Enlarge image

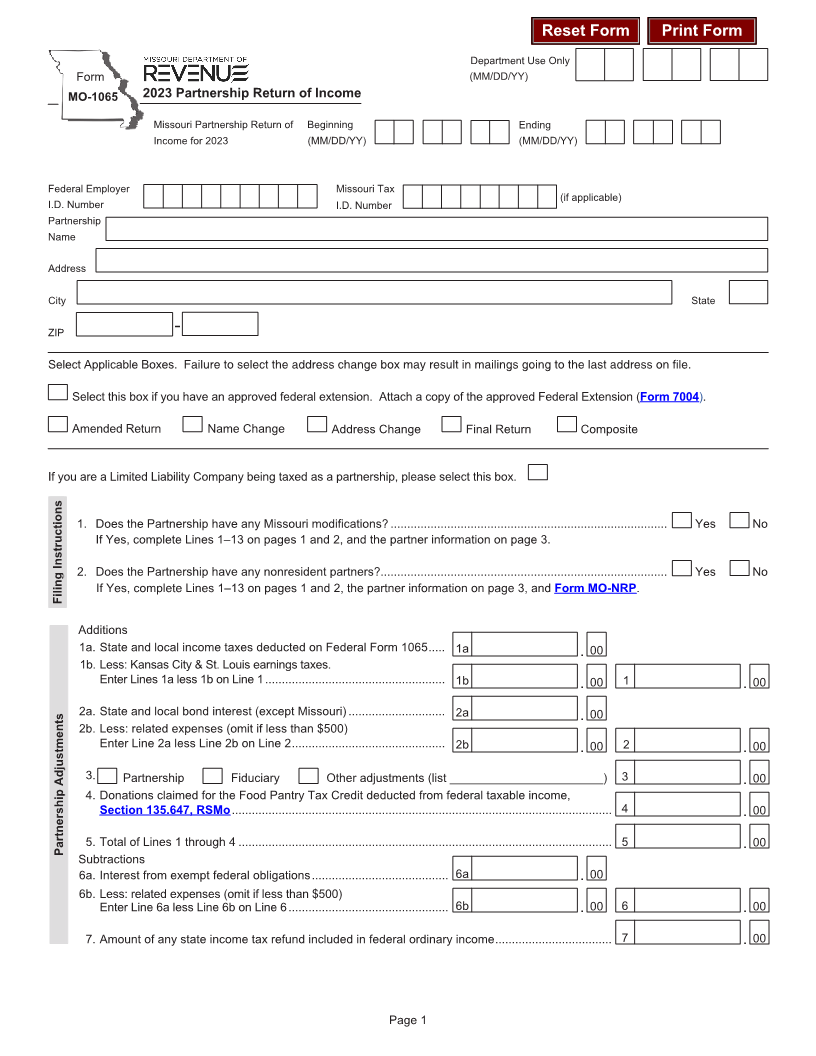

Reset Form Print Form

Department Use Only

Form (MM/DD/YY)

MO-1065 2023 Partnership Return of Income

Missouri Partnership Return of Beginning Ending

Income for 2023 (MM/DD/YY) (MM/DD/YY)

Federal Employer Missouri Tax

(if applicable)

