Enlarge image

Reset Form Print Form

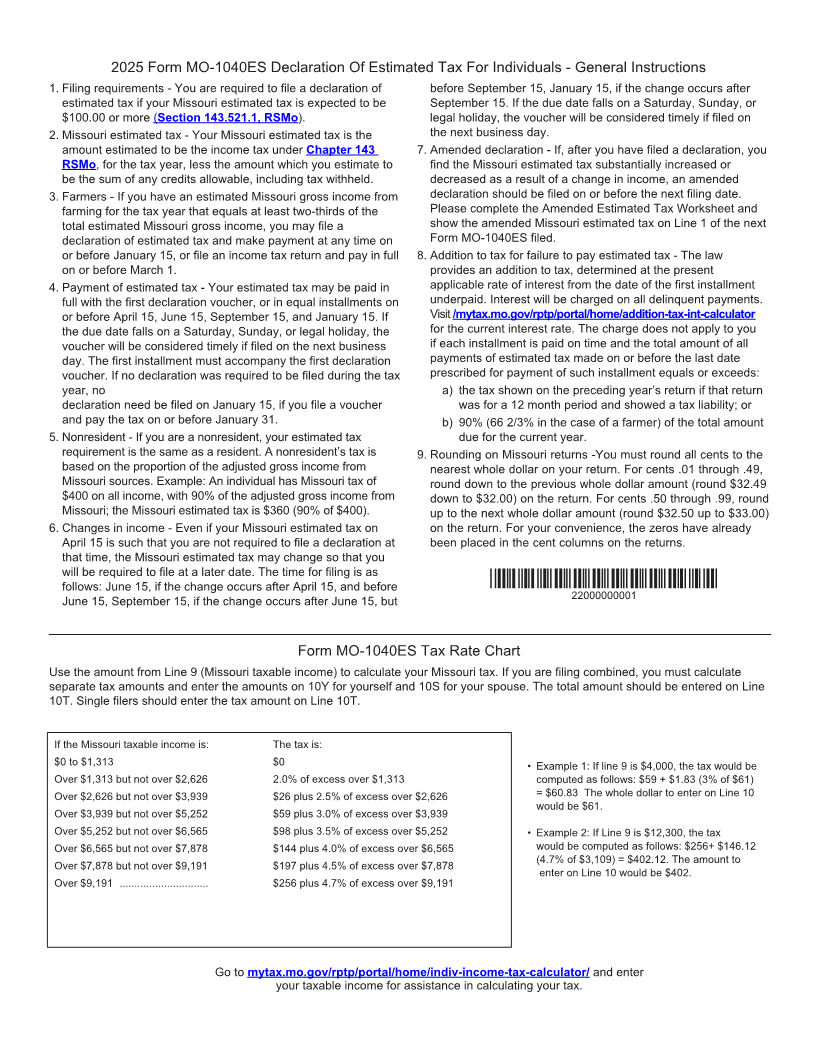

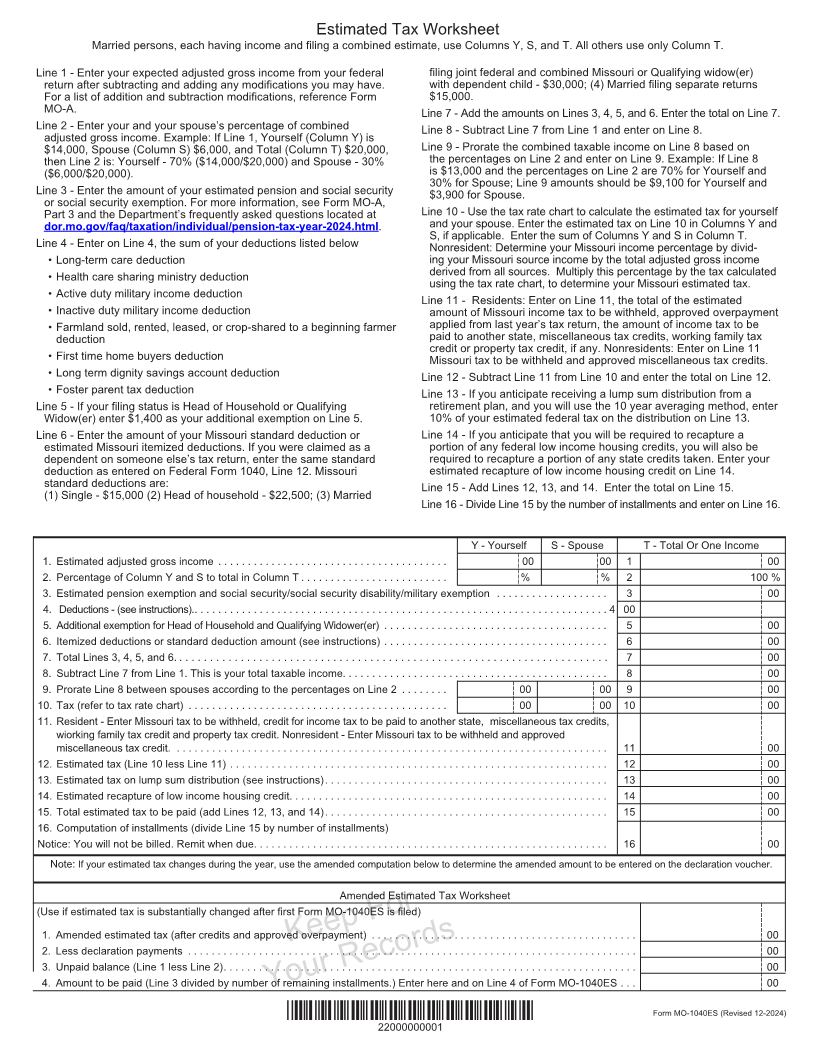

Form

MO-1040ES 2025 Declaration of Estimated Tax for Individuals

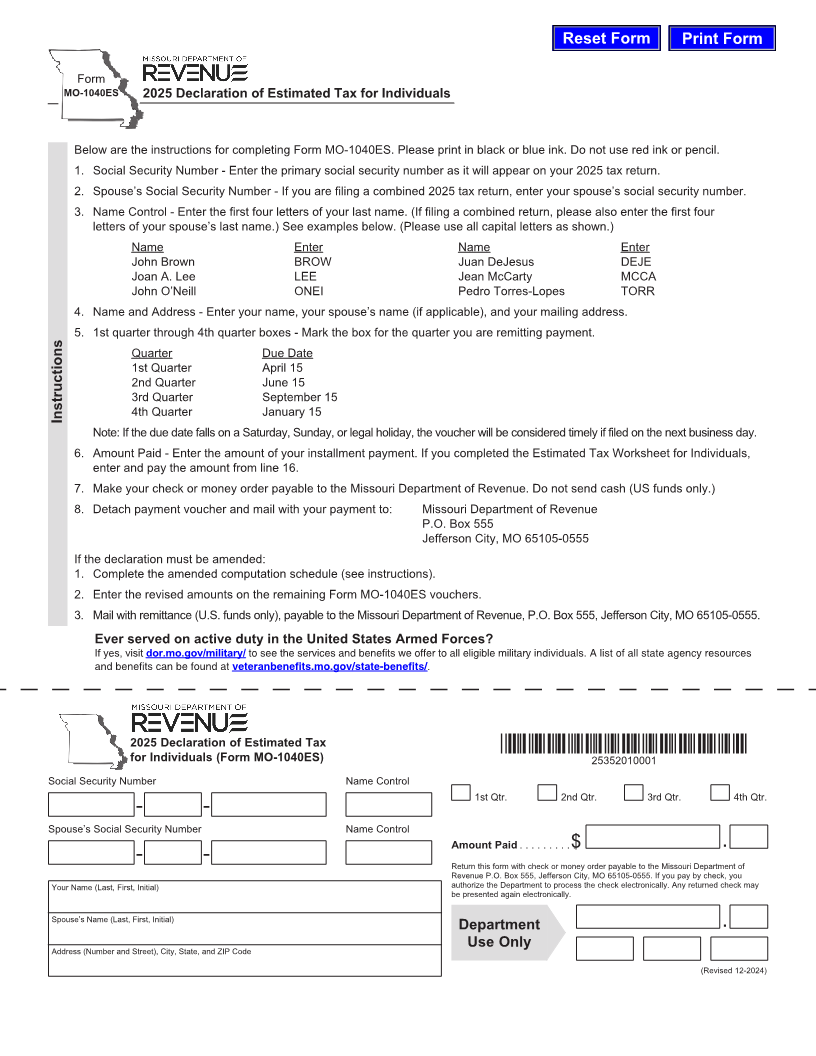

Below are the instructions for completing Form MO-1040ES . Please print in black or blue ink . Do not use red ink or pencil .

1 . Social Security Number - Enter the primary social security number as it will appear on your 2025 tax return .

2 . Spouse’s Social Security Number - If you are filing a combined 2025 tax return, enter your spouse’s social security number .

3 . Name Control - Enter the first four letters of your last name . (If filing a combined return, please also enter the first four

letters of your spouse’s last name .) See examples below . (Please use all capital letters as shown .)

Name Enter Name Enter

John Brown BROW Juan DeJesus DEJE

Joan A . Lee LEE Jean McCarty MCCA

John O’Neill ONEI Pedro Torres-Lopes TORR

4 . Name and Address - Enter your name, your spouse’s name (if applicable), and your mailing address .

