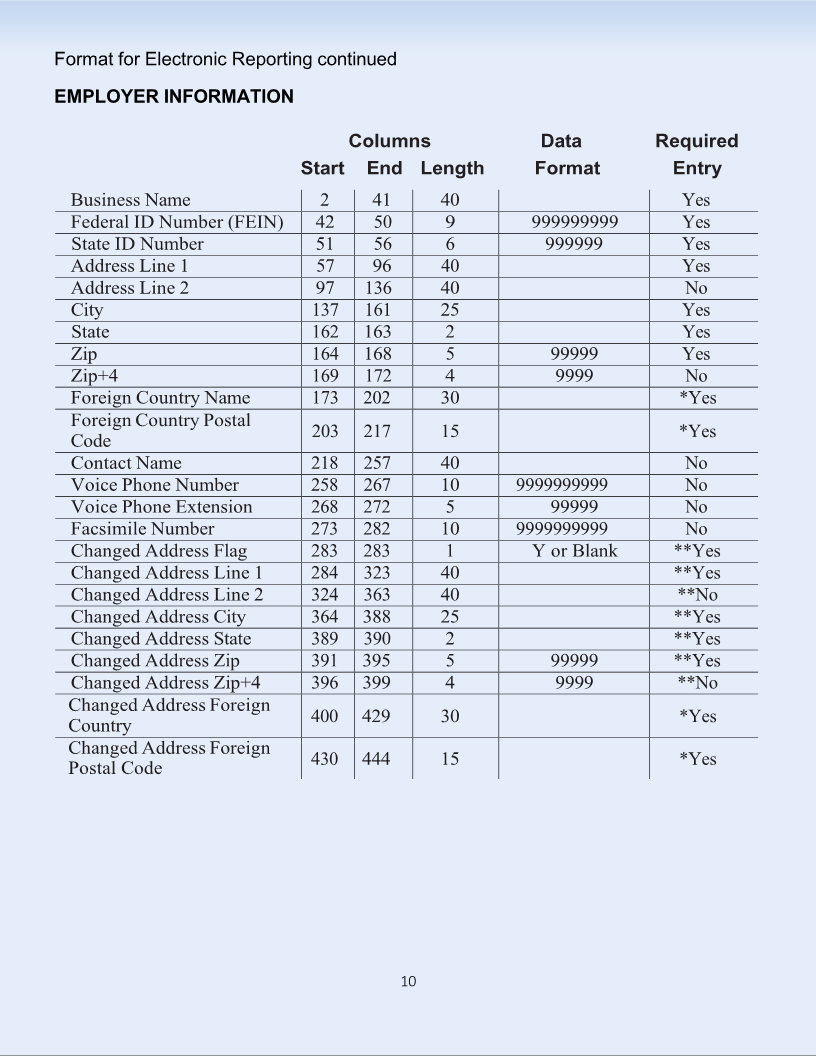

Enlarge image |

Format for Electronic Reporting continued

EMPLOYER INFORMATION

Columns Data Required

Start End Length Format Entry

Business Name 2 41 40 Yes

Federal ID Number (FEIN) 42 50 9 999999999 Yes

State ID Number 51 56 6 999999 Yes

Address Line 1 57 96 40 Yes

Address Line 2 97 136 40 No

City 137 161 25 Yes

State 162 163 2 Yes

Zip 164 168 5 99999 Yes

Zip+4 169 172 4 9999 No

Foreign Country Name 173 202 30 *Yes

Foreign Country Postal

203 217 15 *Yes

Code

Contact Name 218 257 40 No

Voice Phone Number 258 267 10 9999999999 No

Voice Phone Extension 268 272 5 99999 No

Facsimile Number 273 282 10 9999999999 No

Changed Address Flag 283 283 1 Y or Blank **Yes

Changed Address Line 1 284 323 40 **Yes

Changed Address Line 2 324 363 40 **No

Changed Address City 364 388 25 **Yes

Changed Address State 389 390 2 **Yes

Changed Address Zip 391 395 5 99999 **Yes

Changed Address Zip+4 396 399 4 9999 **No

Changed Address Foreign

400 429 30 *Yes

Country

Changed Address Foreign

430 444 15 *Yes

Postal Code

10

|

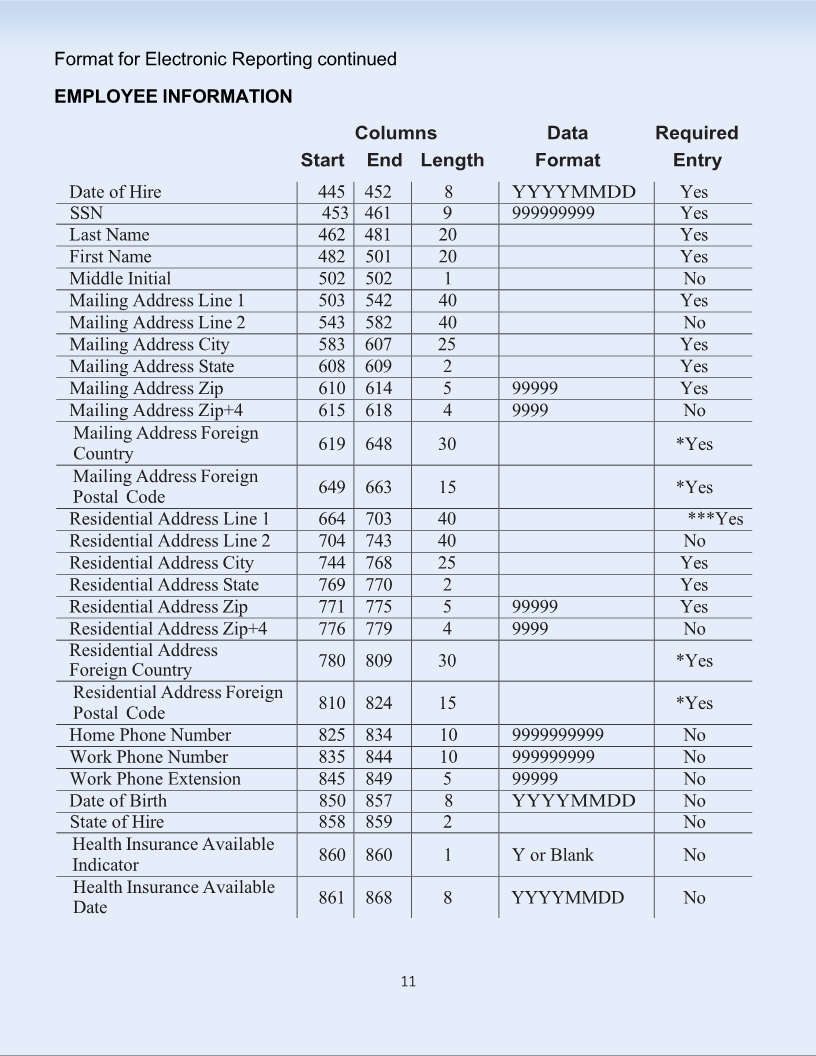

Enlarge image |

Format for Electronic Reporting continued

EMPLOYEE INFORMATION