I.D. Number I.D. Number

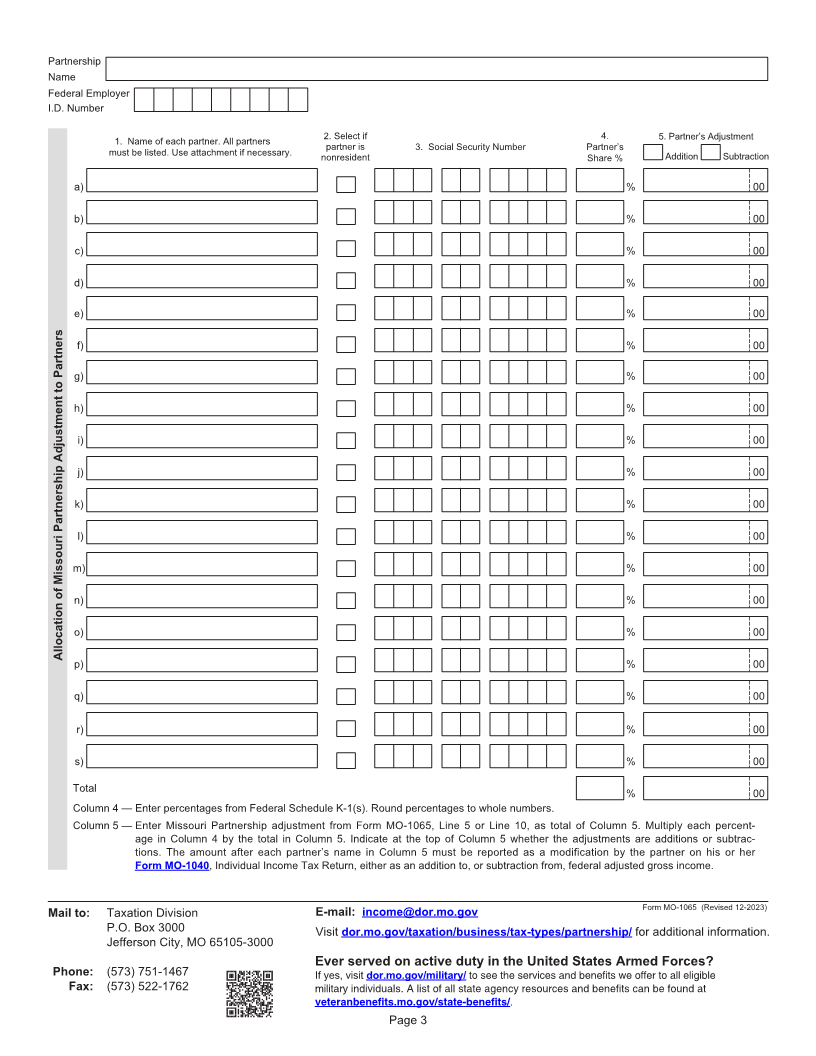

Partnership

Name

Address

City State

ZIP -

Select Applicable Boxes. Failure to select the address change box may result in mailings going to the last address on file.

Select this box if you have an approved federal extension. Attach a copy of the approved Federal Extension (Form 7004).

Amended Return Name Change Address Change Final Return Composite

If you are a Limited Liability Company being taxed as a partnership, please select this box.

1. Does the Partnership have any Missouri modifications? ................................................................................... Yes No

If Yes, complete Lines 1–13 on pages 1 and 2, and the partner information on page 3.

2. Does the Partnership have any nonresident partners?...................................................................................... Yes No

If Yes, complete Lines 1–13 on pages 1 and 2, the partner information on page 3, and Form MO-NRP.