5 . 1st quarter through 4th quarter boxes - Mark the box for the quarter you are remitting payment .

Quarter Due Date

1st Quarter April 15

2nd Quarter June 15

3rd Quarter September 15

Instructions 4th Quarter January 15

Note: If the due date falls on a Saturday, Sunday, or legal holiday, the voucher will be considered timely if filed on the next business day .

6 . Amount Paid - Enter the amount of your installment payment . If you completed the Estimated Tax Worksheet for Individuals,

enter and pay the amount from line 16 .

7 . Make your check or money order payable to the Missouri Department of Revenue . Do not send cash (US funds only .)

8 . Detach payment voucher and mail with your payment to: Missouri Department of Revenue

P .O . Box 555

Jefferson City, MO 65105-0555

If the declaration must be amended:

1 . Complete the amended computation schedule (see instructions) .

2 . Enter the revised amounts on the remaining Form MO-1040ES vouchers .

3 . Mail with remittance (U .S . funds only), payable to the Missouri Department of Revenue, P .O . Box 555, Jefferson City, MO 65105-0555 .

Ever served on active duty in the United States Armed Forces?

If yes, visit dor.mo.gov/military/ to see the services and benefits we offer to all eligible military individuals. A list of all state agency resources

and benefits can be found at veteranbenefits.mo.gov/state-benefits/ .

2025 Declaration of Estimated Tax *25352010001*

for Individuals (Form MO-1040ES) 25352010001

Social Security Number Name Control

1st Qtr . 2nd Qtr . 3rd Qtr . 4th Qtr .

- -

Spouse’s Social Security Number Name Control

Amount Paid . . . . . . . . . .$ .

- - Return this form with check or money order payable to the Missouri Department of

Revenue P .O . Box 555, Jefferson City, MO 65105-0555 . If you pay by check, you

Your Name (Last, First, Initial) authorize the Department to process the check electronically . Any returned check may

be presented again electronically .

Spouse’s Name (Last, First, Initial)

Department .

Address (Number and Street), City, State, and ZIP Code Use Only

(Revised 12-2024)