Enlarge image

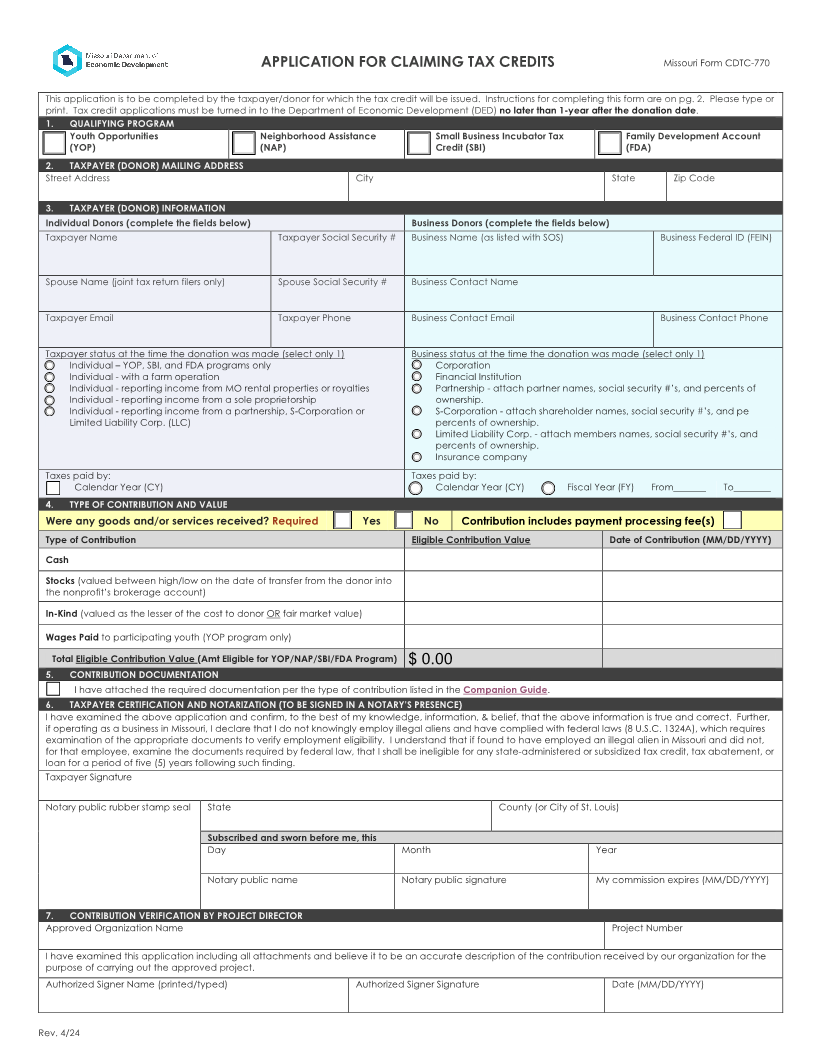

APPLICATION FOR CLAIMING TAX CREDITS Missouri Form CDTC-770

This application is to be completed by the taxpayer/donor for which the tax credit will be issued. Instructions for completing this form are on pg. 2. Please type or

print. Tax credit applications must be turned in to the Department of Economic Development (DED) no later than 1-year after the donation date.

1. QUALIFYING PROGRAM

Youth Opportunities Neighborhood Assistance Small Business Incubator Tax Family Development Account

(YOP) (NAP) Credit (SBI) (FDA)

2. TAXPAYER (DONOR) MAILING ADDRESS

Street Address City State Zip Code

3. TAXPAYER (DONOR) INFORMATION

Individual Donors (complete the fields below) Business Donors (complete the fields below)

Taxpayer Name Taxpayer Social Security # Business Name (as listed with SOS) Business Federal ID (FEIN)

Spouse Name (joint tax return filers only) Spouse Social Security # Business Contact Name

Taxpayer Email Taxpayer Phone Business Contact Email Business Contact Phone

Taxpayer status at the time the donation was made (select only 1) Business status at the time the donation was made (select only 1)

Individual – YOP, SBI, and FDA programs only Corporation

Individual - with a farm operation Financial Institution

Individual - reporting income from MO rental properties or royalties Partnership - attach partner names, social security #’s, and percents of

Individual - reporting income from a sole proprietorship ownership.

Individual - reporting income from a partnership, S-Corporation or S-Corporation - attach shareholder names, social security #’s, and pe

Limited Liability Corp. (LLC) percents of ownership.

Limited Liability Corp. - attach members names, social security #’s, and

percents of ownership.

Insurance company

Taxes paid by: Taxes paid by:

Calendar Year (CY) Calendar Year (CY) Fiscal Year (FY) From_______ To________

4. TYPE OF CONTRIBUTION AND VALUE

Were any goods and/or services received? Required Yes No Contribution includes payment processing fee(s)

Type of Contribution Eligible Contribution Value Date of Contribution (MM/DD/YYYY)

Cash

Stocks (valued between high/low on the date of transfer from the donor into

the nonprofit’s brokerage account)

In-Kind (valued as the lesser of the cost to donor OR fair market value)

Wages Paid to participating youth (YOP program only)

Total Eligible Contribution Value (Amt Eligible for YOP/NAP/SBI/FDA Program) $ 0.00

5. CONTRIBUTION DOCUMENTATION

I have attached the required documentation per the type of contribution listed in the Companion Guide.

6. TAXPAYER CERTIFICATION AND NOTARIZATION (TO BE SIGNED IN A NOTARY’S PRESENCE)

I have examined the above application and confirm, to the best of my knowledge, information, & belief, that the above information is true and correct. Further,

if operating as a business in Missouri, I declare that I do not knowingly employ illegal aliens and have complied with federal laws (8 U.S.C. 1324A), which requires

examination of the appropriate documents to verify employment eligibility. I understand that if found to have employed an illegal alien in Missouri and did not,

for that employee, examine the documents required by federal law, that I shall be ineligible for any state-administered or subsidized tax credit, tax abatement, or

loan for a period of five (5) years following such finding.

Taxpayer Signature

Notary public rubber stamp seal State County (or City of St. Louis)

Subscribed and sworn before me, this

Day Month Year

Notary public name Notary public signature My commission expires (MM/DD/YYYY)

7. CONTRIBUTION VERIFICATION BY PROJECT DIRECTOR

Approved Organization Name Project Number

I have examined this application including all attachments and believe it to be an accurate description of the contribution received by our organization for the

purpose of carrying out the approved project.

Authorized Signer Name (printed/typed) Authorized Signer Signature Date (MM/DD/YYYY)

Rev. 4/24