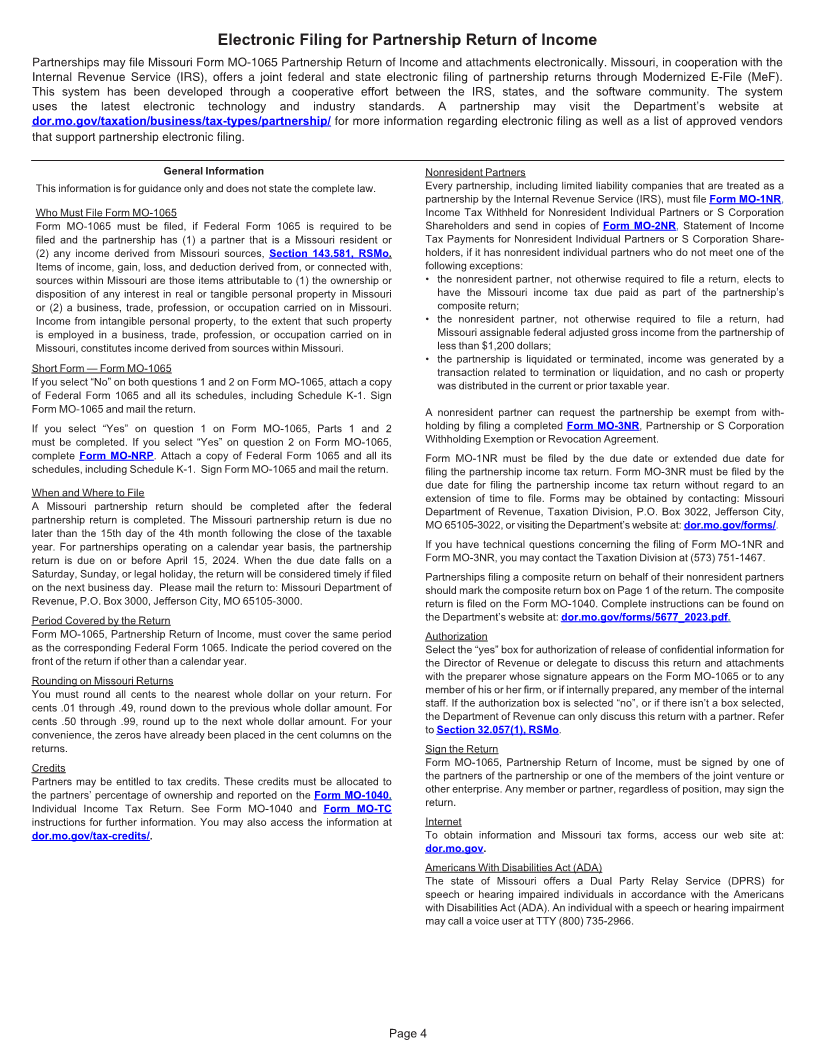

Filing Instructions

Additions

1a. State and local income taxes deducted on Federal Form 1065 ..... 1a . 00

1b. Less: Kansas City & St. Louis earnings taxes.

Enter Lines 1a less 1b on Line 1 ...................................................... 1b . 00 1 . 00

2a. State and local bond interest (except Missouri) ............................. 2a . 00

2b. Less: related expenses (omit if less than $500)

Enter Line 2a less Line 2b on Line 2 .............................................. 2b . 00 2 . 00

3. Partnership Fiduciary Other adjustments (list _______________________) 3 . 00

4. Donations claimed for the Food Pantry Tax Credit deducted from federal taxable income,

Section 135.647, RSMo .................................................................................................................. 4 . 00

