Enlarge image

Reset Form Print Form

Department Use Only

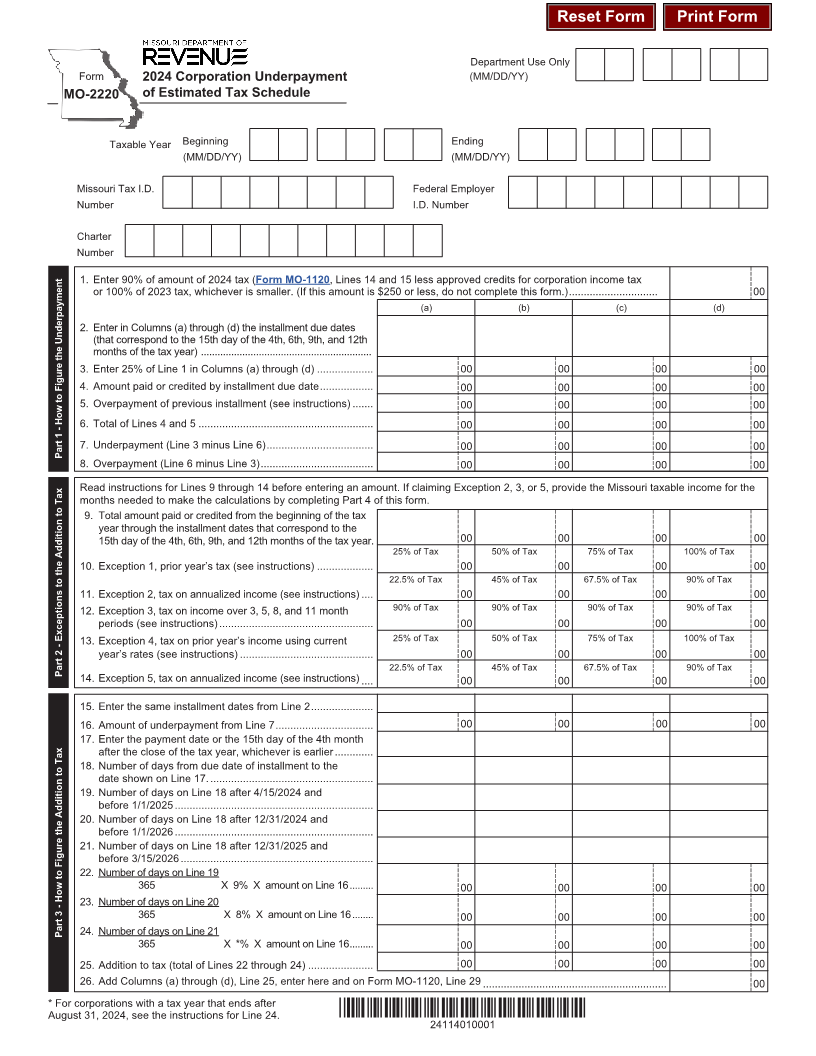

Form 2024 Corporation Underpayment (MM/DD/YY)

MO‑2220 of Estimated Tax Schedule

Taxable Year Beginning Ending

(MM/DD/YY) (MM/DD/YY)

Missouri Tax I.D. Federal Employer

Number I.D. Number

Charter

Number

1. Enter 90% of amount of 2024 tax (Form MO‑1120, Lines 14 and 15 less approved credits for corporation income tax

or 100% of 2023 tax, whichever is smaller. (If this amount is $250 or less, do not complete this form.) .............................. 00

(a) (b) (c) (d)

2. Enter in Columns (a) through (d) the installment due dates

(that correspond to the 15th day of the 4th, 6th, 9th, and 12th

months of the tax year) ..............................................................

3. Enter 25% of Line 1 in Columns (a) through (d) ................... 00 00 00 00

4. Amount paid or credited by installment due date .................. 00 00 00 00

5. Overpayment of previous installment (see instructions) ....... 00 00 00 00

6. Total of Lines 4 and 5 ........................................................... 00 00 00 00

Part 1 ‑ How to Figure the Underpayment 7. Underpayment (Line 3 minus Line 6) .................................... 00 00 00 00

