Enlarge image

Reset Form Print Form

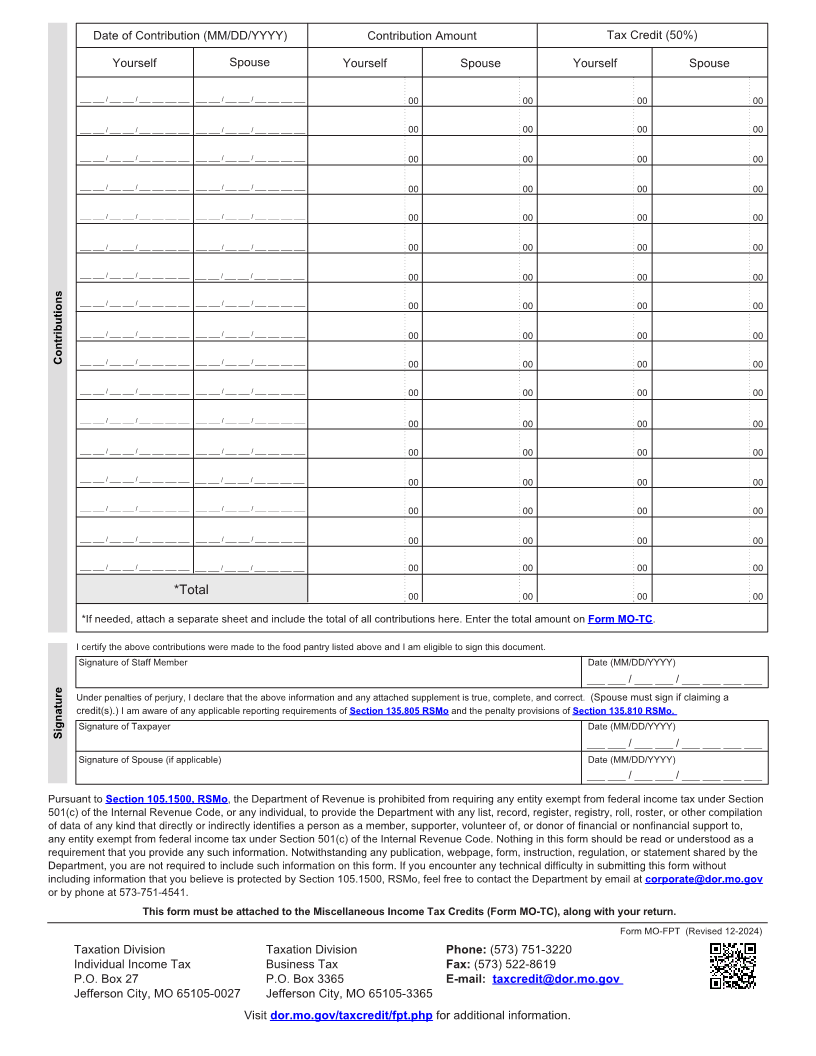

Missouri Department of Revenue Department Use Only

Form Food Pantry, Homeless Shelter, or (MM/DD/YY)

MO-FPT Soup Kitchen Tax Credit

Taxable Year Beginning Ending

(MM/DD/YY) (MM/DD/YY)

Taxpayer’s Social Security

Name Number

Spouse’s Social

Spouse’s Security

Name Number

Business

Name

Missouri Tax I.D. Federal Employer

Number I.D. Number

Charter NAICS Code

Number (if applicable)

Tax Credit Claimant Information

Address City State ZIP Code

Tax Type

Individual Corporation Other _____________________________________________________

Food Pantry, Homeless Shelter, or Soup Kitchen Name

Food Pantry, Homeless Shelter, or Soup Kitchen Address City State ZIP Code

Any taxpayer who donates cash or food to a food pantry, homeless shelter, or soup kitchen unless such food is donated after the

expiration date may claim a tax credit against the tax imposed by Chapter 143 RSMo. The credit granted shall equal 50% of the

value of the contribution or donation made. Donations to a food bank, out-of-state food pantry, out-of-state homeless shelter or

out-of-state soup kitchen do not qualify for the credit. Credits cannot exceed $2,500 per taxpayer per year, cannot exceed the

taxpayer’s tax liability, and cannot be sold or transferred. All claims must be filed by April 15 of the fiscal year. If claims exceed

Qualifications $1.75 million, all claims will be apportioned equally among those filing a valid claim.