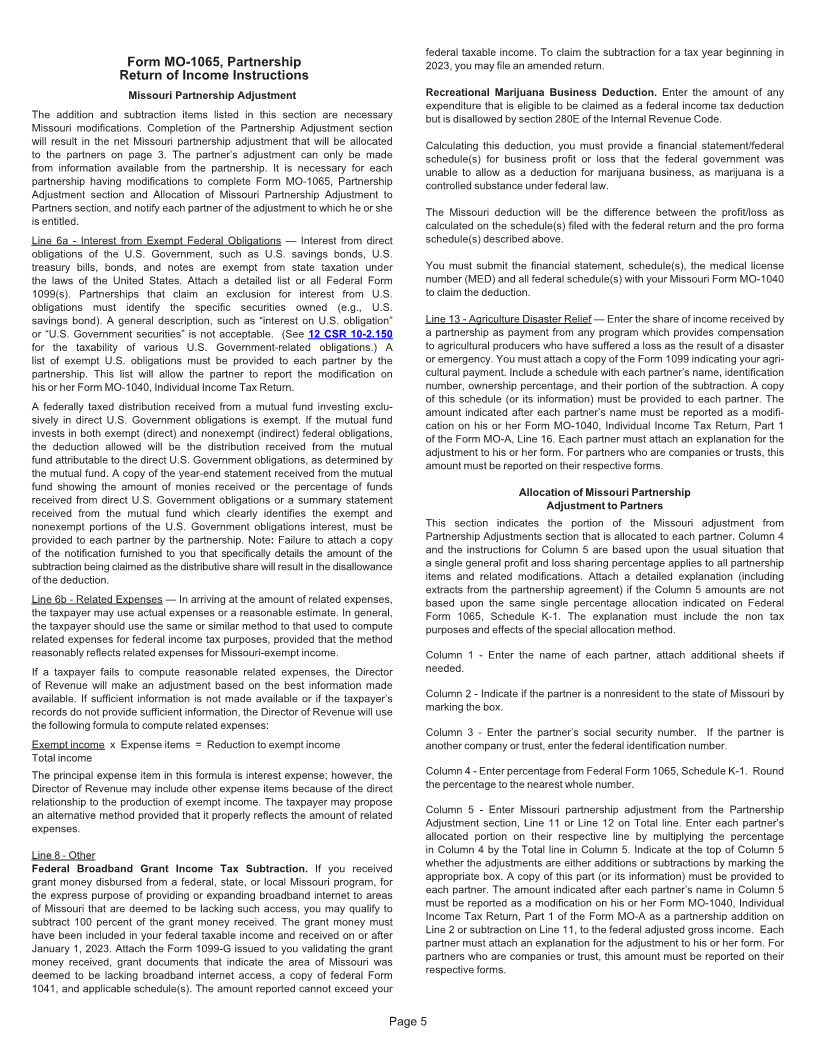

Partnership Adjustments 5. Total of Lines 1 through 4 ................................................................................................................ 5 . 00

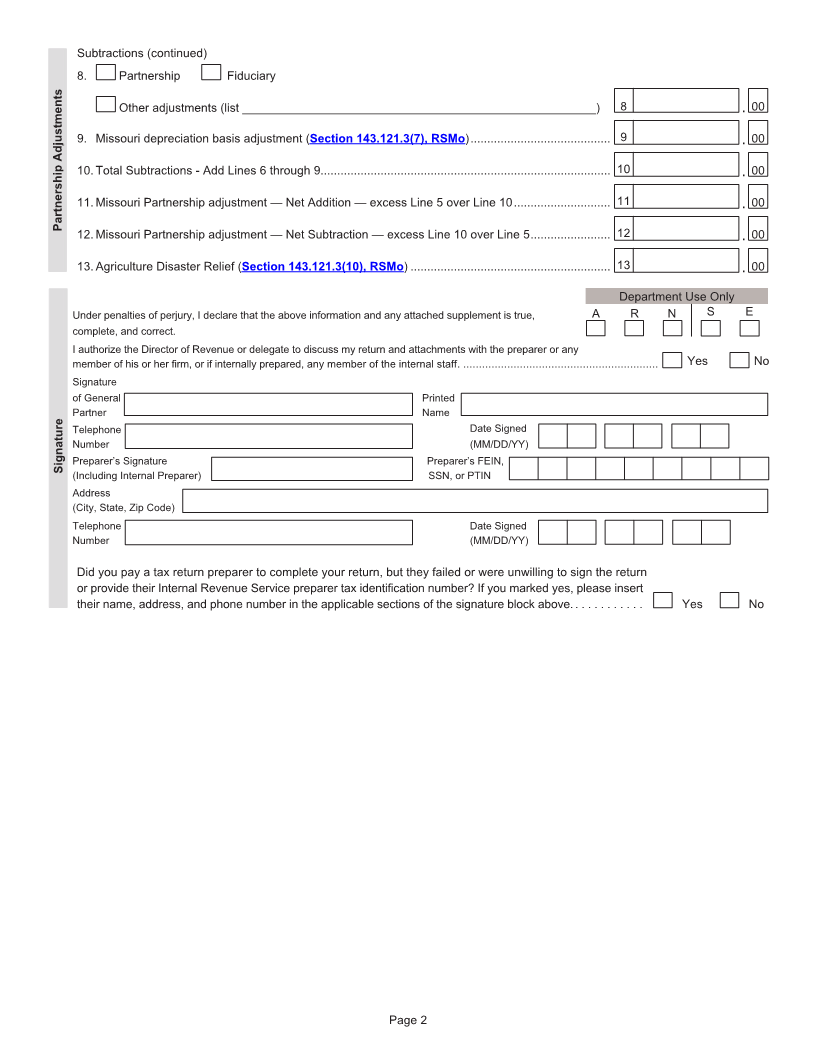

Subtractions

6a. Interest from exempt federal obligations ......................................... 6a . 00

6b. Less: related expenses (omit if less than $500)

Enter Line 6a less Line 6b on Line 6 ................................................ 6b . 00 6 . 00

7. Amount of any state income tax refund included in federal ordinary income ................................... 7 . 00

Page 1