Enlarge image

Reset Form Print Form

Department Use Only

Form (MM/DD/YY)

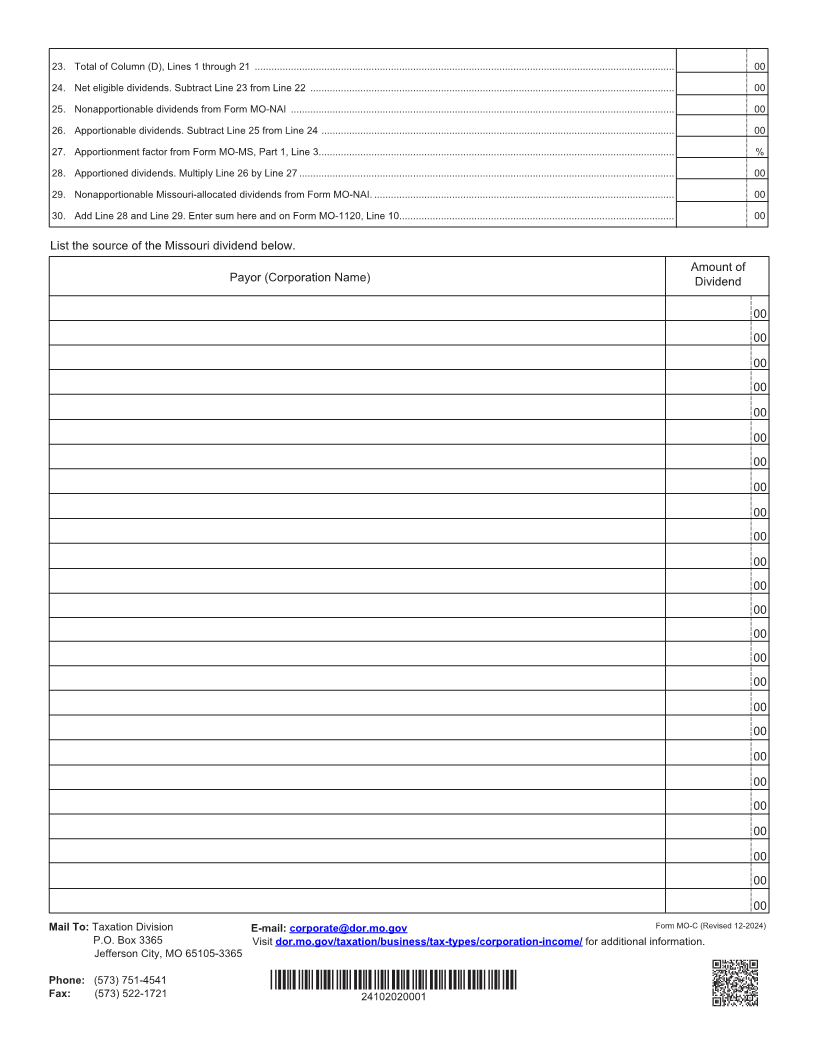

MO-C 2024 Missouri Dividends Deduction Schedule

Taxable Year Beginning Ending

(MM/DD/YY) (MM/DD/YY)

Missouri Tax I.D. Federal Employer

Number I.D. Number

Charter *24102010001*

Number 24102010001

Corporation

Name Attachment Sequence No. 1120‑04

Complete this schedule when computing the Missouri dividends allowed as a deduction pursuant to Section 143.431.2, RSMo.

Column A — Enter the amount of dividends entered on Federal Schedule C (A) (B) (C) (D)

Dividends Deductions

Column B — Enter the amount of dividends received from Missouri sources Federal Eligible % Eligible

Column D — Column (B) times Column (C) Received Dividends (B) X (C)

1. Dividends from less‑than‑20%‑owned domestic corporations

(other than debt‑financed stock) ............................................................................ 00 00 50 00

2. Dividends from 20%‑or‑more‑owned domestic corporations

(other than debt‑financed stock) ............................................................................ 00 00 65 00

See Federal

3. Dividends on debt‑financed stock of domestic and foreign corporations .............. 00 00 Instructions 00

4. Dividends on certain preferred stock of less‑than‑20%‑owned public utilities ....... 00 00 23.3 00

5. Dividends on certain preferred stock of 20%‑or‑more‑owned public utilities ......... 00 00 26.7 00

6. Dividends from less‑than‑20%‑owned foreign corporations and certain FSCs .... 00 00 50 00

7. Dividends from 20%‑or‑more‑owned foreign corporations and certain FSCs ...... 00 00 65 00

8. Dividends from wholly owned foreign subsidiaries ................................................. 00 00 100 00

9. Dividends from domestic corporations received by a small business investment

company operating under the Small Business Investment Act of 1958 ................ 00 00 100 00

10. Dividends from affiliated group members .............................................................. 00 00 100 00

11. Dividends from certain FSCs ................................................................................. 00 00 100 00

12. Foreign‑source portion of dividends received from a specified 10%‑owned

foreign corporation (excluding hybrid dividends) ................................................... 00 00 100 00

13. Dividends from foreign corporations not included on Lines 3, 6, 7, 8, 10, 11 or 12 . 00 00

See Federal

14. Reserved for future use ......................................................................................... 00 00 Instructions 00

15a. Subpart F inclusions derived from the sale by a controlled foreign corporation

(CFC) of the stock of a lower‑tier foreign corporation treated as a dividend ........ 00 00 100 00

15b. Subpart F inclusions derived from hybrid dividends of tiered corporations .......... 00 00

15c. Other inclusions from CFCs under subpart F not included on Lines 14, 15a,

15b, or 16 .............................................................................................................. 00 00

16. Global Intangible Low‑Taxed Income (GILTI) ....................................................... 00 00

17. Foreign dividend gross‑up ..................................................................................... 00 00

18. IC‑DISC and former DISC dividends not included on Lines 1, 2, or 3 .................. 00 00

19. Other dividends (see Form MO‑1120 Instructions regarding REIT and RIC

dividends) ............................................................................................................... 00 00

20. Deduction for dividends paid on certain preferred stock of public utilities ............ 00

21. Section 250 deduction (excluding portion attributable to FDII) ............................. 00

22. Total of Column (B), Lines 1 through 19 .............................................................. 00

Continued on page 2.