8. Overpayment (Line 6 minus Line 3) ...................................... 00 00 00 00

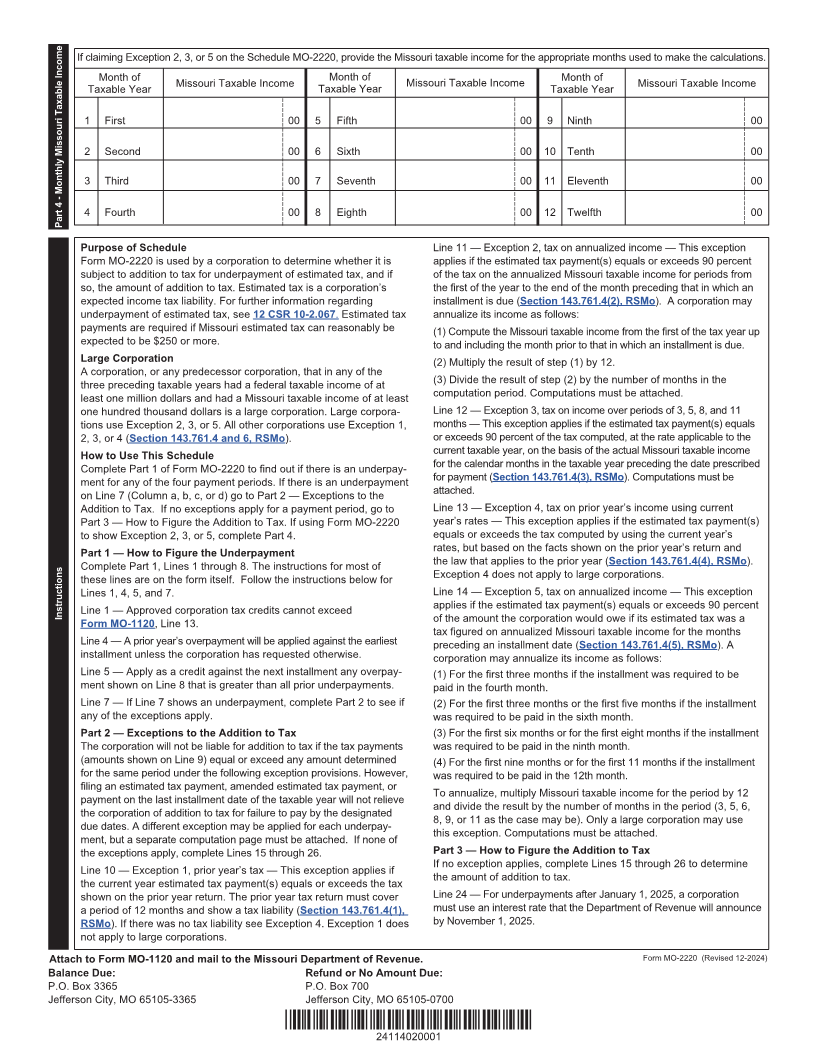

Read instructions for Lines 9 through 14 before entering an amount. If claiming Exception 2, 3, or 5, provide the Missouri taxable income for the

months needed to make the calculations by completing Part 4 of this form.

9. Total amount paid or credited from the beginning of the tax

year through the installment dates that correspond to the

15th day of the 4th, 6th, 9th, and 12th months of the tax year. 00 00 00 00

25% of Tax 50% of Tax 75% of Tax 100% of Tax

10. Exception 1, prior year’s tax (see instructions) ................... 00 00 00 00

22.5% of Tax 45% of Tax 67.5% of Tax 90% of Tax

11. Exception 2, tax on annualized income (see instructions) .... 00 00 00 00

12. Exception 3, tax on income over 3, 5, 8, and 11 month 90% of Tax 90% of Tax 90% of Tax 90% of Tax

periods (see instructions) .................................................... 00 00 00 00

13. Exception 4, tax on prior year’s income using current 25% of Tax 50% of Tax 75% of Tax 100% of Tax

year’s rates (see instructions) ............................................. 00 00 00 00

Part 2 ‑ Exceptions to the Addition to Tax 22.5% of Tax 45% of Tax 67.5% of Tax 90% of Tax

14. Exception 5, tax on annualized income (see instructions) .... 00 00 00 00

15. Enter the same installment dates from Line 2 .....................

16. Amount of underpayment from Line 7 ................................. 00 00 00 00

17. Enter the payment date or the 15th day of the 4th month

after the close of the tax year, whichever is earlier .............

18. Number of days from due date of installment to the

date shown on Line 17. .......................................................

19. Number of days on Line 18 after 4/15/2024 and

before 1/1/2025 ...................................................................

20. Number of days on Line 18 after 12/31/2024 and

before 1/1/2026 ...................................................................

21. Number of days on Line 18 after 12/31/2025 and

before 3/15/2026 .................................................................

22. Number of days on Line 19

365 X 9% X amount on Line 16 ......... 00 00 00 00

23. Number of days on Line 20

365 X 8% X amount on Line 16 ........ 00 00 00 00

Part 3 ‑ How to Figure the Addition to Tax 24. Number of days on Line 21

365 X *% X amount on Line 16 ......... 00 00 00 00

25. Addition to tax (total of Lines 22 through 24) ...................... 00 00 00 00

26. Add Columns (a) through (d), Line 25, enter here and on Form MO‑1120, Line 29 .............................................................. 00

* For corporations with a tax year that ends after

August 31, 2024, see the instructions for Line 24. *24114010001*

24114010001