• If married individuals filing a combined return made • If you included any contributions as charitable donations on

contributions to a food pantry, homeless shelter, or soup your Federal Schedule A, and you claimed itemized

kitchen each spouse may claim up to $2,500. deductions on your Missouri return, you must report those

• If you made contributions to more than one food pantry, contributions on Form MO-A, Line 4. See Form MO-A

homeless shelter, or soup kitchen you will need to complete a instructions for further information.

separate Form MO-FPT for each food pantry, homeless shelter, • An eligible staff member of the food pantry, homeless shelter,

or soup kitchen. or soup kitchen must certify that each contribution reported

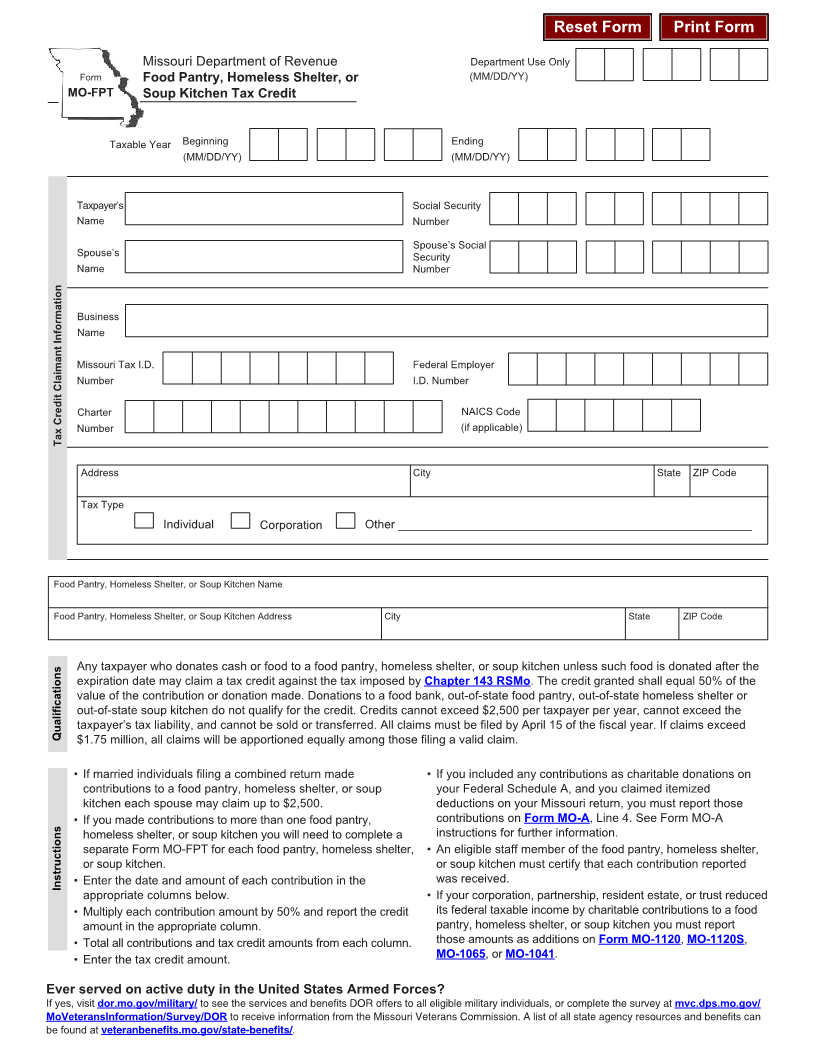

Instructions • Enter the date and amount of each contribution in the was received.

appropriate columns below. • If your corporation, partnership, resident estate, or trust reduced

• Multiply each contribution amount by 50% and report the credit its federal taxable income by charitable contributions to a food

amount in the appropriate column. pantry, homeless shelter, or soup kitchen you must report

• Total all contributions and tax credit amounts from each column. those amounts as additions onForm MO-1120,MO-1120S ,

• Enter the tax credit amount. MO-1065, or MO-1041.

Ever served on active duty in the United States Armed Forces?

If yes, visit dor.mo.gov/military/ to see the services and benefits DOR offers to all eligible military individuals, or complete the survey at mvc.dps.mo.gov/

MoVeteransInformation/Survey/DOR to receive information from the Missouri Veterans Commission. A list of all state agency resources and benefits can

be found at veteranbenefits.mo.gov/state-benefits/.