Columns Data Required

Start End Length Format Entry

Date of Hire 445 452 8 YYYYMMDD Yes

SSN 453 461 9 999999999 Yes

Last Name 462 481 20 Yes

First Name 482 501 20 Yes

Middle Initial 502 502 1 No

Mailing Address Line 1 503 542 40 Yes

Mailing Address Line 2 543 582 40 No

Mailing Address City 583 607 25 Yes

Mailing Address State 608 609 2 Yes

Mailing Address Zip 610 614 5 99999 Yes

Mailing Address Zip+4 615 618 4 9999 No

Mailing Address Foreign

619 648 30 *Yes

Country

Mailing Address Foreign

649 663 15 *Yes

Postal Code

Residential Address Line 1 664 703 40 ***Yes

Residential Address Line 2 704 743 40 No

Residential Address City 744 768 25 Yes

Residential Address State 769 770 2 Yes

Residential Address Zip 771 775 5 99999 Yes

Residential Address Zip+4 776 779 4 9999 No

Residential Address

780 809 30 *Yes

Foreign Country

Residential Address Foreign

810 824 15 *Yes

Postal Code

Home Phone Number 825 834 10 9999999999 No

Work Phone Number 835 844 10 999999999 No

Work Phone Extension 845 849 5 99999 No

Date of Birth 850 857 8 YYYYMMDD No

State of Hire 858 859 2 No

Health Insurance Available

860 860 1 Y or Blank No

Indicator

Health Insurance Available

861 868 8 YYYYMMDD No

Date

11

|